Don’t catch the falling knife although Apple (AAPL) is super under value now. Sarcastically most Analysts have a BUY or OVERWEIGHT call on AAPL but downgrade the target price. You are going to lose money if you just follow blindly the recommendation of the analysts. This is a classic example of combining Fundamental Analysis, Technical Analysis, Analyst Recommendation and the interpretation of Target Price, and develop a Trading Plan or Investment Plan.

Fundamental Analysis

- Last Traded Price = $439.88

- Current PE = 9.96

- Forward PE = 7.73

- PEG = 0.48

- P/B = 3.49

- Current Ratio = 1.50

- Debt / Equity = 0

- ROA = 28.54%

- ROE = 42.84%

Using DCF Valuation Method

- Intrinsic Value (7% annual growth rate for the next 10 years) = $713.54

- Intrinsic Value (12% annual growth rate for the next 10 years) = $918.80

- Operating Cash Flow = $56,728 Million

- No. of Shares Outstanding = 939.06 Million

- Beta = 1.08

- Discount Rate = 5%

- Debt per Share = 0

- Cash per Share = $42.40

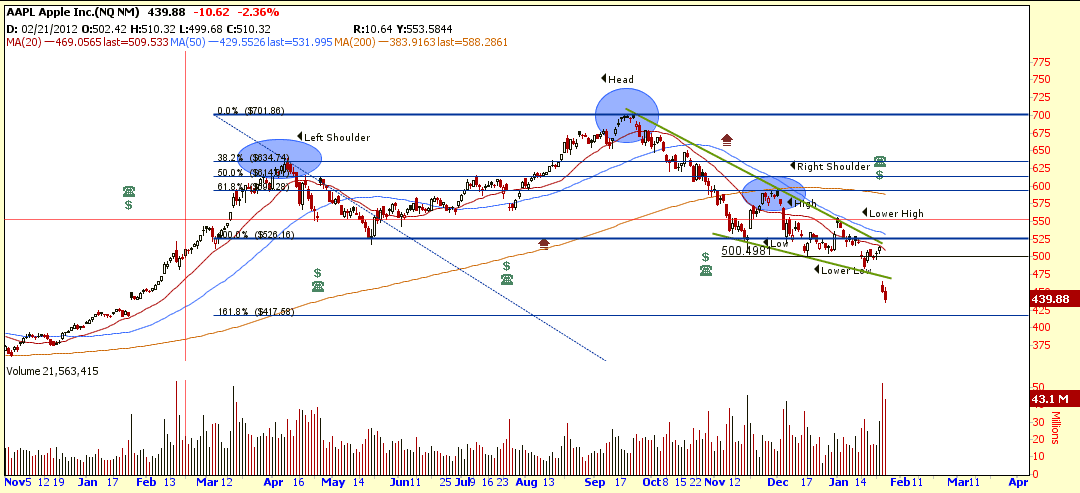

Technical Analysis

- AAPL breakdown from a Falling Wedge with Price Target of about $400 (short term).

- AAPL also breakdown from a Head & Shoulders with neckline at $525 and the price target is $350 (long term).

- Currently AAPL is trading down trend below 20D, 50D and 200D SMA.

Last Analysis on AAPL.

Last Intrinsic Calculation for AAPL.

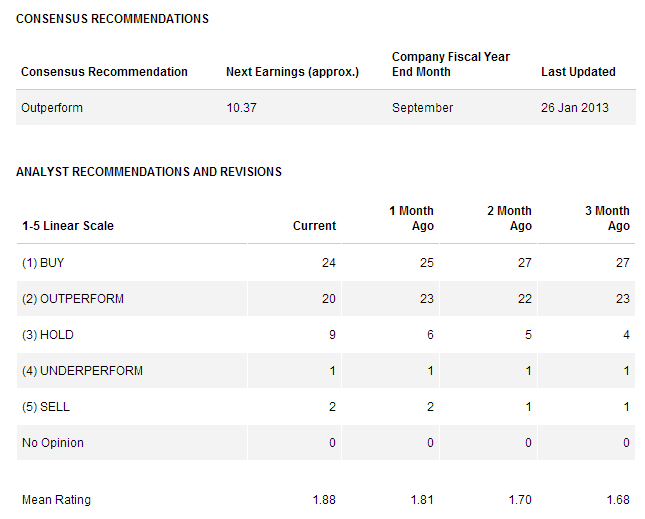

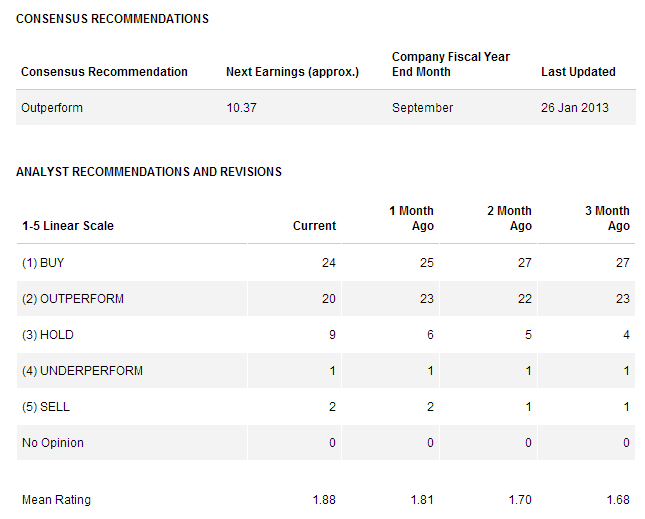

Recent Upgrade / Downgrade

| 24-Jan-13 |

Reiterated |

UBS |

Buy |

$650 → $600 |

|

| 24-Jan-13 |

Reiterated |

RBC Capital Mkts |

Outperform |

$725 → $600 |

|

| 24-Jan-13 |

Reiterated |

Oppenheimer |

Outperform |

$800 → $600 |

|

| 24-Jan-13 |

Reiterated |

Mizuho |

Buy |

$600 → $575 |

|

| 24-Jan-13 |

Reiterated |

ISI Group |

Strong Buy |

$710 → $600 |

|

| 24-Jan-13 |

Reiterated |

Deutsche Bank |

Buy |

$800 → $575 |

|

| 24-Jan-13 |

Reiterated |

Barclays |

Overweight |

$740 → $575 |

|

| 23-Jan-13 |

Reiterated |

FBR Capital |

Outperform |

$725 → $675 |

|

| 22-Jan-13 |

Reiterated |

UBS |

Buy |

$700 → $650 |

|

| 22-Jan-13 |

Reiterated |

Monness Crespi & Hardt |

Buy |

$750 → $670 |

|

| 16-Jan-13 |

Reiterated |

Stifel Nicolaus |

Buy |

$825 → $725 |

|

| 07-Jan-13 |

Reiterated |

Barclays |

Overweight |

$800 → $740 |

|

| 21-Dec-12 |

Reiterated |

RBC Capital Mkts |

Outperform |

$750 → $725 |

|

| 17-Dec-12 |

Reiterated |

Mizuho |

Buy |

$750 → $600 |

|

| 17-Dec-12 |

Reiterated |

Canaccord Genuity |

Buy |

$800 → $750 |

|

| 14-Dec-12 |

Reiterated |

UBS |

Buy |

$780 → $700 |

|

Analyst Recommendation