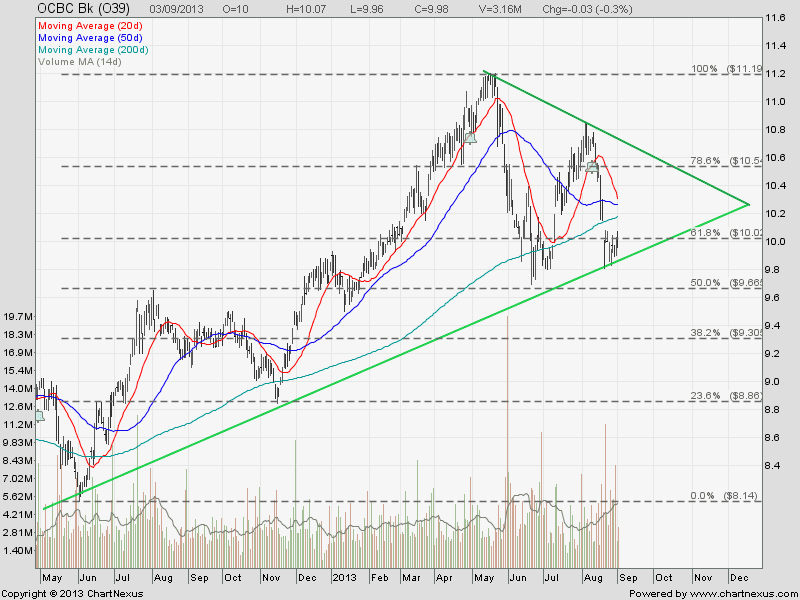

OCBC Bank is currently consolidating in a Symmetrical Triangle and trading just above the Triangle Support. Expect rebound at current level to the Triangle resistance at about $10.50-$10.60.

Original post by Marubozu https://mystocksinvesting.com

Key Statistics for OCBC

| Current P/E Ratio (ttm) | 9.3389 |

|---|---|

| Estimated P/E(12/2013) | 13.1455 |

| Relative P/E vs. FSSTI | 0.7431 |

| Earnings Per Share (SGD) (ttm) | 1.0740 |

| Est. EPS (SGD) (12/2013) | 0.7630 |

| Est. PEG Ratio | 2.4196 |

| Market Cap (M SGD) | 34,437.33 |

| Shares Outstanding (M) | 3,433.43 |

| 30 Day Average Volume | 4,124,400 |

| Price/Book (mrq) | 1.4845 |

| Price/Sale (ttm) | 4.1289 |

| Dividend Indicated Gross Yield | 3.39% |

| Cash Dividend (SGD) | 0.1700 |

| Last Dividend | 08/12/2013 |

| 5 Year Dividend Growth | 3.96% |

| Next Earnings Announcement | 11/08/2013 |