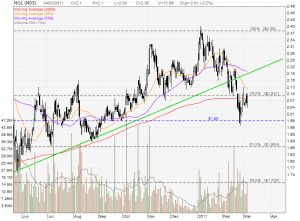

NOL: Testing 200D MA Resistance

Current NOL chart looks bearish. A Bearish Engulfing candlestick pattern especially at the resistance level was observed. This is a reversal pattern after the recent rebounce. Keep a close eye that whether 20D MA crosses down the 200D MA in the next few days. If yes, NOL will start a bearish down trend.