Tailored Portfolio Solutions: Precision Investing for Your Future

In an era of market volatility and information overload, a “one-size-fits-all” investment strategy is no longer sufficient. True wealth management requires a sophisticated, institutional-grade approach that aligns your capital with your specific life goals, risk tolerance, and liquidity needs.

I provide a comprehensive suite of investment vehicles, moving beyond traditional boundaries to build robust, multi-asset portfolios.

Our Investment Universe

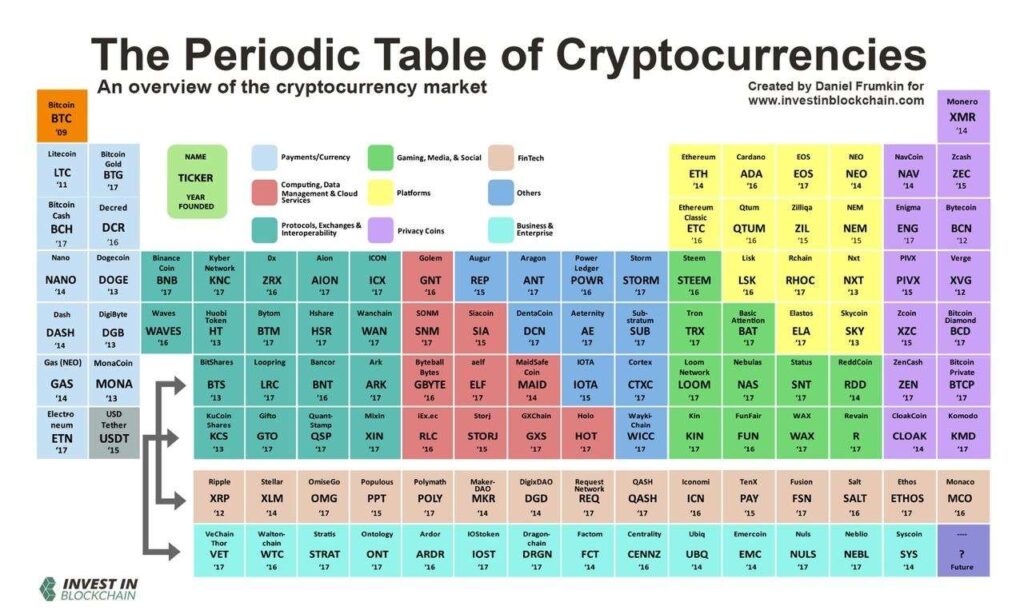

We utilize a broad spectrum of asset classes and strategies to ensure your portfolio is truly diversified across different economic cycles.

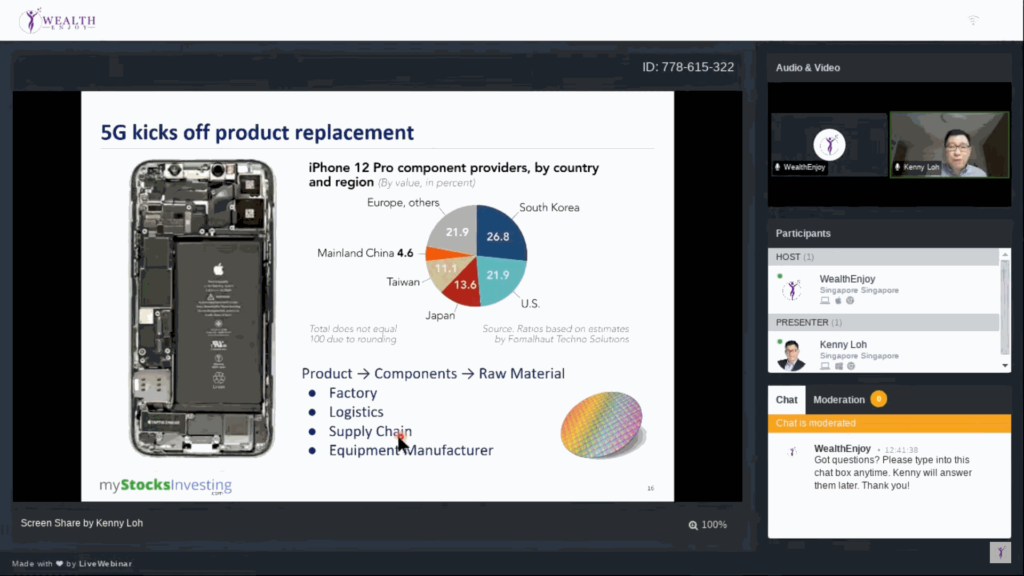

- Equities & ETFs: Direct access to global stock markets and low-cost Exchange Traded Funds for efficient market exposure and core growth.

- Unit Trusts (UT): Curated access to top-tier active fund managers across specialized sectors, regions, and fixed-income strategies.

- Alternative Investments: Institutional-level access to non-traditional assets, including private credit, trade finance, and real estate, designed to provide low correlation to public equity markets.

- Quant Strategies: Data-driven, algorithmic approaches that remove emotional bias and capitalize on market inefficiencies through systematic execution.

- Real Estate Focus: Deep expertise in structuring REIT-heavy portfolios for consistent yield and long-term capital appreciation.

The Customization Process

Our methodology is rooted in a “Client-First” architecture. We don’t just pick products; we build a framework.

- Needs Discovery: We begin by defining your “Why”—whether it is legacy planning, retirement income, or aggressive capital growth.

- Risk Calibration: Using advanced risk-profiling tools, we determine your psychological and financial capacity for volatility.

- Strategic Asset Allocation: We blend traditional and alternative assets to optimize your efficient frontier—aiming for the highest possible return for your chosen level of risk.

- Active Monitoring & Rebalancing: Markets shift, and so do life circumstances. We provide ongoing oversight to ensure your portfolio remains aligned with your original objectives.

- Why Diversification Matters: By spreading investments across uncorrelated assets—like combining the steady income of Private Credit with the growth potential of Quant-driven Equities—we aim to reduce “drawdowns” (peak-to-trough declines) and smooth out your investment journey.

Secure Your Legacy

Investment management is not just about the numbers; it’s about the peace of mind that comes from knowing your wealth is being managed with professional rigor and a clear vision.

Ready to institutionalize your personal wealth strategy?

Let’s review your current holdings and discuss how a customized, diversified framework can better serve your long-term objectives.

Click Here to Book a Private Consultation

Kenny Loh is a distinguished Wealth Advisory Director with a specialization in holistic investment planning and estate management. He excels in assisting clients to grow their investment capital and establish passive income streams for retirement. Kenny also facilitates tax-efficient portfolio transfers to beneficiaries, ensuring tax-efficient capital appreciation through risk mitigation approaches and optimized wealth transfer through strategic asset structuring.

In addition to his advisory role, Kenny is an esteemed SGX Academy trainer specializing in S-REIT investing and regularly shares his insights on MoneyFM 89.3. He holds the titles of Certified Estate & Legacy Planning Consultant and CERTIFIED FINANCIAL PLANNER (CFP).

With over a decade of experience in holistic estate planning, Kenny employs a unique “3-in-1 Will, LPA, and Standby Trust” solution to address clients’ social considerations, legal obligations, emotional needs, and family harmony. He holds double master’s degrees in Business Administration and Electrical Engineering, and is an Associate Estate Planning Practitioner (AEPP), a designation jointly awarded by The Society of Will Writers & Estate Planning Practitioners (SWWEPP) of the United Kingdom and Estate Planning Practitioner Limited (EPPL), the accreditation body for Asia.

If you need any financial advice, please contact kennyloh@fapl.sg

You can join his Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement