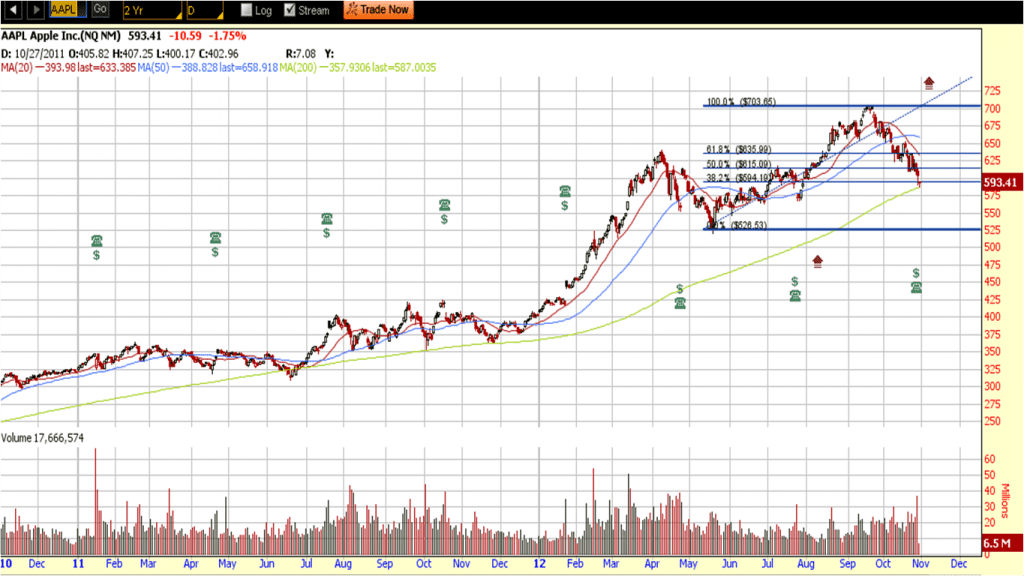

AAPL is getting near to 200D SMA, a very reliable support at about $587. I expect strong rebound at this level and just need to watch for a reversal candle to appear when the value investors jump into the trade.

Key Statistics for AAPL

| Current P/E Ratio (ttm) |

13.4293 |

| Estimated P/E(09/2013) |

11.8079 |

| Relative P/E vs.SPX |

0.9395 |

| Earnings Per Share (USD) (ttm) |

44.1600 |

| Est. EPS (USD) (09/2013) |

50.2240 |

| Est. PEG Ratio |

0.5523 |

| Market Cap (M USD) |

556,987.00 |

| Shares Outstanding (M) |

939.21 |

| 30 Day Average Volume |

19,647,658 |

| Price/Book (mrq) |

4.7118 |

| Price/Sale (ttm) |

3.5413 |

| Dividend Indicated Gross Yield |

1.79% |

| Cash Dividend (USD) |

2.6500 |

| Last Dividend |

11/07/2012 |

| 5 Year Dividend Growth |

– |

| Next Earnings Announcement |

01/24/2013 |

- Intrinsic Value = $935 (WOW!!!).

- 1-3 Years Growth Rate = 20% (conservative)

- 4-10 Years Growth Rate = 15%

- Net Operating Cash Flow = $50, 856 Million

- Beta = 1.21

- Discount Rate = 7%

Valuation Ratios

| |

Company |

Industry |

Sector |

| P/E Ratio (TTM) |

13.68 |

12.10 |

21.78 |

| P/E High – Last 5 Yrs. |

20.09 |

21.06 |

52.06 |

| P/E Low – Last 5 Yrs. |

14.61 |

10.70 |

11.70 |

| |

| Beta |

1.21 |

1.18 |

0.93 |

| |

| Price to Sales (TTM) |

3.62 |

0.98 |

9.38 |

| Price to Book (MRQ) |

4.80 |

2.10 |

3.51 |

| Price to Tangible Book (MRQ) |

5.02 |

2.35 |

4.14 |

| Price to Cash Flow (TTM) |

12.58 |

10.41 |

11.78 |

| Price to Free Cash Flow (TTM) |

13.66 |

21.17 |

30.26 |

Recent Upgrade / Downgrade

| 24-Oct-12 |

Reiterated |

Canaccord Genuity |

Buy |

$797 → $800 |

|

| 13-Sep-12 |

Reiterated |

UBS |

Buy |

$740 → $780 |

|

| 13-Sep-12 |

Reiterated |

RBC Capital Mkts |

Outperform |

$700 → $750 |

|

| 13-Sep-12 |

Reiterated |

FBR Capital |

Outperform |

$675 → $725 |

|

| 13-Sep-12 |

Reiterated |

Deutsche Bank |

Buy |

$650 → $775 |

|

| 27-Aug-12 |

Reiterated |

Oppenheimer |

Outperform |

$680 → $800 |

|

| 22-Aug-12 |

Reiterated |

Needham |

Buy |

$620 → $750 |

|

| 09-Aug-12 |

Initiated |

Stifel Nicolaus |

Buy |

$825 |

|