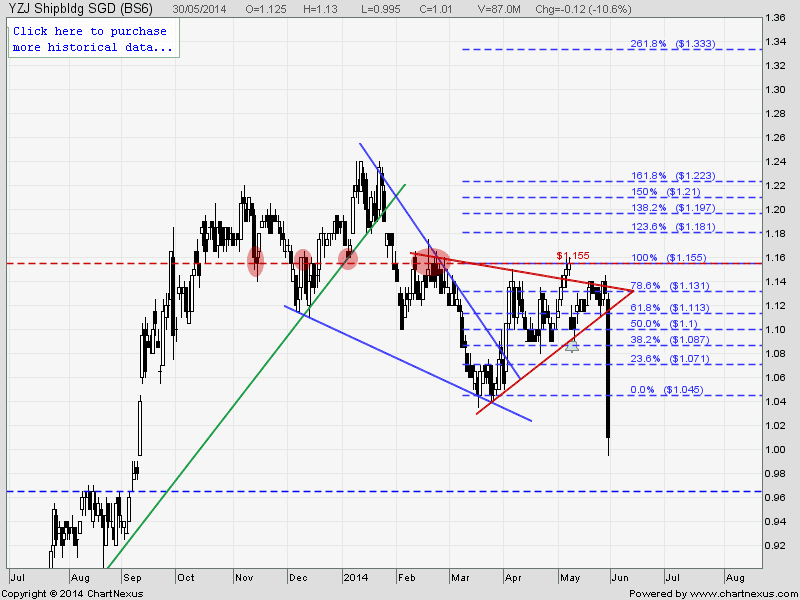

I believe many retail investors get burnt on Yangzijiang today after the counter went through a 10.62% sell off at about 3pm due to the recent news release. Those retail investors who do not have time to monitor the stock market closely or do not have stop loss in place have their capital wipe out more than 10% in just 2 hours.

Yangzijiang shares slide as rail firm readies legal fight

Rail company calls for investigation into shipbuilding tycoon Ren Yuanlin

There are a few stock market lessons to be learnt here:

- Throw out all the technical analysis when there is such a news. TA cannot will not work on sudden news.

- If you are buying software and trade base on software buy and sell signal, good luck to you! Those signals are lagging indicators.

- You just need one such trade to wipe out all your trading profits. So, do not put all eggs into one trade.

- If you don’t have time to monitor the market, don’t trade. Retail investors have no chance to escape from such lightning sell off unless you have instructed your broker to monitor this counter specifically for you.

- Always put a stop loss order when enter a trade. Stop Loss can prevent you to lose big in this kind of situation.

- When a drastic sell off happens, cut loss first and ask question later.

- Do not hope the counter will rebound the next few days. No one know what is going to happen. Don’t be surprise that this counter may be suspended for investigation.

- However, this may be a good opportunity to buy a good fundamental stock (provided no accounting regularity) when there is a panic sell off. So, wait for the dust to settle first.

Feel free to share your views on what are the lessons can be learnt from this trade.

Cheers!

YZJ back up to 1.14 today. Just shows how useful stop loss and technical analysis. No one got burned.