CapitaMall: Still On Up Trend But …..

CapitaMall is closing in 3 years high although it is still trading in the up trend channel. Rolling PE is 51.76 and distribution yield is 4.42%. Base on these numbers, this Capita Mall Trust is overvalue and near 3 years high. Do your own math to calculate what is the upside potential vs downside risk, and decide whether you want to hold on or take profit. You may want to look at the distribution yield and compare with other similar trust or REITs…. There are other better choices out there…..

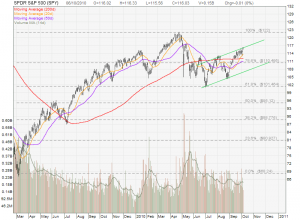

Sept has been a bullish month, What goes up must come down…. I may be wrong but I will not lose money if I am taking a safety first , wait and see approach without committing any additional money in the market.

Sept has been a bullish month, What goes up must come down…. I may be wrong but I will not lose money if I am taking a safety first , wait and see approach without committing any additional money in the market.