Broadcom (BRCM) Trade Idea

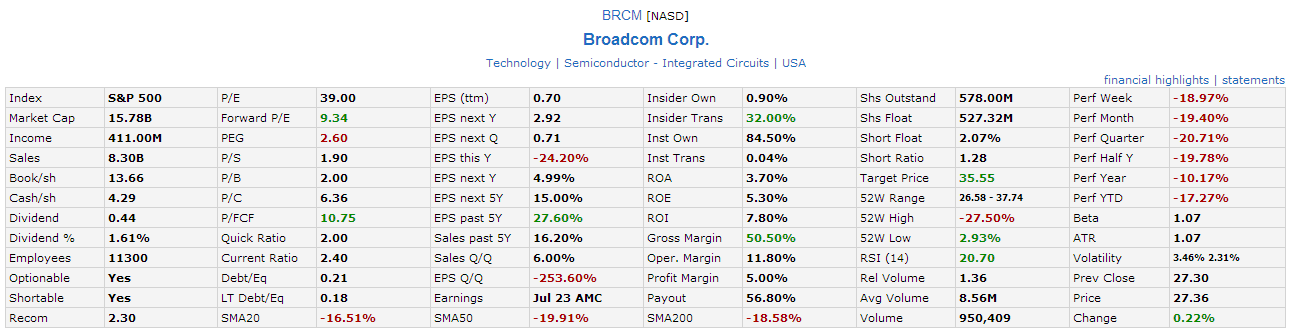

Technical Analysis: BRCM Gapped down after a posting 2Q loss on $501M impairment charges. Currently BRCM is just sitting on the critical support level at about $27.00 (Dec 2012 low) and also the 161.8% Fibonacci Retracement Level.

See Earning Announcement of BRCM.

Trading Plan: Wait another a few more days to see whether this support is strong and show sign of reversal pattern.

Trading Strategy: either Short Put Spread or Long Call

- STO BRCM Sept 13 30 Put

- BTO BRCM Sept 13 26 Put

- If break support, BTC BRCM Sept 13 30 Put to repair (1 month before expiry), else close both positions.

or

- BTO BRCM Sept 13 28 Call

- Close position one month before expiry date to minimize Time Decay.

BRCM Chart

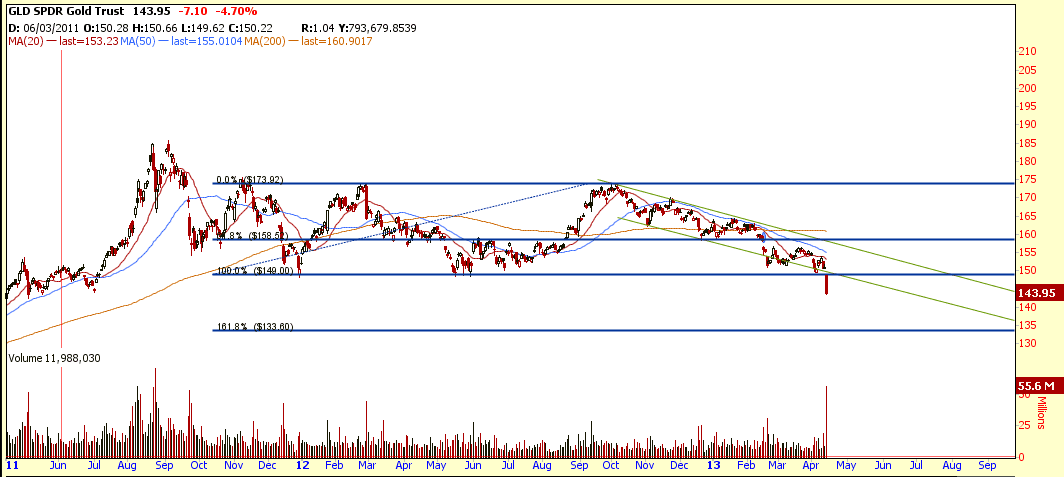

BRCM Fundamental