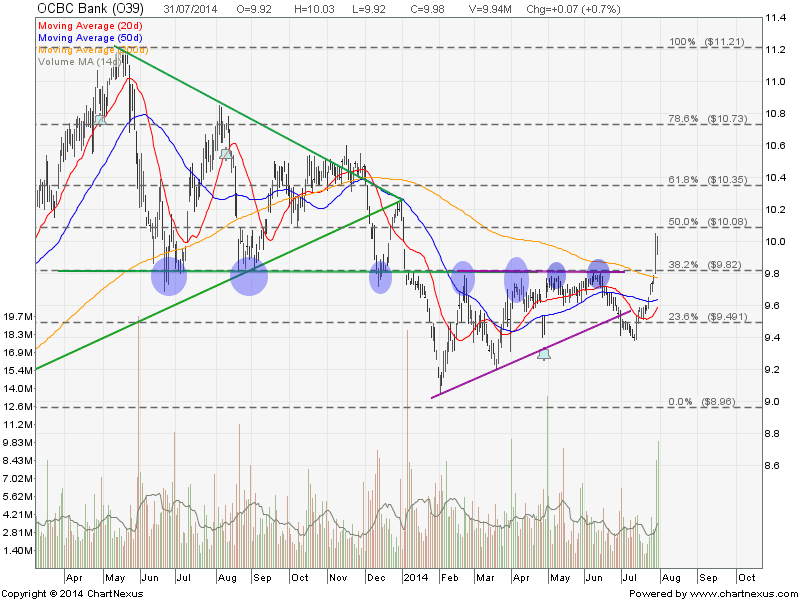

OCBC breaks the tough support turned resistance at about $9.82 and currently testing a psychological $10.00 resistance. If OCBC can stay above $9.82, it is a confirmed that OCBC will start an uptrend.

Original post by Marubozu from My Stocks Investing Journey.

| Current P/E Ratio (ttm) | 11.8810 |

|---|---|

| Estimated P/E(12/2014) | 11.5376 |

| Relative P/E vs. FSSTI | 0.8335 |

| Earnings Per Share (SGD) (ttm) | 0.8400 |

| Est. EPS (SGD) (12/2014) | 0.8650 |

| Est. PEG Ratio | – |

| Market Cap (M SGD) | 34,857.21 |

| Shares Outstanding (M) | 3,492.71 |

| 30 Day Average Volume | 3,041,567 |

| Price/Book (mrq) | 1.3163 |

| Price/Sale (ttm) | 3.8098 |

| Dividend Indicated Gross Yield | 3.41% |

| Cash Dividend (SGD) | 0.1700 |

| Dividend Ex-Date | 04/28/2014 |

| 5 Year Dividend Growth | 3.96% |

| Next Earnings Announcement | 08/05/2014 |