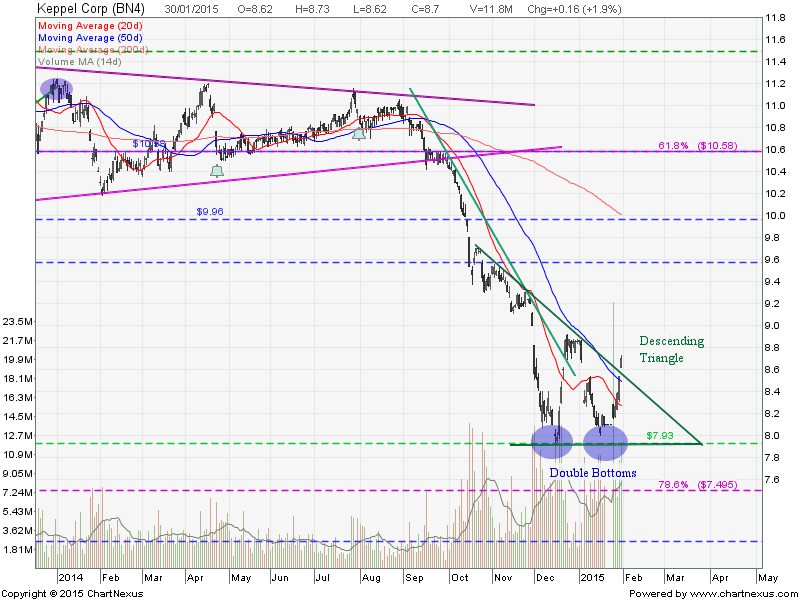

Keppel Corp looks like have bottoming up and showing reversal chart pattern. Breaking out from Descending Triangle is a first sign but Kep Corp will be facing the gap resistance and the Double Bottoms neckline resistance between $8.80 and $8.90. Need to wait for all these confirmation to confirm the trend reversal.

Original post by Marubozu from My Stocks Investing Journey.

| Current P/E Ratio (ttm) | 8.3815 |

|---|---|

| Estimated P/E(12/2015) | 9.7643 |

| Relative P/E vs. FSSTI | 0.6204 |

| Earnings Per Share (SGD) (ttm) | 1.0380 |

| Est. EPS (SGD) (12/2015) | 0.8910 |

| Est. PEG Ratio | 4.0348 |

| Market Cap (M SGD) | 15,763.30 |

| Shares Outstanding (M) | 1,811.87 |

| 30 Day Average Volume | 6,827,027 |

| Price/Book (mrq) | 1.5235 |

| Price/Sale (ttm) | 1.1885 |

| Dividend Indicated Gross Yield | 5.52% |

| Cash Dividend (SGD) | 0.3600 |

| Dividend Ex-Date | 04/22/2015 |

| 5 Year Dividend Growth | 5.12% |

| Next Earnings Announcement | 04/16/2015 |