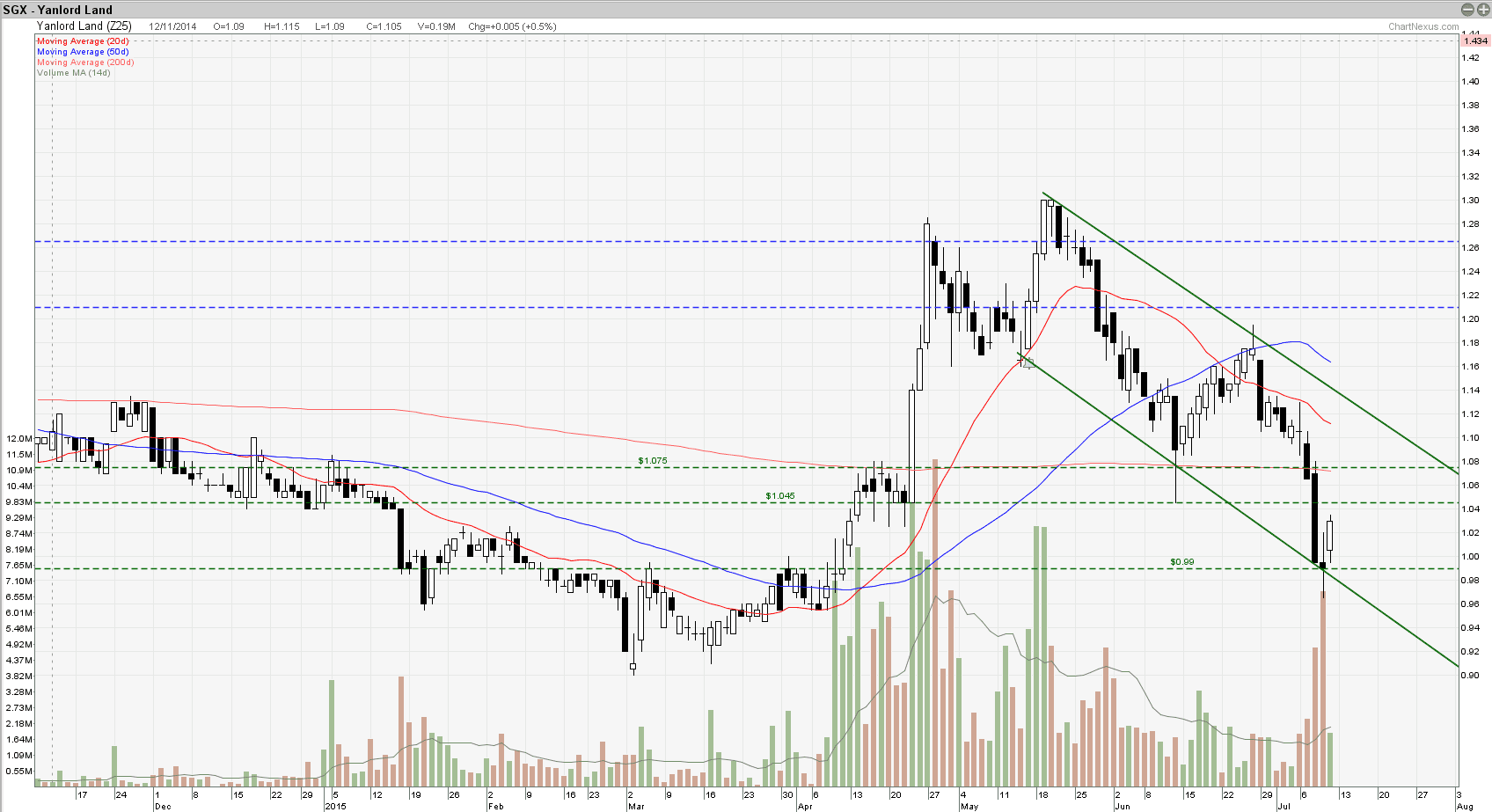

Yanlord: Trading in a Down Trend Channel

Yanlord is currently trading in a Down Trend Channel but seems like rebounding from the down trend channel support at the moment. However, this Morning Star reversal pattern is not fully formed yet as it is not meeting the Morning Star Pattern criteria. Immediate resistance at $1.07 which is also the 200D SMA resistance.

So far the candlestick reversal patterns are relatively reliable for Yanlord.

- Morning Star at the start of the down trend channel support

- Hanging Man and Evening Star at start of the down trend channel resistance

- Bullish Harami and Three Inside Up at down trend channel support

- Shooting Star and Evening Star at down trend channel resistance

To learn how to candlestick patterns to identify the trend reversal , check out the Technical Analysis Hands on class here.