INTRODUCTION TO OUE Commercial REIT

OUE C-REIT is a Singapore real estate investment trust (“REIT”) established with the principal investment strategy of investing, directly or indirectly, in a portfolio of income-producing real estate used primarily for commercial purposes (including real estate used primarily for office and/or retail purposes) in financial and business hubs within and outside of Singapore, as well as real estate-related assets.

- IPO Price = S$0.80

- Projected DPU Yield = 6.8% (2014), 6.89% (2015)

- Number of Units = 866,000,000 (Page 65 of OUE C-REIT IPO Prospectus)

- Subscription by Cornerstone investors = 225,000,000 (Page 58 of OUE C-REIT IPO Prospectus)

- Net Asset = S$902,984,000 (Page 65 of OUE C-REIT IPO Prospectus)

- NAV = S$1.0427 –> IPO price is 23.3% Discount to the NAV.

- Total Debt = S$681,416,000 (Page 65 of Balance Sheet of of OUE C-REIT IPO Prospectus)

- Total Asset = S$1,652,403,000 (Page 65 of Balance Sheet of of OUE C-REIT IPO Prospectus)

- Gearing Ratio = 41.2%

Check out how to analyse of OUE C-REIT here, understand whether OUE C-REIT is worth for IPO subscription and what are the risks involved.

Also see comparison Table of other Singapore REITs.

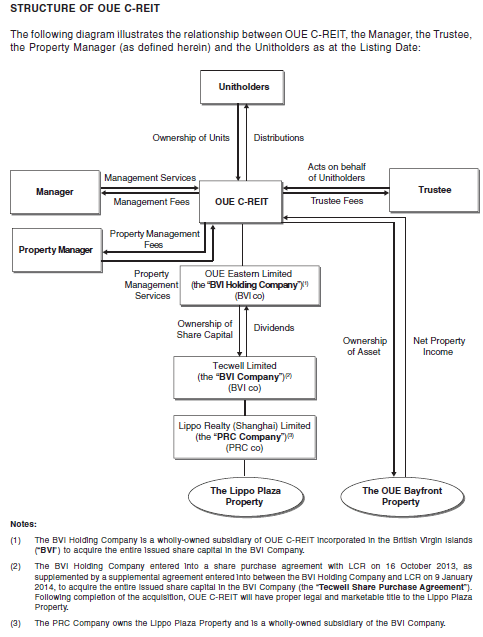

OUE C-REIT Structure

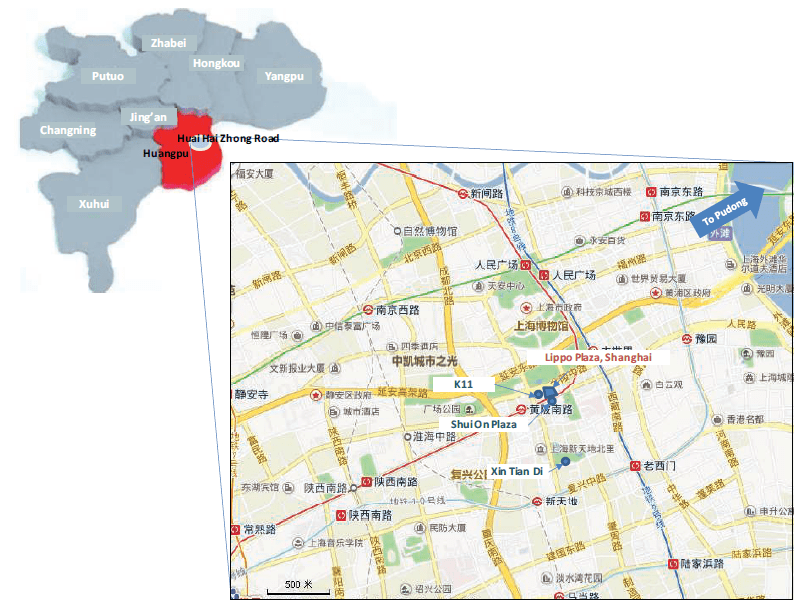

Portfolio Summary

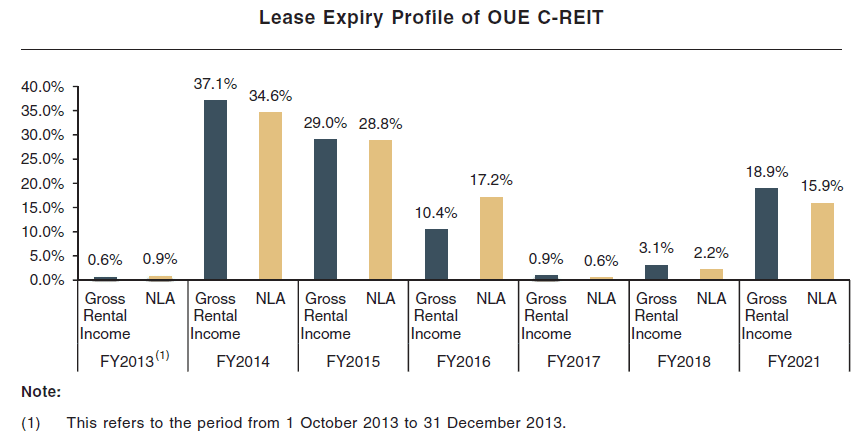

Tenant Mix & Lease Expiry

Distribution Yield Forecast

See detail OUE C-REIT IPO Prospectus here.

wanted to buy OUE Reit but unable to do it at ATM. please advise. thanks

IPO subscription for OUE C-REIT closed yesterday.