Original post from https://mystocksinvesting.com

Completed a training “How to Build a Diversified Portfoliof for Retirement” at Natixis Global Asset Management last night. In the class, I have gone through the Personal Investment Risk Profile (Life Stage Adjusted) with the participants so that everyone know how they can do their asset allocation in their investment portfolio. I also shared how to reduce the portfolio volatility and max draw down by varying the asset allocation percentage, By varying the asset classes and asset allocation % can help us to navigate in different market condition and remove our emotion in the decision making.

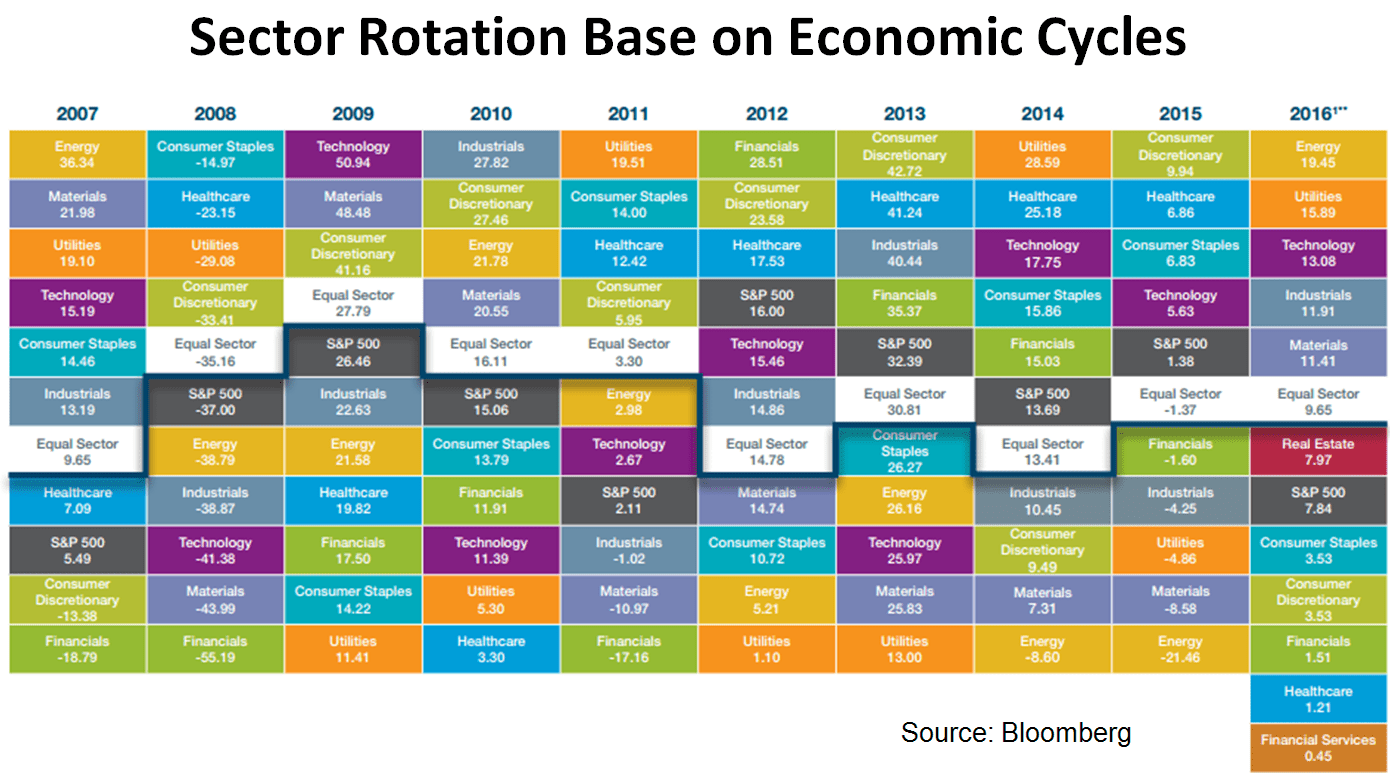

Lastly I shared about the importance and the needs of Portfolio Re-balancing as this is a systematic and disciplined approach in managing our investment portfolio. I also shared the stock market is cyclical in nature, so buy/close one eye/hold forever may not be a good strategy over the long run. The reason is any country, any sector, any regional cannot be the best performer year after years, and they have to come down after a while. Thus, We have to re-balancing our portfolio at least once a year in order to optimise the returns.

Feel free to send me an email marubozu@mystocksinvesting.com if you want to understand more how to build a diversified investment portfolio to manage your investment risk,