City Development: More Down Side

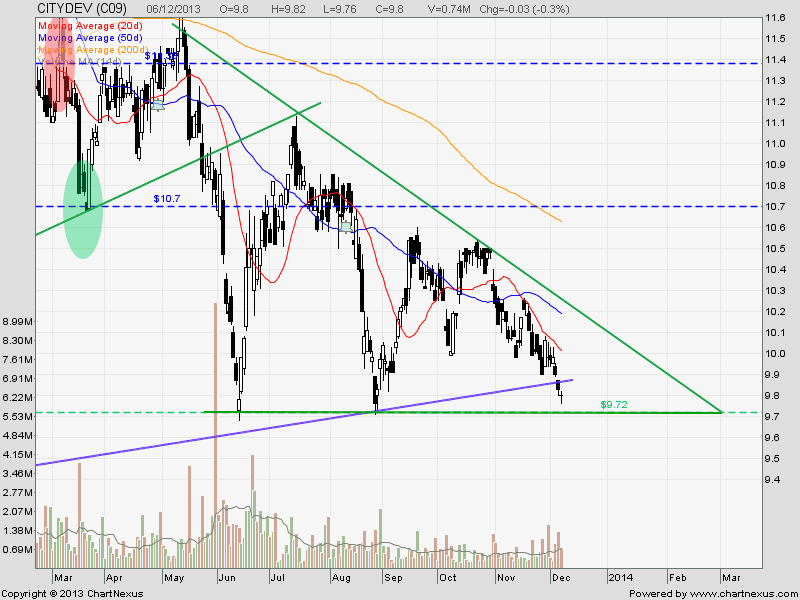

City Development breakdown from a Descending Triangle. Currently City Development rebound and retest the Triangle support turned resistance. Failing to move above $9.72 will confirm the breakout with price target of $8.25.

City Development is on the confirmed long term down trend as 200D SMA is sloping down. A “Lower Low, Lower High” down trend pattern has also been formed.

Original Post by Marubozu @ My Stocks Investing Journey

| Current P/E Ratio (ttm) | 12.5000 |

|---|---|

| Estimated P/E(12/2013) | 15.0235 |

| Relative P/E vs. FSSTI | 0.9319 |

| Earnings Per Share (SGD) (ttm) | 0.7680 |

| Est. EPS (SGD) (12/2013) | 0.6390 |

| Est. PEG Ratio | 2.4657 |

| Market Cap (M SGD) | 8,729.29 |

| Shares Outstanding (M) | 909.30 |

| 30 Day Average Volume | 753,633 |

| Price/Book (mrq) | 1.2000 |

| Price/Sale (ttm) | 2.6662 |

| Dividend Indicated Gross Yield | 0.83% |

| Cash Dividend (SGD) | 0.0800 |

| Dividend Ex-Date | 08/13/2013 |

| 5 Year Dividend Growth | 0.98% |

| Next Earnings Announcement | 02/28/2014 |