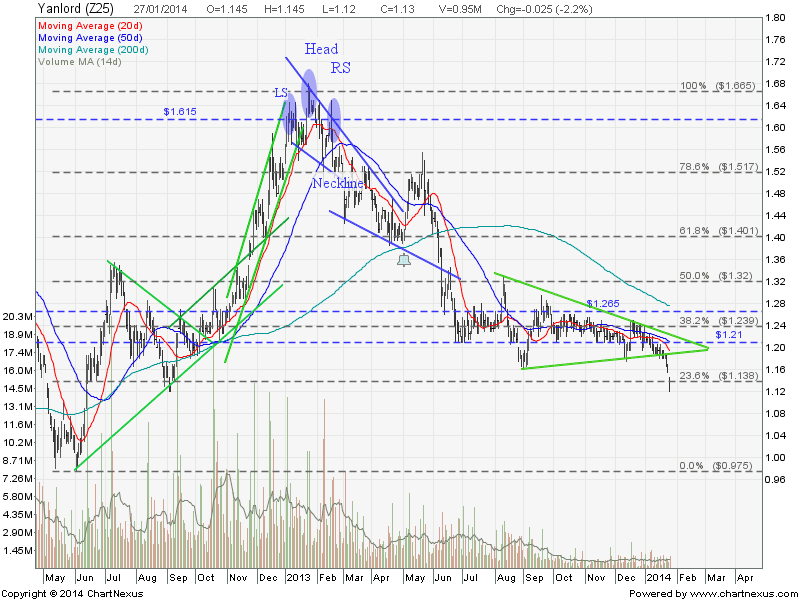

Yanlord broke out from a Symmetrical Triangle after 6 months of consolidation. Price target of this breakdown is $1.05.

Original post by Marubozu from My Stocks Investing Journey.

| Current P/E Ratio (ttm) | 10.7482 |

|---|---|

| Estimated P/E(12/2013) | 10.0387 |

| Relative P/E vs. FSSTI | 0.8261 |

| Earnings Per Share (CNY) (ttm) | 0.4978 |

| Est. EPS (CNY) (12/2013) | 0.5330 |

| Est. PEG Ratio | 0.9044 |

| Market Cap (M SGD) | 2,202.07 |

| Shares Outstanding (M) | 1,948.74 |

| 30 Day Average Volume | 680,033 |

| Price/Book (mrq) | 0.6241 |

| Price/Sale (ttm) | 0.9346 |

| Dividend Indicated Gross Yield | 1.65% |

| Cash Dividend (SGD) | 0.0186 |

| Dividend Ex-Date | 05/02/2013 |

| 5 Year Dividend Growth | 8.98% |

| Next Earnings Announcement | 02/27/2014 |