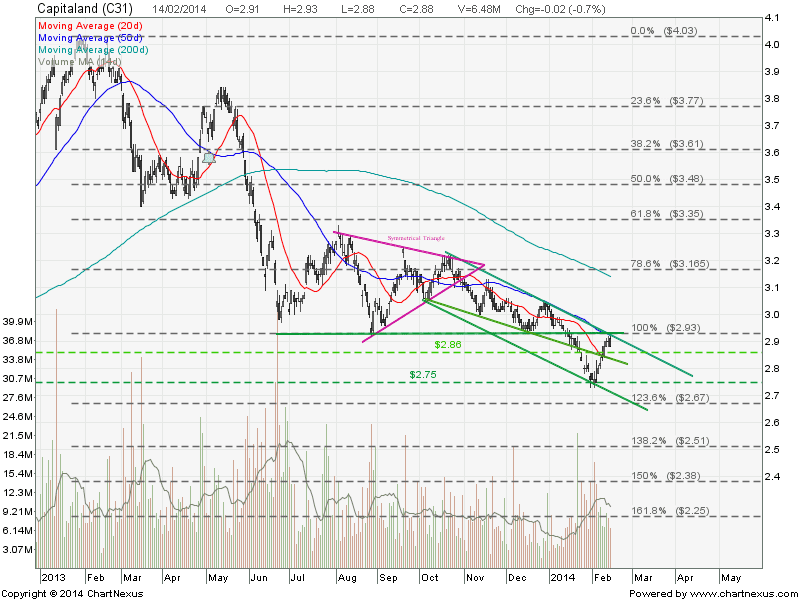

Capitaland: Dead Cat Bounce Finished?

Capitaland was rejected at 50D SMA resistance with a Doji Bearish Engulfing. This resistance ($2.93) is the previous support turned resistance and also the Down Trend Channel Resistance. It looks like Capitaland will continue the down trend from here onwards. Technically Capitaland is on the down trend when 20D, 50D and 200D are all sloping down.

See other post for Capitaland fundamental data comparison with other property counters here.