It is not a surprise Super Group faced a huge sell off after the recent headline news of “Super: 3Q13 Net Profit Down 17% To S$18.7 Million”.

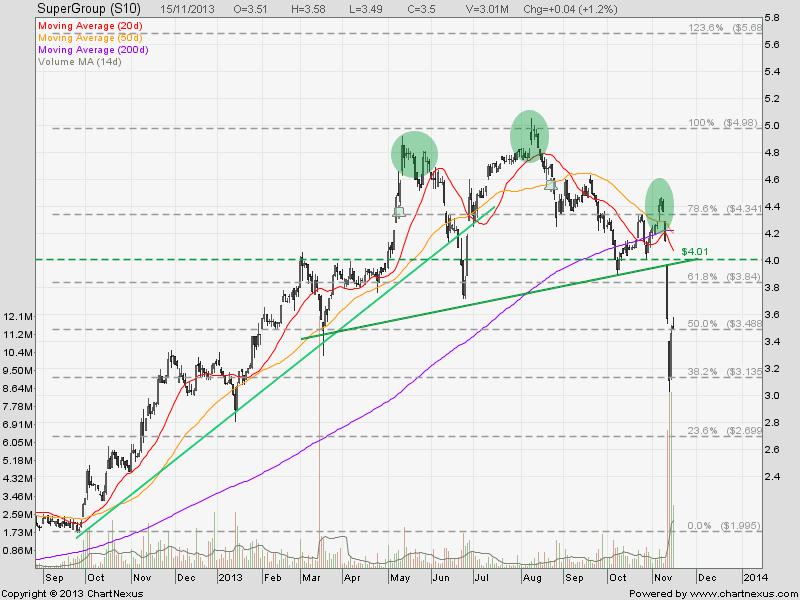

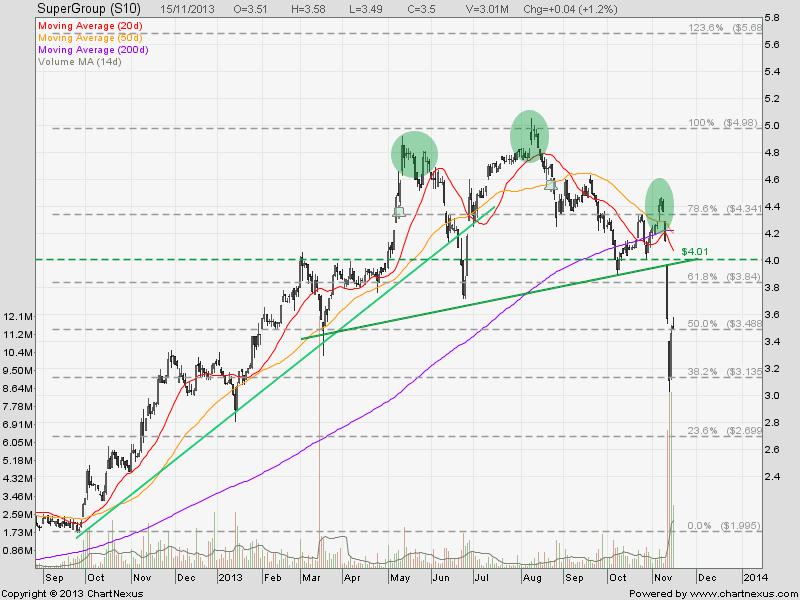

Fundamentally the stock is not cheap base on PE ratio. Technically Super Group is showing a Head and Shoulder and the stock price records a historical high at about $5.00. The shorties have been watching the $4.00 neckline for quite sometimes.

Super Group will start the down trend from now on as the stock has already entered into bearish territory. Watch for the rebound back to $3.50 (50% FR), $3.84 (61.8% FR) or $4.00 (neckline support turned resistance + round number) to short again!

Original post by Marubozu @ My Stocks Investing Journey.

Key Statistics for SUPER

| Current P/E Ratio (ttm) |

19.7406 |

| Estimated P/E(12/2013) |

22.4359 |

| Relative P/E vs. FSSTI |

1.4417 |

| Earnings Per Share (SGD) (ttm) |

0.1773 |

| Est. EPS (SGD) (12/2013) |

0.1560 |

| Est. PEG Ratio |

1.2972 |

| Market Cap (M SGD) |

1,951.55 |

| Shares Outstanding (M) |

557.59 |

| 30 Day Average Volume |

1,419,600 |

| Price/Book (mrq) |

4.4465 |

| Price/Sale (ttm) |

3.4897 |

| Dividend Indicated Gross Yield |

2.03% |

| Cash Dividend (SGD) |

0.0200 |

| Dividend Ex-Date |

08/23/2013 |

| 5 Year Dividend Growth |

34.72% |

| Next Earnings Announcement |

02/27/2014 |