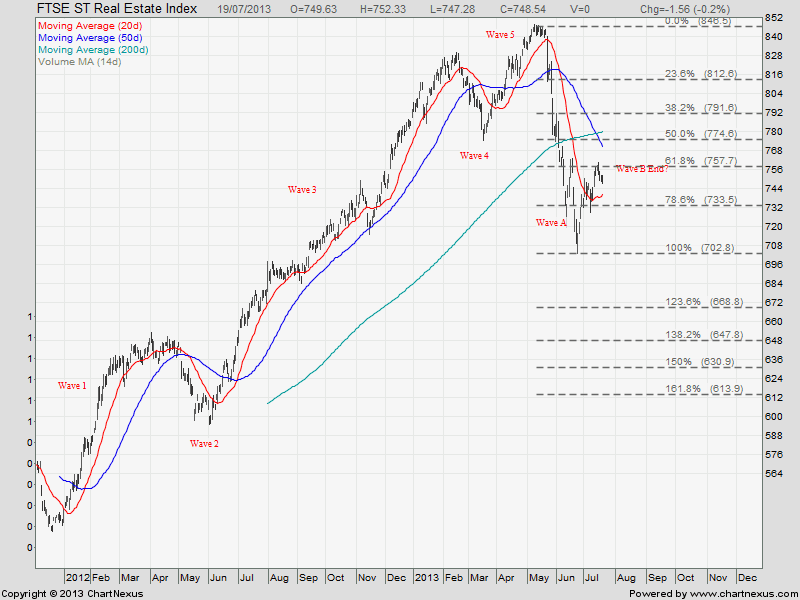

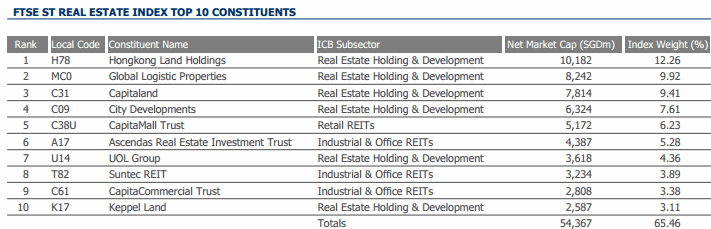

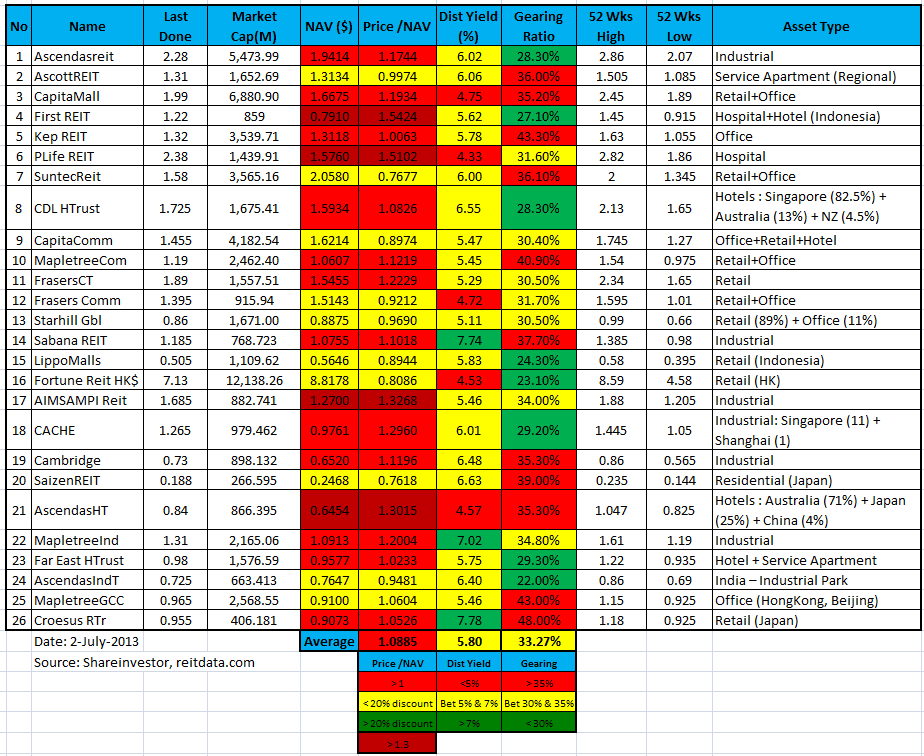

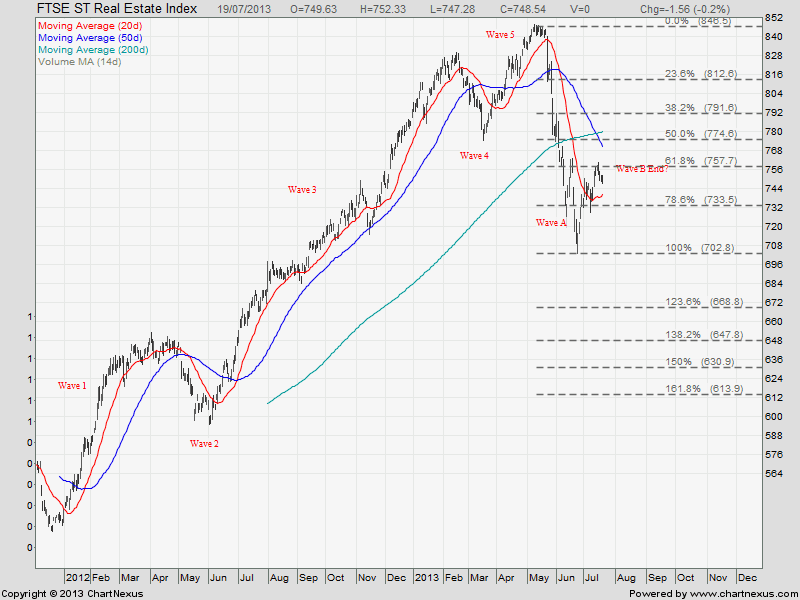

FTSE ST Real Estate is showing a Elliott Wave pattern. Currently the index is trading in a Wave B. Wave C (bearish wave) will start if the index break the support of 733.5. It is important to monitor the FTSE ST Real Estate Index because we can detect whether there is any strength or weakness in property counters to plan our trade.

Analysis by Marubozu https://mystocksinvesting.com

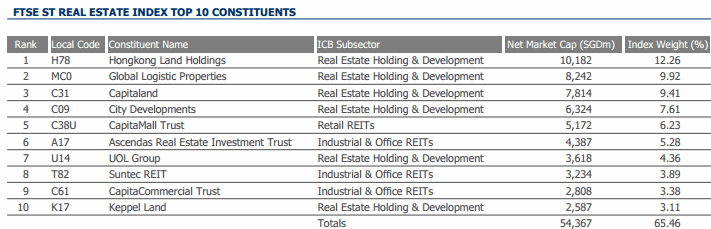

If the sector is weak, we can look for the Top 10 components stock to short by looking at the individual stock chart.

