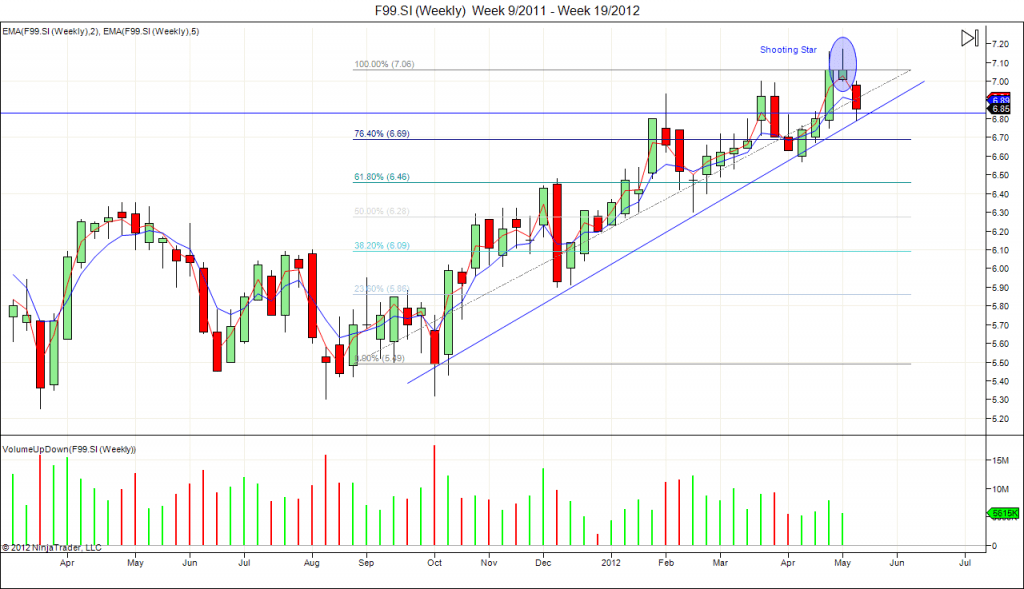

Global Logistic Prop (GLP): Shooting Star

GLP showed a Shooting Star at the Up Trend Channel Resistance, a potential short term retracement of GLP back to up trend channel support or 20D / 50D SMA. Opportunity for short term bearish trade or buy on dip for long term investment. Currently GLP is on up trend technically. Take note that GLP is not under value base on PE ratio.

Key Statistics for GLP

| Current P/E Ratio (ttm) | 17.9633 |

|---|---|

| Estimated P/E(03/2013) | 27.3886 |

| Relative P/E vs. FSSTI | 1.5338 |

| Earnings Per Share (USD) (ttm) | 0.1282 |

| Est. EPS (USD) (03/2013) | 0.0840 |

| Est. PEG Ratio | – |

| Market Cap (M SGD) | 13,367.11 |

| Shares Outstanding (M) | 4,756.98 |

| 30 Day Average Volume | 10,775,970 |

| Price/Book (mrq) | 1.2899 |

| Price/Sale (ttm) | 16.5015 |

| Dividend Indicated Gross Yield | 1.07% |

| Cash Dividend (SGD) | 0.0300 |

| Last Dividend | 07/24/2012 |

| 5 Year Dividend Growth | – |

| Next Earnings Announcement | 02/14/2013 |