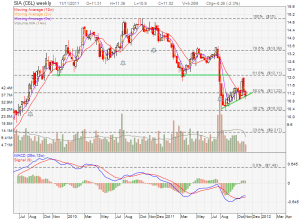

First REIT: Up Trend Support Broken!

First REIT uptrend has ended after the support trend line is broken. First REIT is trading below 20D and 50D SMA. The next support is at $0.975 followed by $0.925.

First REIT Fundamental Analysis

- Last Done Price = $1.02

- NAV = $0.7893

- Price / NAV = 1.2923

- DPU = $0.06955

- DPU Yield = 6.819%

- Gearing Ratio = 15.9%

- Market Cap = $645.296 M

Summary:

- Fundamentally & Technically the current level is not the right level to enter. First REIT has very good fundamental in terms on the stability of the distribution income, WALE (Weighted Average of Lease Expiry), gearing ratio and type of properties (hospital). The plan is to wait for First REIT to drop below the NAV and wait for the correction to finish.

- As First REIT is currently going through a correction base on chart and fundamentally the stock price is over value base on NAV, profit taking is a better option.

Other Singapore REIT Fundamental Comparison Table

Disclaimer: This is only a personal analysis. This is not buy or sell recommendation and I hold no responsibility in anyone profit or loss for trading or investing this stock.