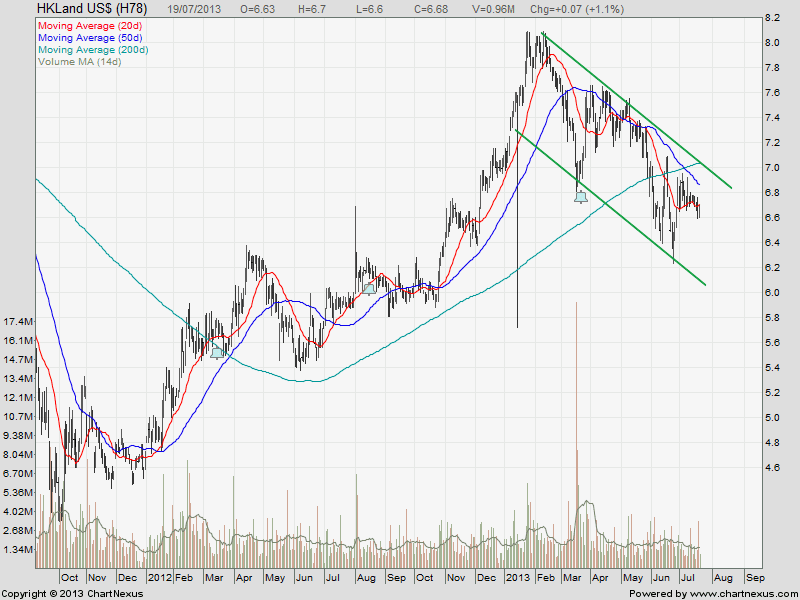

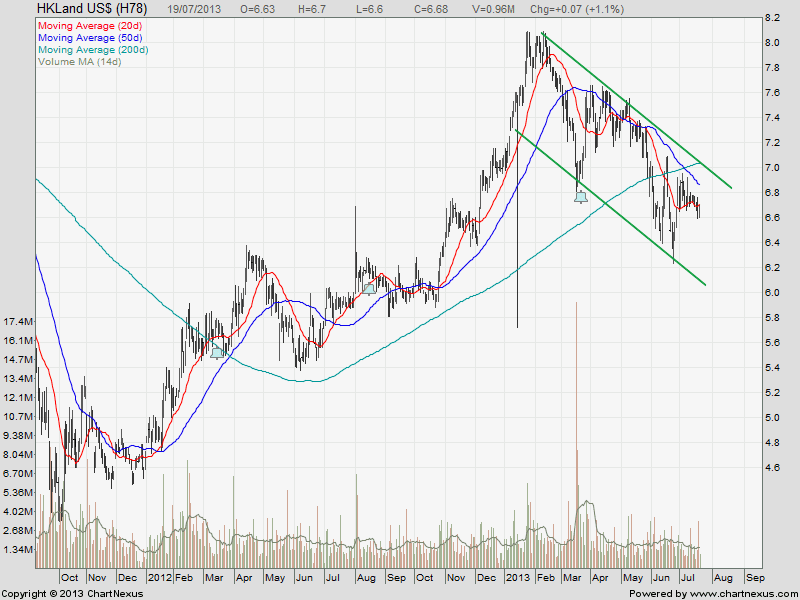

Look at Hongkong Land’s chart and you can see the weakness of the stock. The stock is trading in a down trend channel.

