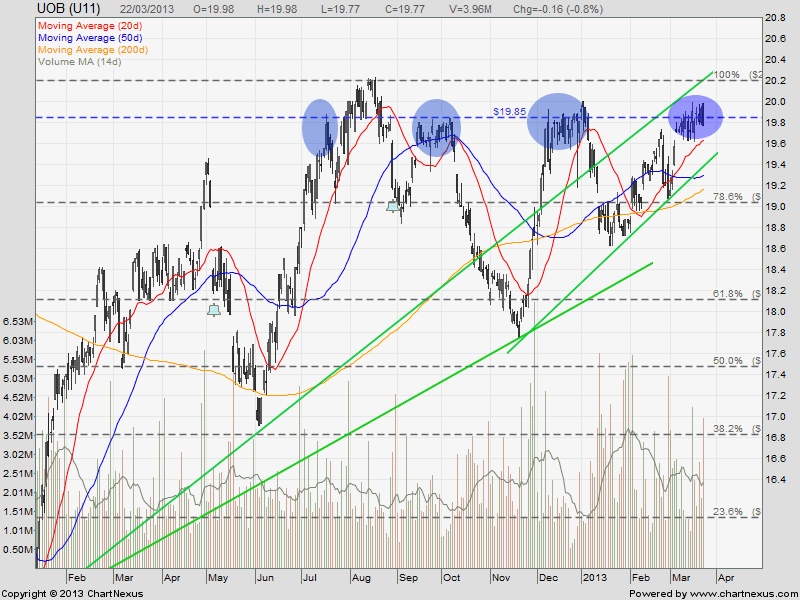

UOB Bank: Rejected at $20 Resistance

UOB rejected at $20.00 resistance with Bearish Engulfing pattern with a spike in trading volume. Is it a first sign of trend reversal? Anyway, I have shorted the stock using CFD base on my trading strategy “Buy Near Support, Sell Near Resistance” when I see a reversal candlestick pattern with a very tight stop loss just slightly above $20.00 resistance. All other technical indicators have not shown any bearish signals yet.

On a bigger scale, UOB is showing a Huge Ascending Triangle with a tough pyschological resistance at $20.00. 200D SMA support is at about $19.15.

Previous analysis on UOB Bank.

Key Statistics for UOB

| Current P/E Ratio (ttm) | 11.5109 |

|---|---|

| Estimated P/E(12/2013) | 11.6775 |

| Relative P/E vs. FSSTI | 1.0717 |

| Earnings Per Share (SGD) (ttm) | 1.7175 |

| Est. EPS (SGD) (12/2013) | 1.6930 |

| Est. PEG Ratio | 1.3011 |

| Market Cap (M SGD) | 31,134.76 |

| Shares Outstanding (M) | 1,574.85 |

| 30 Day Average Volume | 2,327,567 |

| Price/Book (mrq) | 1.3577 |

| Price/Sale (ttm) | 3.6342 |

| Dividend Indicated Gross Yield | 3.03% |

| Cash Dividend (SGD) | 0.1000 |

| Last Dividend | 05/06/2013 |

| 5 Year Dividend Growth | -5.09% |

| Next Earnings Announcement | 05/09/2013 |