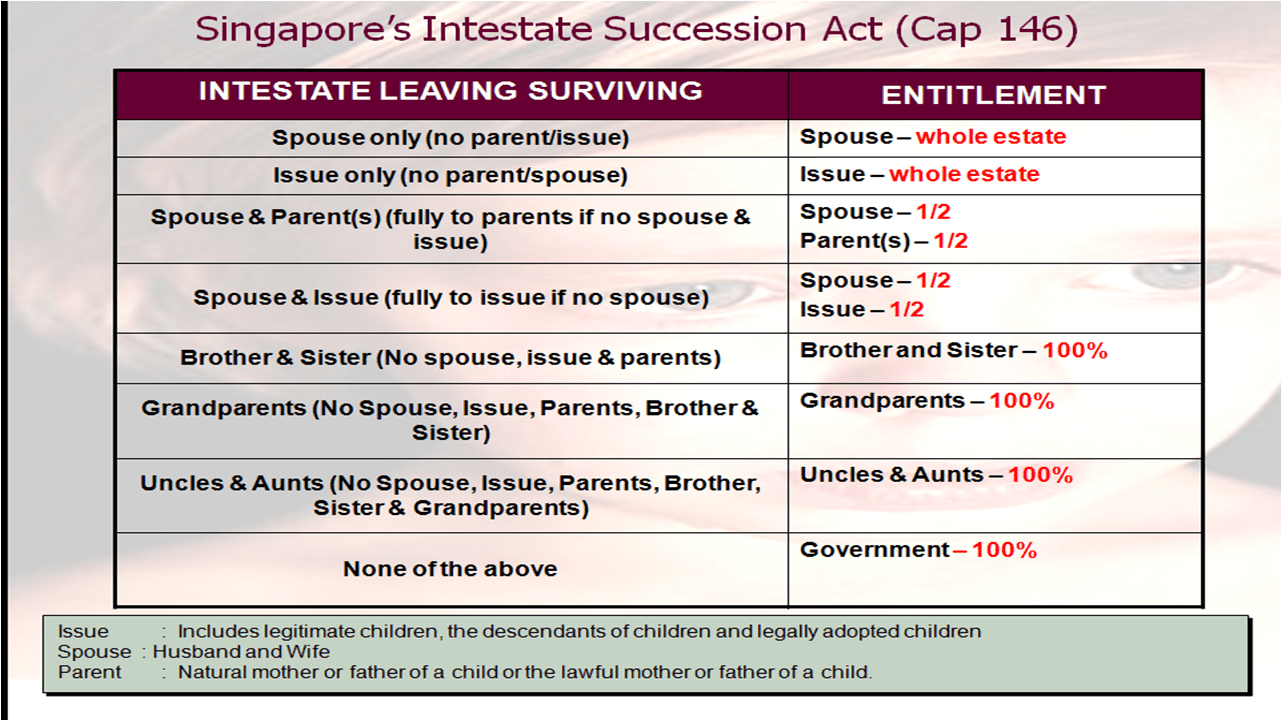

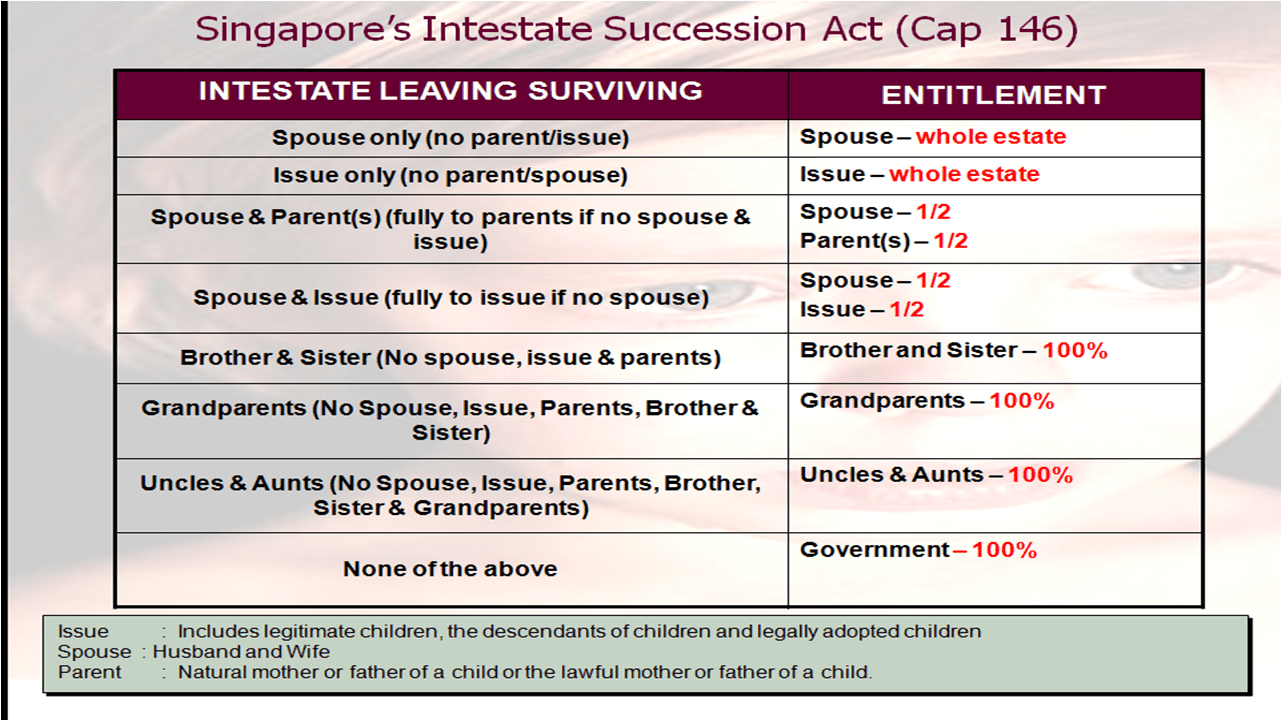

MUST READ! You must know how and where your Asset to be distributed after your death without a Will. Your asset will eventually go to government if your assets are not able to be distributed base on Intestate Succession Act (ISA).

I have listed down case study for different scenarios of wealth distribution base on Intestate Succession Act (ISA).

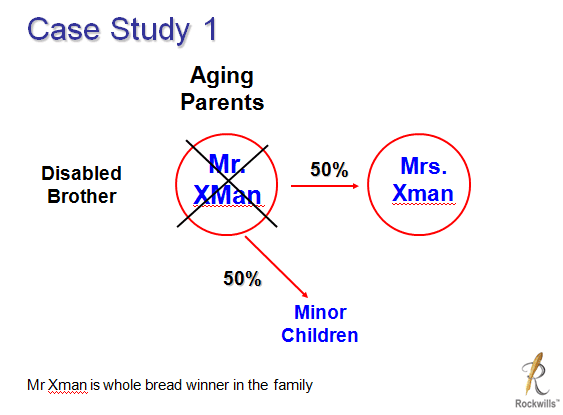

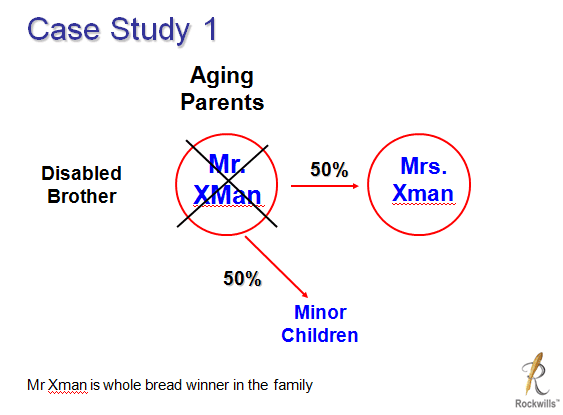

Case Study 1

Mr Xman is the sole bread winner in the family taking care of his aging parents (retired and not working), disabled brother and his own family (not working spouse and 1 minor children). If Mr Xman passes away without will, his estate to be distributed evenly between his wife and his children. His elderly parents and disabled brother will be cut off financially because they will not have any shares in Mr Xman’s wealth distribution. Mrs Xman has no legal obligation to take care of Mr. Xman parents and brother.

Case Study 2

Mr Xman & Mrs Xman are perished in a common accident. Both of them die together and the time of death is not able to be identified. Base on the law, it is presumed that the elder Mr. Xman passes away first. Base on ISA, Mr Xman’s shares to be distributed to Mrs Xman and Children. Then Mrx Xman’s shares will go 100% to the minor children. The negative consequence of this wealth distribution:

- The assets are not distributed to the Needy parents and disabled brother.

