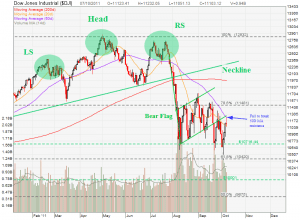

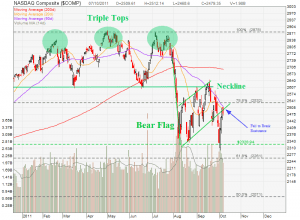

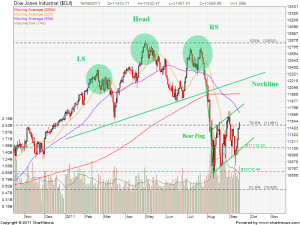

City Development: Time to Short?

Base on current daily & weekly chart, City Development is showing bearish signal on 2/5 EMA. A Double Tops pattern is formed on Daily chart and currently CityDev is just sitting on the neckline of about $11.45 (currently forming a Bear Flag). Breaking down from this neckline will send CityDev to the target price of about $11.00 which is also the 61.8% Fibonacci Retracement Level & 50D SMA. On Weekly chart, a Evening Doji Star candlestick pattern was formed which is also the trend reversal pattern. Current chart pattern presents a good opportunity to short CityDev.

Key Statistics for CIT

| Current P/E Ratio (ttm) | 18.1201 |

|---|---|

| Estimated P/E (12/2012 ) | 17.3788 |

| Earnings Per Share (SGD) (ttm) | 0.6330 |

| Est. EPS (SGD) (12/2012) | 0.6600 |

| Est. PEG Ratio | – |

| Market Cap (M SGD) | 10,429.69 |

| Shares Outstanding (M) | 909.30 |

| Enterprise Value (M SGD) (ttm) | 14,145.29 |

| Enterprise Value/EBITDA (ttm) | 15.12 |

| Price/Book (mrq) | 1.4968 |

| Price/Sale (ttm) | 3.2986 |

| Dividend Indicated Gross Yield | 0.6975 |

| Next Earnings Announcement | 11/09/2012 |