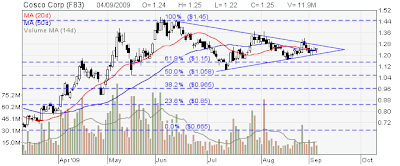

Jaya Holding – Breaking out from the Symmetrical Triangle

Jaya Holding looks like breaking out from the Symmetrical Triangle.

Technical Indicators also look bullish:

- Stock price above 20D, 50D and 200D MA.

- Stock price at upper Bollinger Band

- Stock price is below Parabolic SAR curve

- MACD Bullish Convergence

- RSI & Stochastic at Overbought region.

However, this bullishness may not be sustainable due to lack of volume.