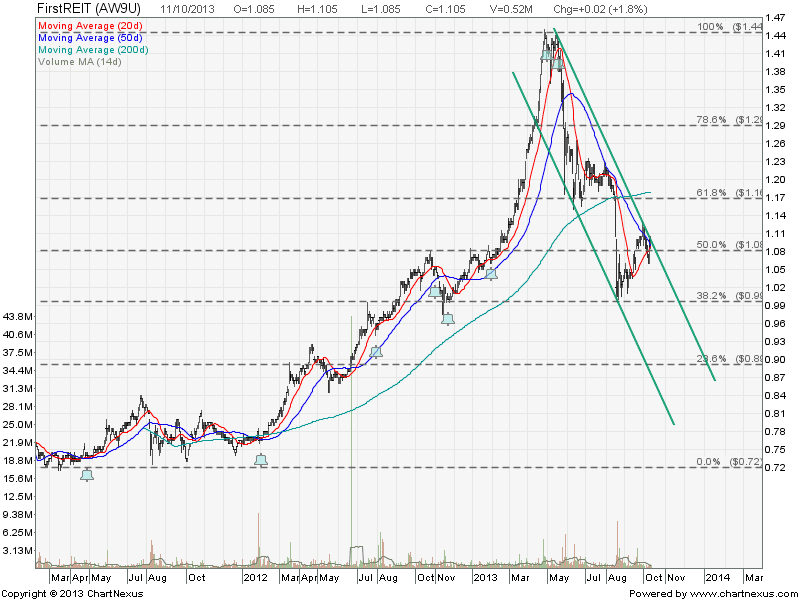

First REIT: Fundamental & Technical Analysis

Fundamental Analysis

- Last Price = $1.105

- NAV = $0.895

- Price / NAV = 1.2346

- Distribution Yield = 6.195%

- Gearing Ratio = 33.4%

- Plus Points: Rental pegged at SGD and USD & Long Master Lease.

- Minus Point: Gearing at the high side.

FIRST REIT last presentation at Macquarie ASEAN Conference on Aug 28, 2013.

Technical Analysis

First REIT is technically bearish (below 200D SMA) and currently seems like trading within a down trend channel. Currently the stock price is testing the down trend channel resistance. If rejected at this resistance and break the recent support of $1.06, First REIT will continue the down trend.

See Singapore REIT Comparison Table here.