US Market Indices Review: Dow Jones Industrial, S&P500, NASDAQ – Is the Bear Get Killed?

In order to prevent some jokers who think they are the PhD (Stock Market) and use text book material to pick fault in my analysis, please read my disclaimer below before proceeding to my analysis.

Disclaimer: This is my own analysis and my opinion. I am not representing any financial institution nor I am the certified financial analyst. I use my knowledge, education and experience to form my own opinion. Everyone has their own opinion and do give respect to other people’s opinion. It is up to individual knowledge, education, experience to judge whether they want to accept or reject the opinion.

What a week that change the whole chart pattern after breaking the 50D MA resistance! The question: Is the Bull really coming back to kill the Bear to reverse the current bearish trend to bullish trend? If this scenario is true, the current market may have found the bottom and prepare for the rebound. However, one concern is the trading volume is very low for the past 1 week rally. Normally this kind of Price Volume Divergence type of rally is not sustainable. Seems that the buyers are not convinced enough to go in big time to grab the stocks. No one can predict the market correctly but it is important to have some idea how the market is heading in the coming week. If the stock market is reversed to the uptrend, it is time to do Fundamental Analysis to pick up cheap stocks for investing strategy. Some Singapore stocks are pretty cheap now! If the recently rally is not sustainable, the stock market will head straight down to continue the down trend. Using Technical Analysis to short the market should be the key strategy.

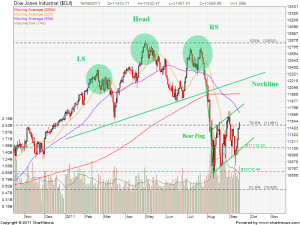

Dow Jones Industrial ($DJI)

- Price Volume Divergence on the recent rally after breaking the 50D MA resistance.

- Currently testing the resistance at about 11,620. $DJI may pull back anytime after climbing close 1,000 points in two weeks.

- Supports: 11,200 (50D MA) and 11,160 (20D MA). If these supports hold after the retracement, there is relatively higher possibility the down trend is ended and up trend is on the way. However, still need a “Higher High, Higher Low” chart pattern to confirm the uptrend.

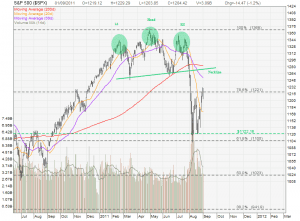

S&P500 ($SPX)

- Price Volume Divergence on the recent rally after breaking the 50D MA resistance.

- Resistances: 1,220 (78.6% Fibonacci Retracement Level and previous two highs). Currently testing the resistance.

- Supports: 1,172 (50D MA) & 1,166 (20D MA) – If these supports hold after the retracement, there is relatively higher possibility the down trend is ended and up trend is on the way. However, still need a “Higher High, Higher Low” chart pattern to confirm the uptrend.

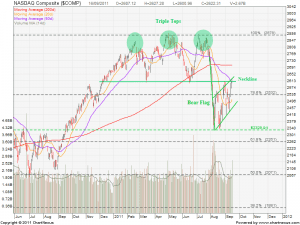

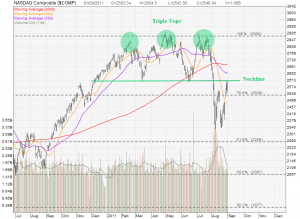

NASDAQ Composite ($COMP)

- Price Volume Divergence on the recent rally after breaking the 50D MA resistance.

- Resistance: about 2,700 (200D MA)

- Supports: 2,520 (20D MA); 2,500 (50D MA). $COMP to stay above about 2,500 level to have higer possibility to kick start the uptrend.

Word of Caution: Recent stock market movement has shown “Fast Up Fast Down”. Trade and Invest with care!

I welcome for any constructive comments.