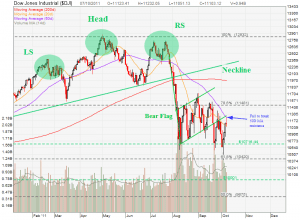

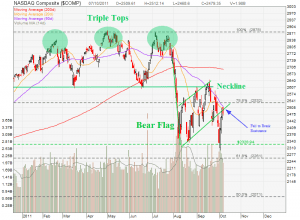

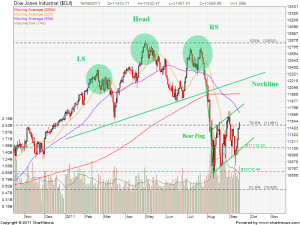

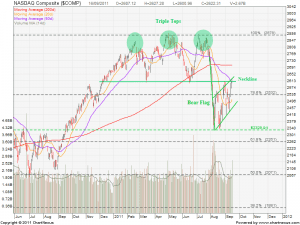

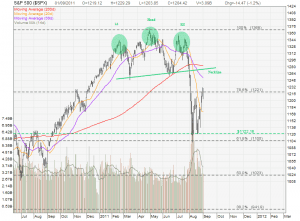

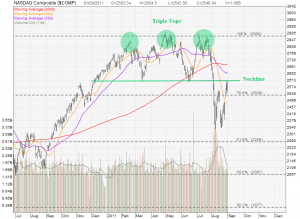

US Market Indices Review: Dow Jones Industrial, S&P500, NASDAQ – THE RETURN OF THE BEAR?

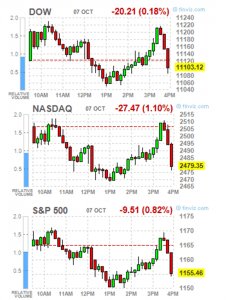

All 3 US Key Indices Dow Jones Industrial, S&P500 and NASDAQ Composite faced sell off in the last 30 mins of trading hour. This is not really unexpected because I am predicting the stock market will turn to bear again after the recent 3 days strong rally because they are hitting the resistance. Fasten your seat beat in the coming week because I am anticipating another Bear Flag, ie. another big sell off!