OUE Commercial REIT Quarterly Earning Report on Aug 12 2015

- Last Done Price = $0.63

- Market Cap = $799.4 M

- NAV = $1.1

- Price / NAV = 0.57 (43% Discount)

- IPO Price = $0.80

- Price / NAV (High) = 0.77

- Price / NAV (Low) = 0.57

- Distribution Yield = 9.21%

- Gearing Ratio = 37.9%

- WADM = 2.46 Years

- WALE = 2.7 Years

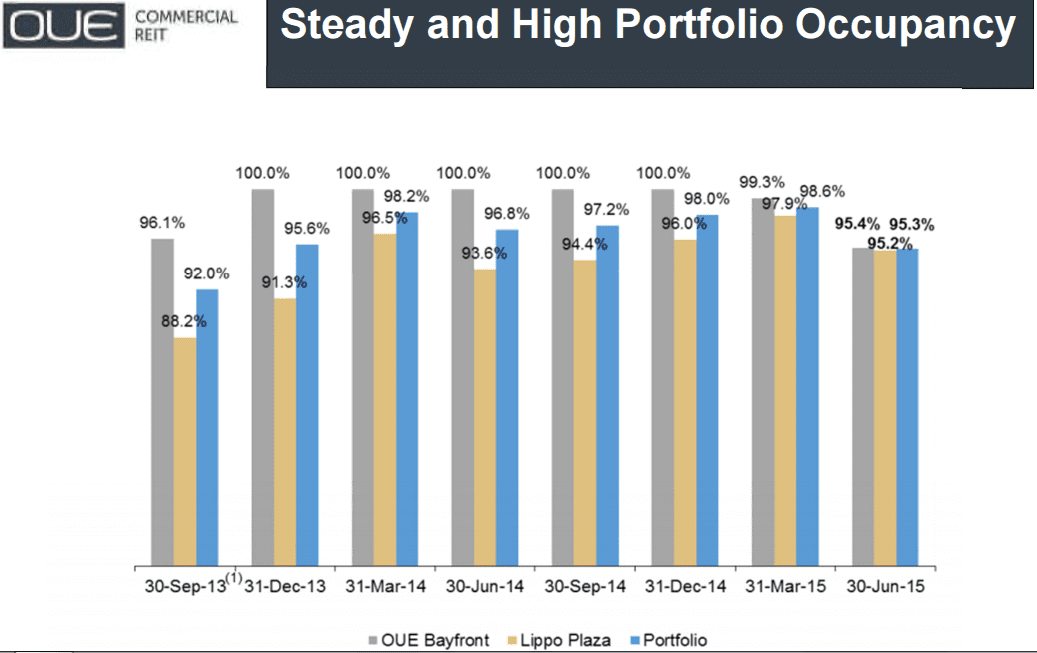

- Occupancy Rate = 95.3%

See OUE Commercial REIT IPO information here.

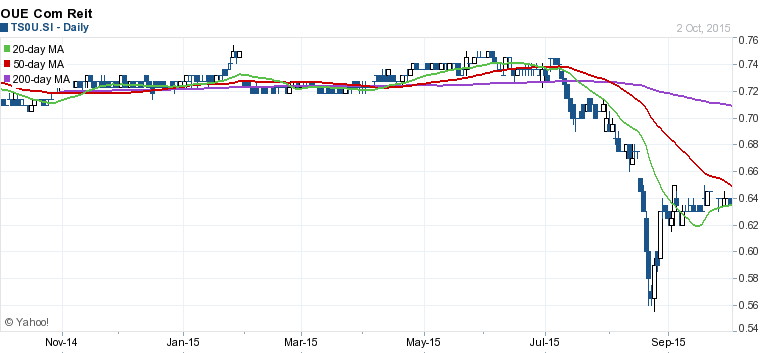

OUE Commercial REIT Technical Analysis & Stock Chart

OUE Commercial REIT is currently trading below 200D SMA and currently on short term sideway consolidation. Medium term and long term trend remain down.

Although valuation and distribution yield of OUE Commercial Trust looks very attractive but there are a couple of risks in the fundamental. It is not so straight forward to spot those risks. So, do your Due Diligence before investing.

Check out Singapore REIT Course here on how to identify the risks and analyse the sustainability of Singapore REIT. https://mystocksinvesting.com/course/singapore-reits-investing/