Financial Sector is the WORST Performing Sector Year To Date. This is not really a surprise to me as the Debt crisis in Europe and US are at the edge of getting out of control. You can check out the relative Sector Performance HERE (Finviz.com) . (I simply LOVE this site!) The recent news of lawsuit by the Federal Housing Finance Agency over the US banks make the situation worst. Read the news here. All these bad news will affect Singapore Financial Sector like UOB Bank, OCBC Bank, DBS Bank, SGX, etc although they are fundamentally strong. I expect more downsides for these 4 stocks although they are holding pretty well and not as bad as the US banks so far. This phenomenom is called Movement in Sympathy in stock market.

So, is this bad news or good news? For those who are still holding bank stocks and still “hope” the banks stock price will recover to make profit or breakeven, you probably need to do more exercise to get a stronger heart to ride through this volatile period. To me, I see many good trading opportunities in the Financial sector.

Below is my trading plan:

-

Look for opportunities to short UOB, DBS, OCBC and SGX using CFD. – Use Technical Analysis.

-

Buy US Short Financial ETF. – Use Technical Analysis.

-

Bottom fishing Singapore Banks when they are super under value. – Use Fundamental Analysis and Stock Valuation (PE Ratio, Price to Book Ratio, Discounted Cash Flow Model, Discounted Dividend Model, Discounted EPS Model)

The reason I don’t plan to buy any US bank stocks when they are under value because fundamentally the US banks are still very fragile and the debt crisis in US cannot be fixed overnight especially when the Republican and Democrat cannot work together to solve the economy problem.

I listed some relevant Financial ETF and Singapore Bank Stocks here for reference.

XLF (Financial Select Sector SPDR ETF)

A wide array of diversified financial service firms are featured in this sector with business lines ranging from investment management to commercial and investment banking. Among the companies included in the Index are JPMorgan Chase, Wells Fargo, and BankAmerica Corp.

http://finviz.com/chart.ashx?t=XLF&ty=c&ta=0&p=d&s=l

SKF (ProShares Ultrashort Financials ETF)

ProShares UltraShort Financials seeks daily investment results, before fees and expenses, that correspond to twice (200%) the inverse (opposite) of the daily performance of the Dow Jones U.S. Financials IndexSM. This ETF seeks a return of -200% of the return of an index (target) for a single day.

http://finviz.com/chart.ashx?t=SKF&ty=c&ta=0&p=d&s=l

SEF (ProShares Short Financials ETF)

ProShares Short Financials seeks daily investment results, before fees and expenses, that correspond to the inverse (opposite) of the daily performance of the Dow Jones U.S. Financials IndexSM. This ETF seeks a return of -100% of the return of an index (target) for a single day.

http://finviz.com/chart.ashx?t=SEF&ty=c&ta=1&p=d&s=l

UOB Bank

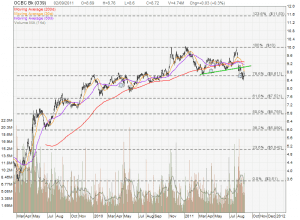

OCBC Bank

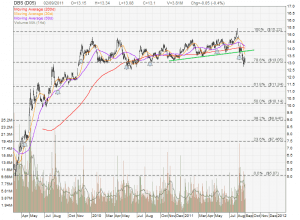

DBS Bank

Singapore Exchange (SGX)

Feel free to re-forward or share with your friends, relatives and family if you find my analysis is useful. No copyright.

Disclaimer: All the information above are for my own analysis. I am not a Certified Financial Analyst and not from any brokers, banks or any related financial institution. It is not my recommendation to buy or sell any stocks. The trading strategy listed above is not suitable to everyone due to individual risk profile, different degree of knowledge of Macro-economy, Fundamental Analysis and Technical Analysis.