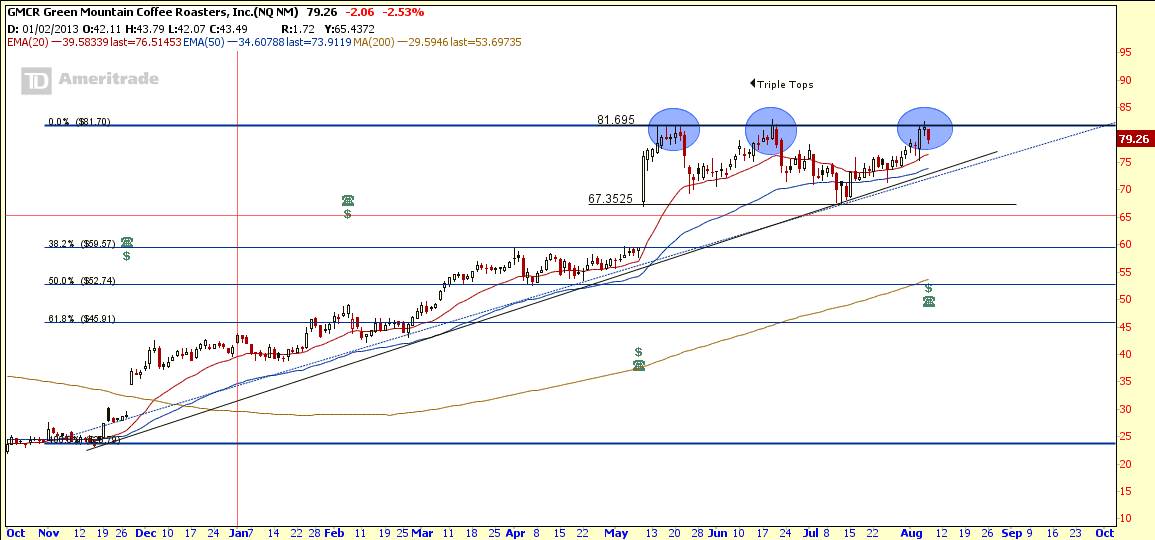

Chart Pattern: GMCR is forming a Triple Tops with resistance at about $81.70.

Trading Strategy: Short Call Spread 80/82.5

- STO GMCR Sept 13 80 Call

- BTO GMCR Sept 13 82.5 Call

- If break $81.70 resistance and move above $82.5, BTC GMCR Sept 13 80 Call to repair (1 month before expiry), else close both positions.

- If break uptrend support (about $74.00), short by BTO GMCR Oct 13 72.5 Put.

- If break Triple Tops Neckline at $67.35, may consider to Long another Put option to continue shorting. Price target $60.00 (Gap Support & 38.2% Fibonacci Retracement Level)

GMCR Chart

GMCR Fundamental

Chart from thinkorswim, get FREE chart here.

Original post by Marubozu from My Stocks Investing Journey.

Hey there!

My comments a bit late cause I just found your website. But when you put on this trade for GMCR, the earnings is coming up isn’t it. Did you noticed or are you playing through it?

In Singapore, it’s hard to find another person who post about options trading. Glad I found you:)

Thanks

Pok Chow

Pok Chow,

I am watching GMCR but did not enter any trade because the spread is large for GMCR option chain. I am aware of the earning date.

Marubozu

That’s the thing about $2.50 wide spreads. They’re generally not as liquid as underlyings with $1 wide spreads.

Thank you

Pok