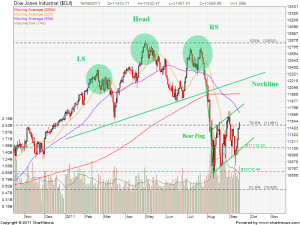

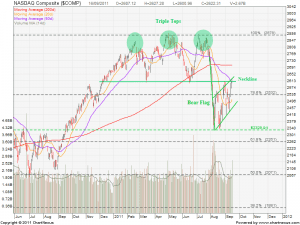

Stock market staged an impressive rally last week with NO BAD NEWS. Is this the return of the Bull market? Base on the chart pattern, it looks like a Bear Market Rally as all 3 US indices Dow Jones Industrial, S&P500 and NASDAQ are forming a Bear Flag chart pattern. Both Dow Jones Industrial ($DIJ) and S&P500 ($SPX) are getting near the Flag Resistance and the 50D MA resistance, whereas NASDAQ has reached the Flag Resistance and the Triple Tops neckline. Watch out for the potential trend reversal pattern in the coming few days. Another scenario will be all 3 Indices break the Flag Resistance and 50D MA resistance. The Bull may return if this scenario happens.

Previous Analysis on Dow Jones Industrial, S&P500 and NASDAQ.

Dow and Nasdaq are going to test their resistance at 11100 and 2532 respectively 😀

Looks like the world economy is improving, m?

No. Leading indicators in Europe and China like PMI do not tell the story of improving of economy. PMI is showing contraction in economy. Now we just need a lagging indicator GDP reports to show official recession and the whole market will crash!

NASDAQ bounce back on hitting the 2512 resistance tonight 😀