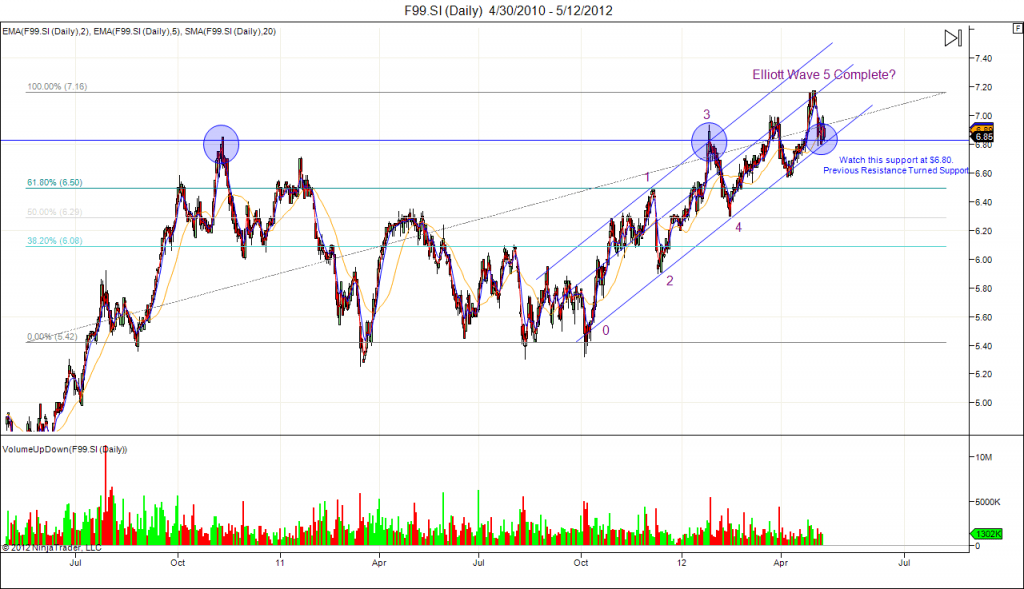

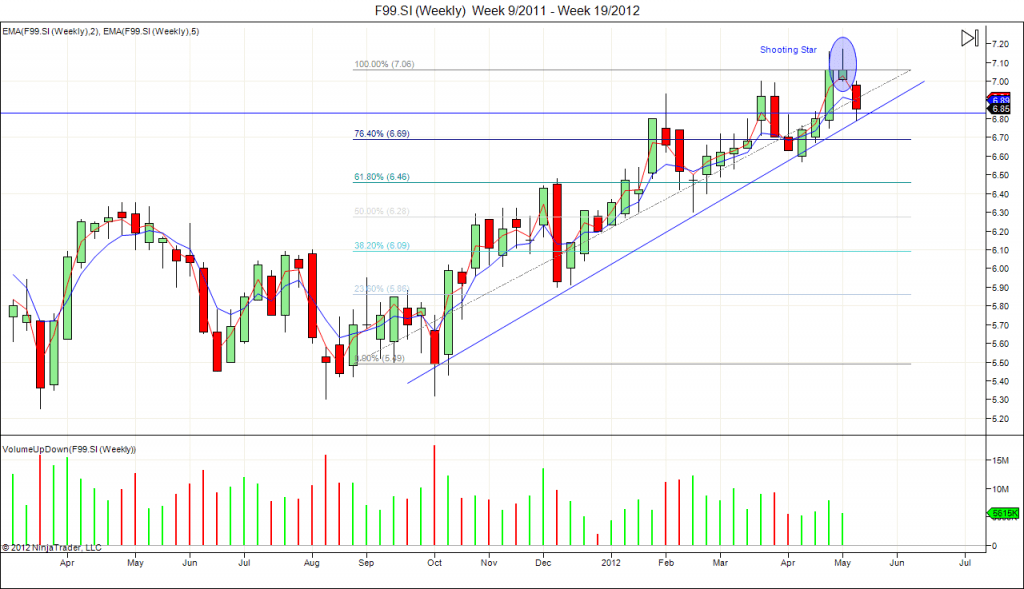

Base on current daily and weekly chart, F&N is still on uptrend. F&N is still trading above 50D and 200D SMA. However, need to watch out for a few potential reversal signals:

- The stock seems like trading at Elliott Wave 5 now on Daily chart. If F&N completes Wave 5, a bearish corrective wave A-B-C will start.

- $6.80 is the previous resistance level and 50D SMA. Need to see whether F&N is able to hold above this $6.80 resistance turned support level.

- Shooting Star and Evening Star were formed at the historical high F&N stock price, these two are reversal candlestick patterns.

- 2/5 EMA is going to show bearish crossover on both daily and weekly chart.

- 2/5 EMA is going to cross down 20 SMA on daily chart.

- If all the above bearish signals appear with increase in trading volume, who say there is no “Sell in May and Go Away” this year?

If the $6.80 support is strong and F&N continues the uptrend, I will still NOT enter any long position.

Reason? My rule: NEVER BUY AT HIGH!