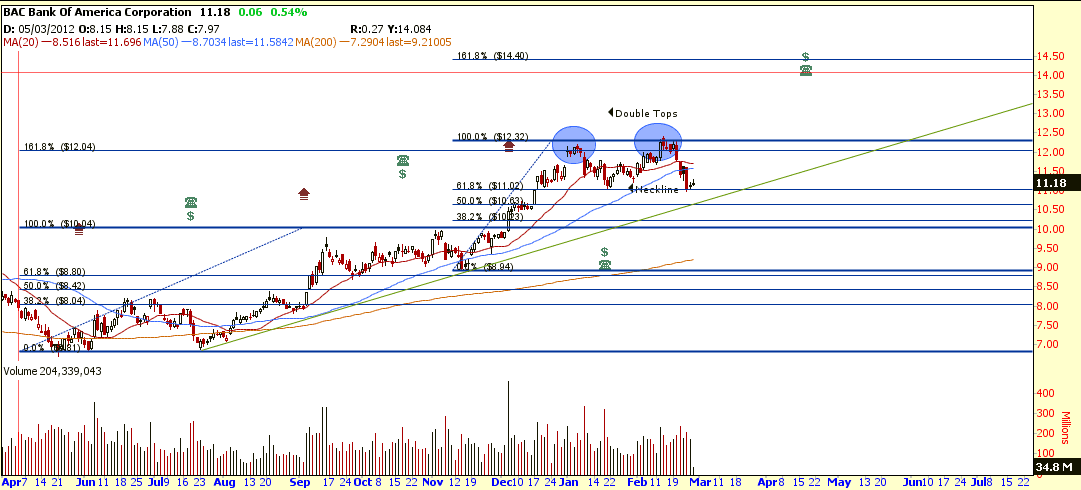

Bank of America (BAC) is forming a Double Tops with neckline at about $11.00. If BAC rebound from this neckline (also the 61.8% FR), BAC will continue the uptrend with price target of $14.40 (161.8% FR). If BAC break below $11.00 support, the price target of this Double Tops breakout is about $10.00

Key Statistics for BAC

| Current P/E Ratio (ttm) | 12.2033 |

|---|---|

| Estimated P/E(12/2013) | 11.2814 |

| Relative P/E vs. SPX | 0.8262 |

| Earnings Per Share (USD) (ttm) | 0.9200 |

| Est. EPS (USD) (12/2013) | 0.9950 |

| Est. PEG Ratio | 1.3017 |

| Market Cap (M USD) | 121,007.57 |

| Shares Outstanding (M) | 10,778.26 |

| 30 Day Average Volume | 157,886,592 |

| Price/Book (mrq) | 0.5546 |

| Price/Sale (ttm) | 1.2045 |

| Dividend Indicated Gross Yield | 0.36% |

| Cash Dividend (USD) | 0.0100 |

| Last Dividend | 02/27/2013 |

| 5 Year Dividend Growth | -55.91% |

| Next Earnings Announcement | 04/17/2013 |