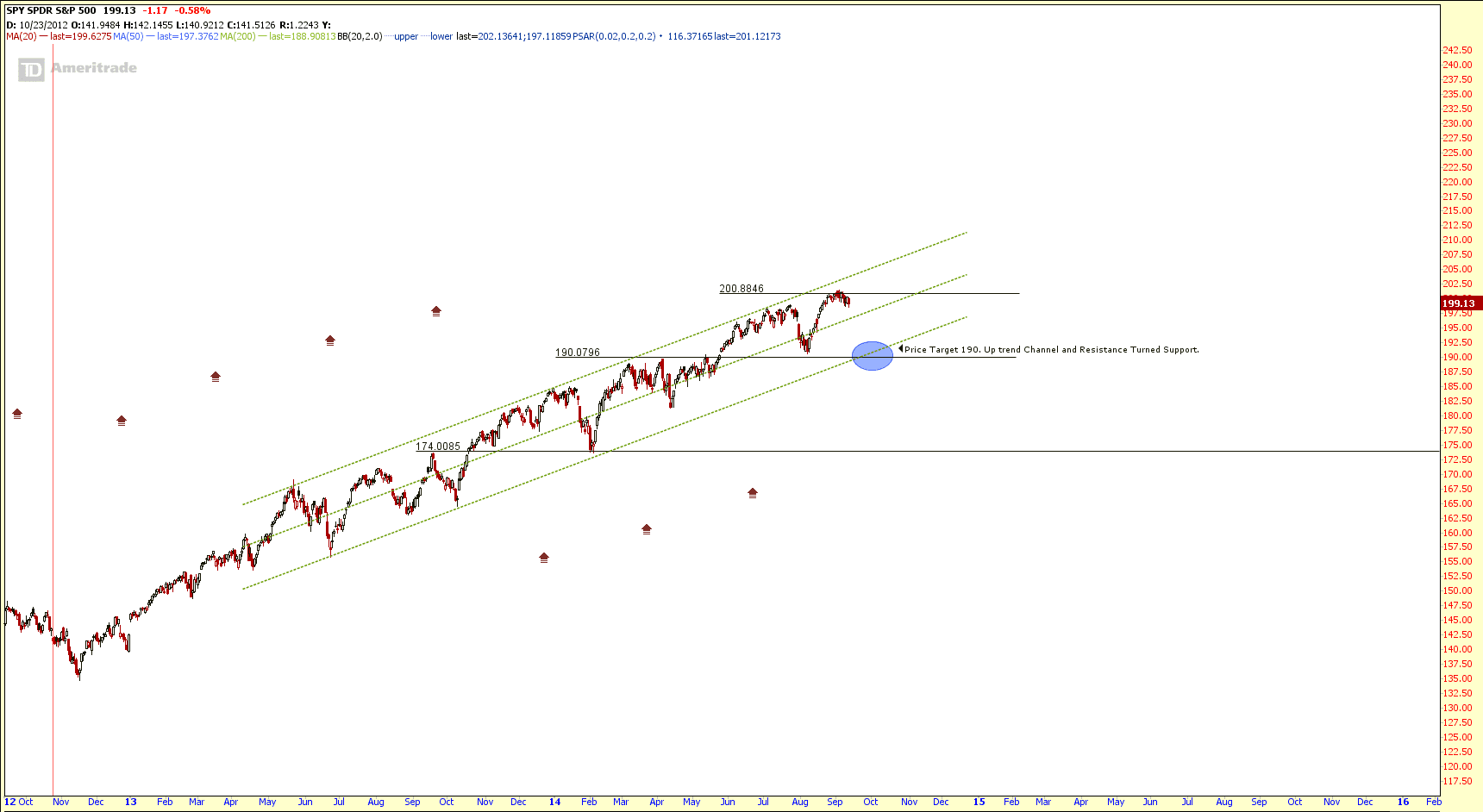

SPY: Sell off but still on Up Trend

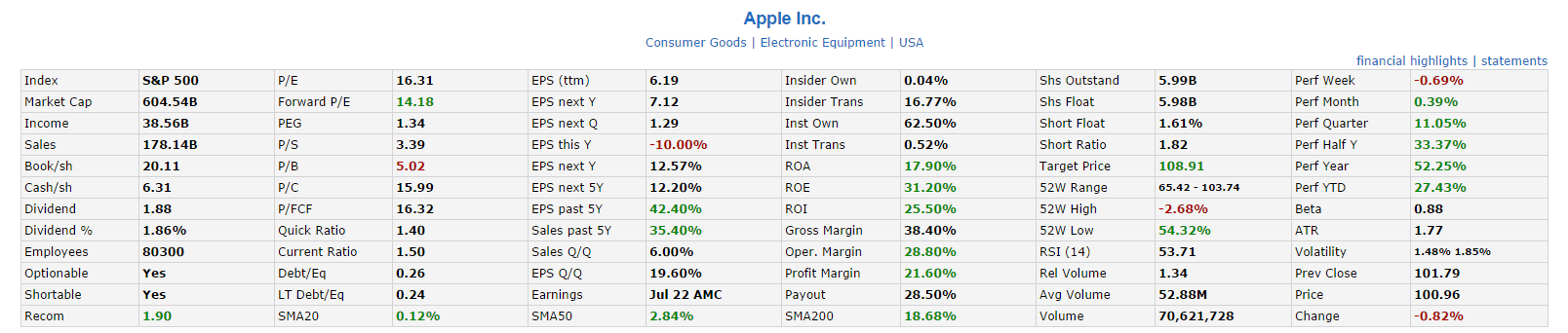

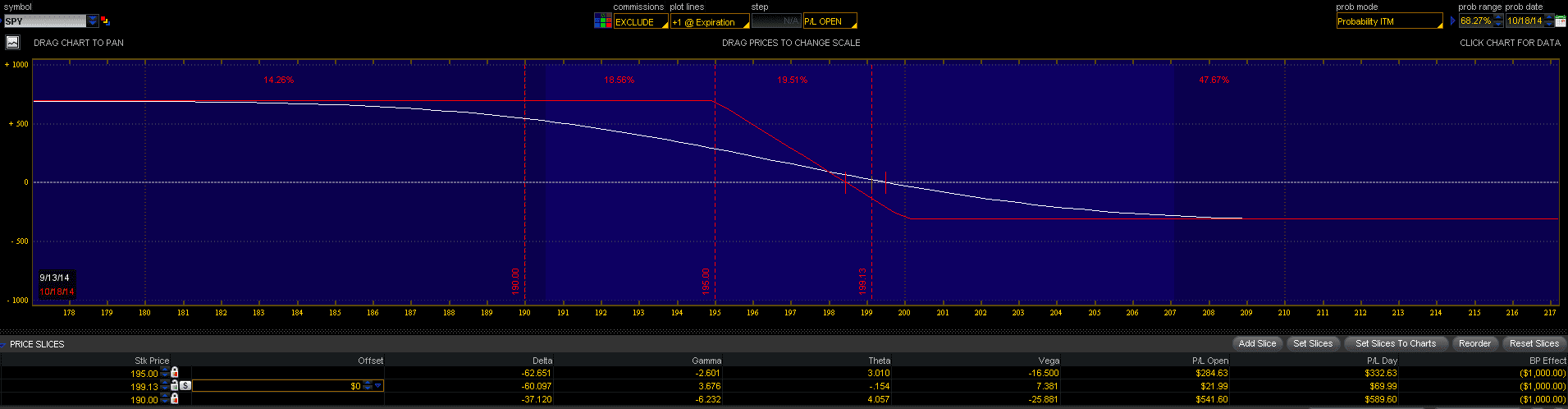

SPY (SPDR S&P500 ETF) has a very volatile week and has a huge sell off across the sectors. However technically SPY is still trading within an uptrend channel. SPY rebounded from the 50D SMA support on last Friday. Keep an eye of this 50D SMA and uptrend support (194-195 region) in the coming weeks. Take note that Window Dressing and Portfolio Pumping/Dumping at Sept Quarter End.

As we are moving into Oct, be extremely cautious on the October effect.

See last analysis on SPY.