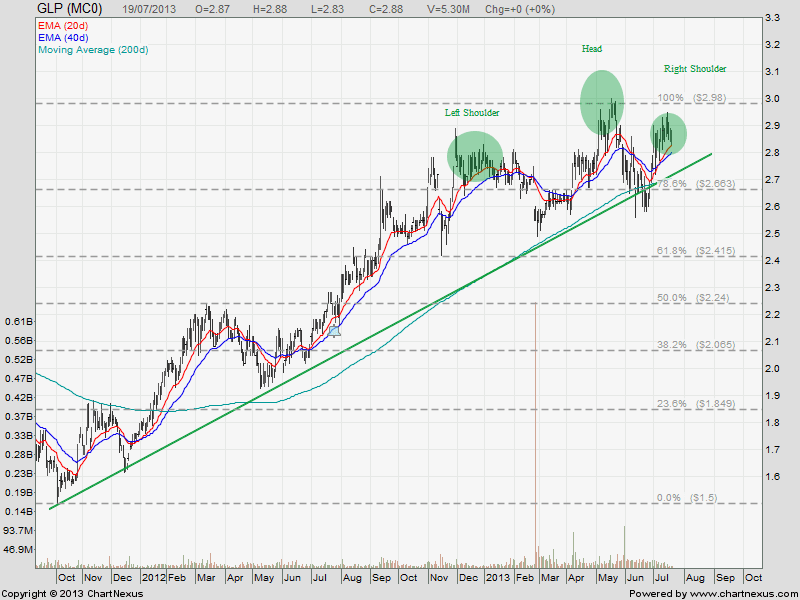

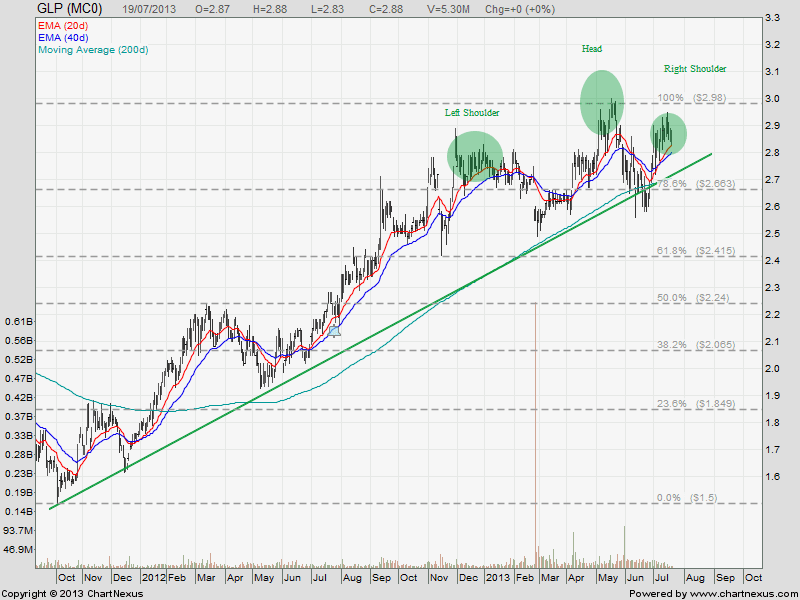

Although Global Logistic Properties (GLP) is still on uptrend but be cautious that a Head and Shoulders may be in formation.

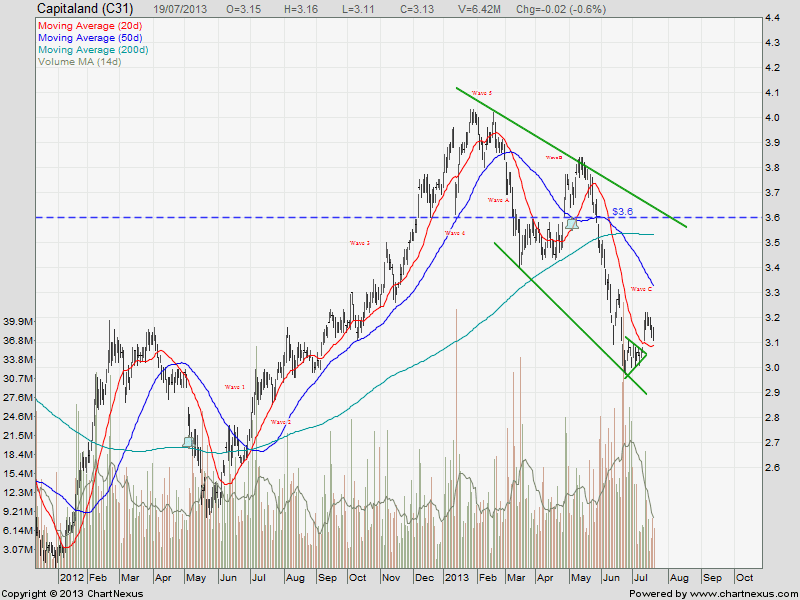

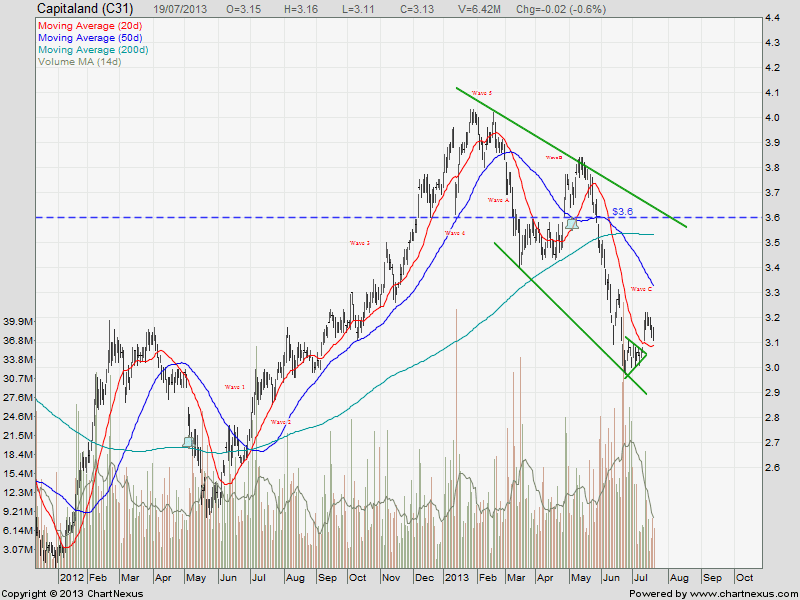

Capitaland’s chart is bearish and trading in down trend.