Finally Singapore REIT started selling off and SREIT P/B drops from 1.22 to 1.12. Is it good time to get in now as what The Straits Times (June 1, 2013) suggested? Personally I have cleared all my REIT portfolio and wait for a good opportunity for Great Singapore Sales. However I don’t think this is the right time to get in yet base on 3 reasons:

-

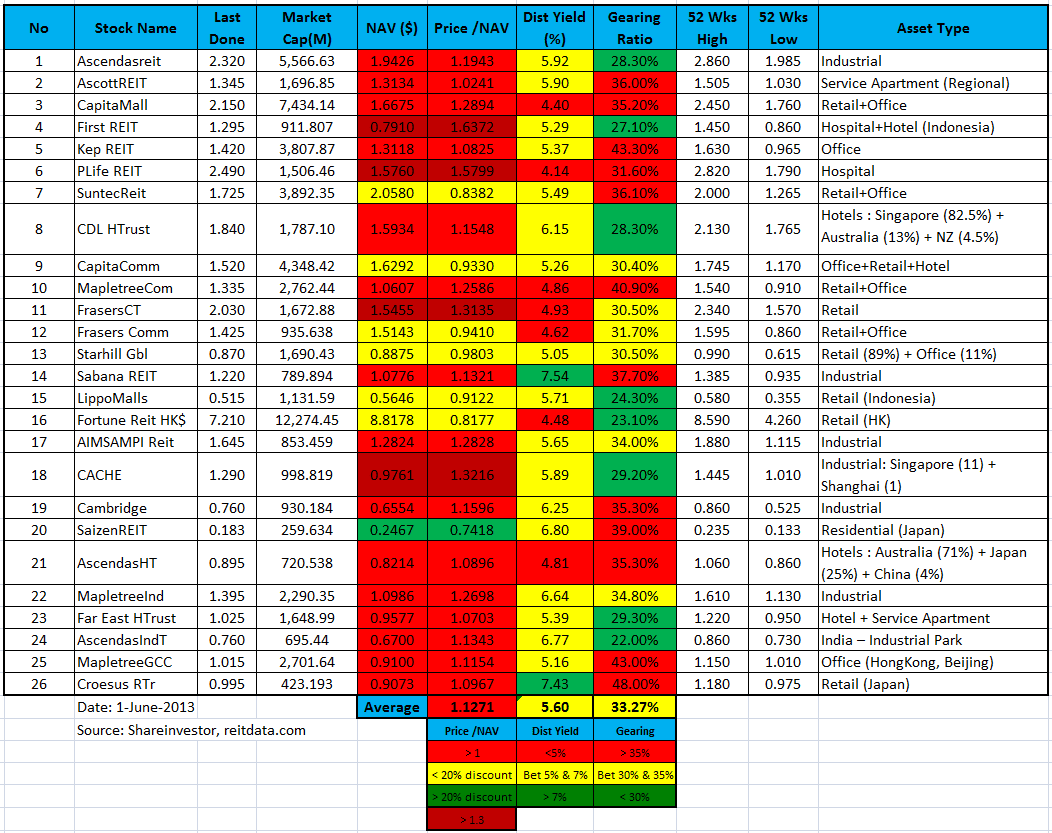

Fundamentally the current REIT is NOT cheap and still over value base on NAV.

- Technically most REIT has broken the uptrend support and starting a bearish trend.

- Distribution yield will drop if there is increase in interest rate.

Added Croesus Retail Trust.

Compare to last month SREIT comparison table:

- Price/NAV decreases from 1.22 to 1.12.

- Dividend Yield increases from 4.97% to 5.6%

- Gearing Ratio increases from 32.92% to 33.27%

Doing Fundamental Analysis of Singapore REIT is relatively easier than stock. If you are interested to learn how to do research on Singapore REIT and also time the entry / exit by learning the simple Trend Analysis, you may want to check out my 1st public tutorial “How to pick Singapore REIT for Dividend Investing” .

Disclaimer applied. I am NOT a certified Financial Advisor and NOT making any Buy or Sell recommendation. The above article is just my OWN analysis and PERSONAL opinion.