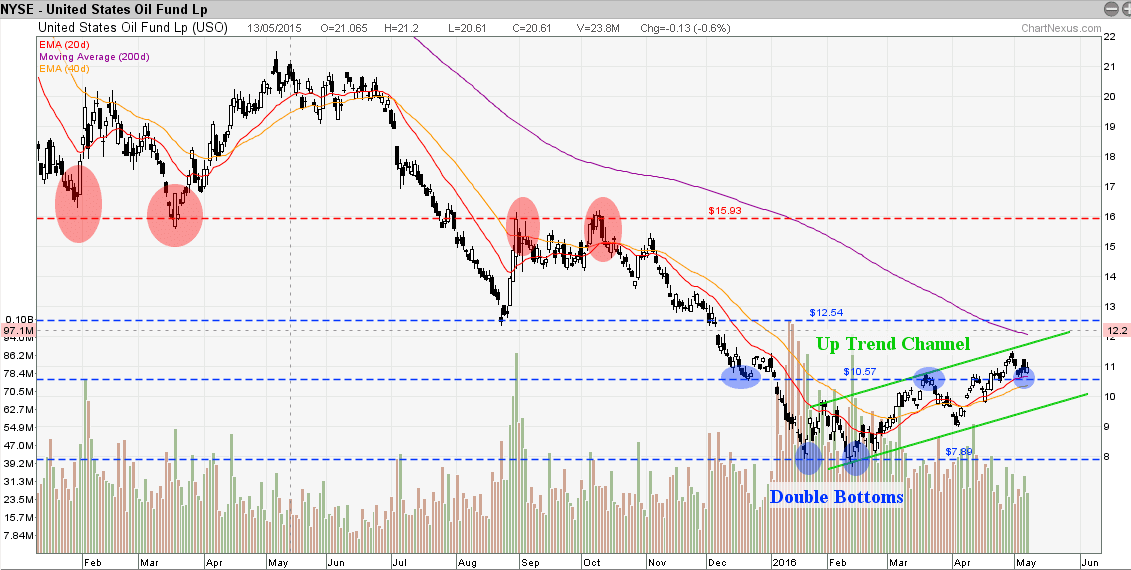

United States Oil Fund (USO): On Short Term Up Trend

United States Oil Fund (USO) is currently trading in up trend channel after breaking out from a Double Bottoms reversal chart pattern. However, this short term up trend may be capped by the declining 200D SMA resistance. Looking at the longer term chart, USO is very near to historical low.

In Summary for USO base on Technical Analysis:

- Price very near to historical low.

- Double Bottoms Reversal Pattern

- Currently on Up Trend

Compute the Reward vs Risk Ratio and make your investing decision.

What is USO ?

United States Oil Fund

The United States Oil Fund® LP (USO) is an exchange-traded security designed to track the daily price movements of West Texas Intermediate (“WTI”) light, sweet crude oil. USO issues shares that may be purchased and sold on the NYSE Arca.

The investment objective of USO is for the daily changes in percentage terms of its shares’ NAV to reflect the daily changes in percentage terms of the spot price of light, sweet crude oil delivered to Cushing, Oklahoma, as measured by the daily changes in price of USO’s Benchmark Oil Futures Contract, less USO’s expenses.

USO’s Benchmark is the near month crude oil futures contract traded on the NYMEX. If the near month futures contract is within two weeks of expiration, the Benchmark will be the next month contract to expire. The crude oil contract is WTI light, sweet crude oil delivered to Cushing, Oklahoma.

USO invests primarily in listed crude oil futures contracts and other oil-related futures contracts, and may invest in forwards and swap contracts. These investments will be collateralized by cash, cash equivalents, and US government obligations with remaining maturities of two years or less.

USO’s Fund Benefits

- USO offers commodity exposure without using a commodity futures account.

- USO provides “equity-like” features including, intra-day pricing, and market, limit, and stop orders.

- USO provides Portfolio Holdings, Market Price, NAV and TNA its website each day.