- Minor does not have legal right in the asset until 21 years old. The children monthly maintenance, fund for education, medical expense, etc will be affected unless there is a trustee and guardian appointed. The legal cost may be very high and it will take a very long process to appoint an Administrator and find 2 Sureties / Guarantors to distribute the wealth.

Case Study 3 (Very Important to Married Couple without Children to know)

Mr Xman & Mrs Xman are perished in a common accident. Both of them die together and the time of death is not able to be identified. Base on the law, it is presumed that the elder Mr. Xman passes away first. Base on ISA, Mr Xman’s shares to be distributed 50% each to Mr Xman’s parent and Mrs Xman since they do not have any children, later be distributed to Mrs Xman’s parents (50% from Mr Xman and 100% from Mrs Xman). Mr. Xman parents will only get 50% of their son’s estate and the other 50% goes to parent in law. This kind of distribution will create tension to the both families because Mr. Xman’s parent may take the legal action to get back his son’s estate.

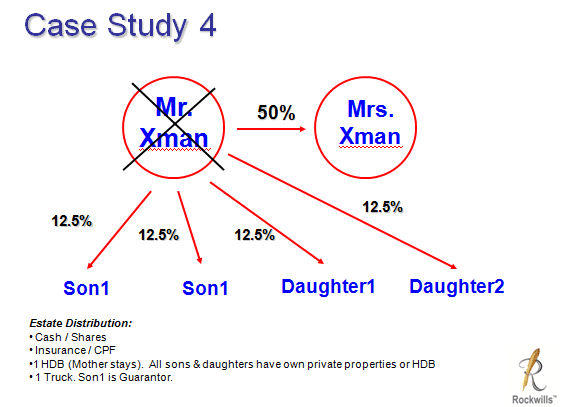

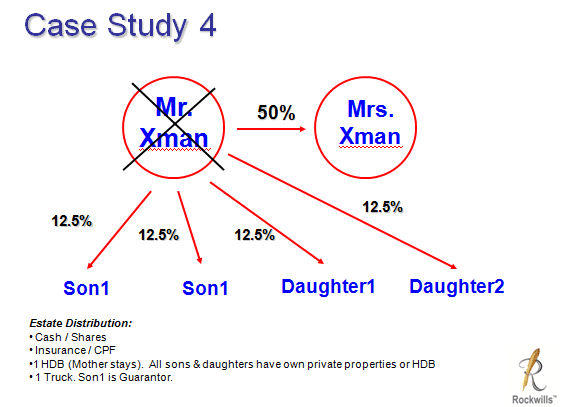

Case Study 4

- Cash and Shares can be distributed easily since they are liquid. However, shares may be sold at the market value at the wrong time (e.g. stock market crashes).

- Insurance & CPF are distributed according to the nomination.

- Property distribution is complex as it may incur unnecessary taxes (inheritance tax, Sales tax, Capital Gain Tax for oversea properties according to local law) and stamp duties (ABSD, SSD). As they cannot own 2 HDB in Singapore, the sons or daughters have to sell their own properties or sell the inherited HDB (which the mother is staying). This type of scenario can lead to family dispute on how to deal with the properties and where the mother is going to stay.

We plan everything for ourselves and our children in our life. But it is also very important to plan our wealth distribution properly after our death to avoid family conflicts. Almost every week we can see in the newspaper that Family members take legal action suing each other over the estate. Personally I am also experiencing the potential legal lawsuit among my uncles and my father due to my Grand Father’s Will was not done properly more than 10 years ago. My grandfather is 98 years old and bedridden. As my father is the executor of my grandfather’s Will, I am giving advice to my father what need to prepare now to avoid any legal complication in the future.

It is very sad to see family members become enemy due to wealth distribution. If you love your family, get your Will done today. A simple Will is still better than no Will. Today almost every Singaporean has half a millionaire worth of estate upon death (one HDB flat and Insurance). It cost about approximately S$500 (average) to do a Will now than spending a few thousands dollar to appoint a lawyer to distribute wealth in future. I believe the last thing we want to see is the fighting among family members after our death.

Hope my sharing can help many of you. Feel free to write to me at kkloh163@gmail.com if you need any help in the Estate Planning and Will Writing. I am happy to provide free consultation by understanding your situation. For more information, visit Rockwills Estate Planning and Will Writing.

See previous post What will happen to Our Wealth After Death.

..

..