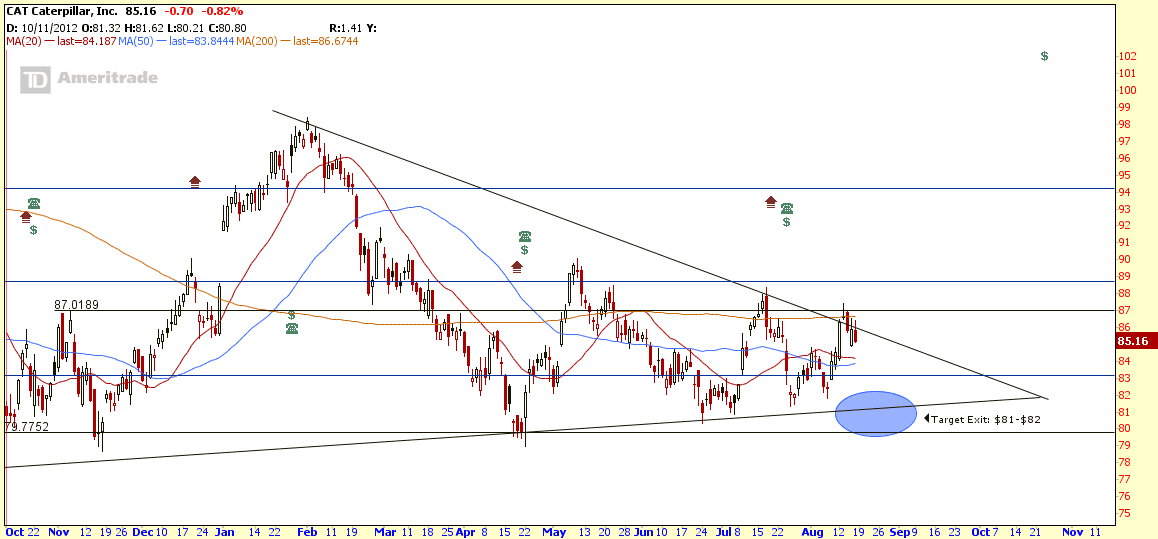

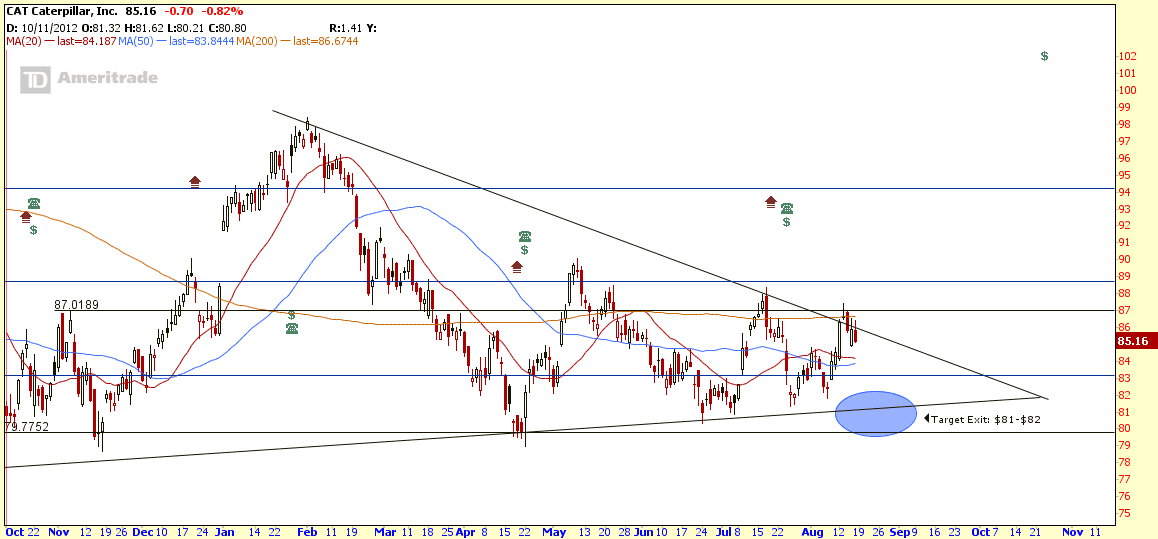

Unable to enter any trade base on last trade idea on Caterpillar as CAT did not reach my target entry price. Fortunately the chart presented me another entry level few days ago. This time is a bearish entry when CAT was rejected at 200D SMA resistance and also the Symmetrical Triangle resistance. In addition, the candlestick patterns were shouting LOUD and CLEAR at me with Shooting Star and Bearish Engulfing patterns.

Trading Strategy: Short Call Spread Sept 13 85/90

- Direction: Bearish (Rejected at Symmetrical Triangle Resistance and 200D SMA resistance)

- STO CAT Sept 13 85 Call

- BTO CAT Sept 13 90 Call

- If the resistance (about $87) is broken, close both legs to cut loss.

- Entry Price: $86.22

- Breakeven Price: $87.01

- Max Profit: $603

- Max Loss: $897

- Reward vs Risk: 0.67

- Probability Price Below Breakeven: 65%

- Exit Target: CAT price near to the Symmetrical Triangle support about $81-$82 region

Chart from thinkorswim, get FREE chart here.