Navigating the Giants: A Singaporean Guide to Investing in US vs. SG Stocks

For many Singapore-based investors, the local market feels like home—stable, familiar, and conveniently denominated in SGD. However, the allure of the US market, with its world-famous tech titans and immense scale, is hard to ignore.

As we move through 2026, the contrast between these two markets remains stark. Whether you are a local Singaporean or an expat, understanding the structural and tax differences is vital to avoid expensive surprises.

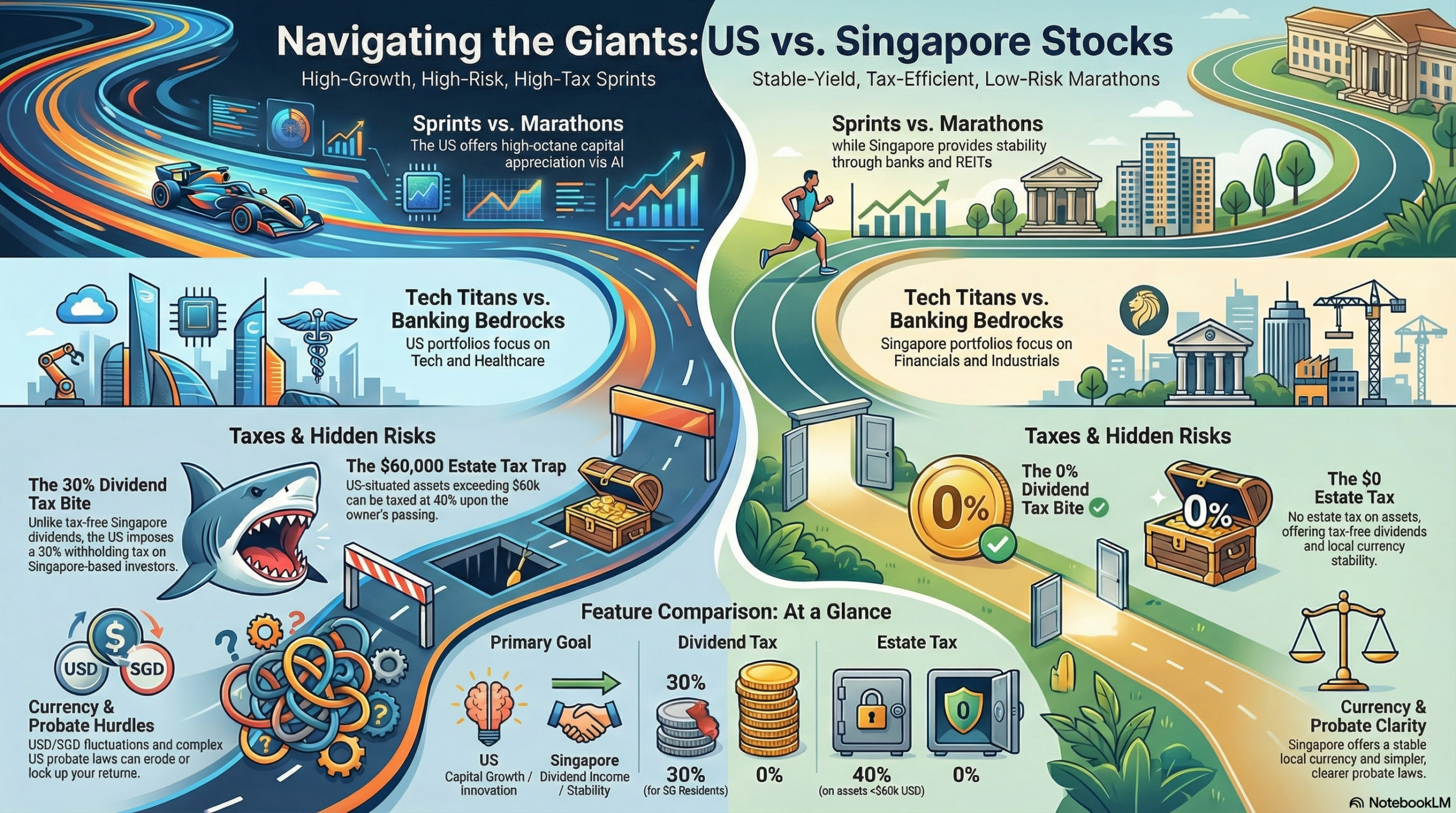

1. Growth Potential: Sprints vs. Marathons

The primary differentiator is the velocity of growth.

- US Market: Historically, the US (represented by indices like the S&P 500 or Nasdaq) is the go-to for capital appreciation. In 2026, the focus remains heavily on the AI infrastructure buildout, with massive capital expenditure driving potential double-digit earnings growth for market leaders.

- Singapore Market: The Straits Times Index (STI) is often characterized as a “yield play.” While the US offers high-octane growth, Singapore offers stability and resilience. For 2026, the STI is supported by strong bank earnings and a recovering REIT sector, making it ideal for those prioritizing steady wealth preservation over aggressive gains.

2. Sectors: Tech Titans vs. Banking Bedrocks

The “flavor” of your portfolio changes significantly depending on where you shop.

- US: Dominated by Technology, Healthcare, and Consumer Discretionary. It is the birthplace of “Magnificent Seven” style companies that lead global innovation in AI, cloud computing, and biotech.

- Singapore: Heavily weighted toward Financials (the “Big Three” banks), Real Estate (REITs), and Industrials. If you want exposure to the digital frontier, the US is king; if you want exposure to the backbone of Southeast Asian trade and property, Singapore is your base.

3. The Tax Bite: Withholding and Estate Taxes

This is where many Singaporean investors get caught off guard.

- Dividend Withholding Tax (WHT): Singapore does not tax dividends. However, the US imposes a 30% withholding tax on dividends paid to non-resident aliens (including Singaporeans), as there is currently no tax treaty between the US and Singapore to reduce this rate.Tip: If you are yield-hungry, US stocks are “expensive” tax-wise. You may prefer Ireland-domiciled ETFs which can reduce this WHT to 15% due to the US-Ireland tax treaty.

- US Estate Tax: This is the “hidden” risk. For non-resident aliens, the US estate tax exemption is a mere $60,000. If your US-situated assets (stocks, property) exceed this value at the time of your passing, your estate could be taxed at rates up to 40%. In contrast, Singapore abolished estate duty in 2008. Check the article here on How to Navigate US Estate Tax for Singaporean Investors.

4. Probate and Jurisdictional Hurdles

Investing across borders adds a layer of legal complexity known as Probate.

- The Challenge: If a Singapore-based investor passes away holding significant US stocks in a personal brokerage account, their executors may need to apply for a Grant of Probate in a US court to unlock those assets. This is often a slow, expensive process involving US lawyers.

- The Workaround: Many investors use “Joint-Tenancy” accounts or hold assets through a corporate wrapper or a trust to ensure a smoother transition of wealth to beneficiaries.

5. USD vs. SGD: The Currency “Double Whammy”

When you buy US stocks, you aren’t just betting on a company; you’re betting on the USD/SGD exchange rate.

- The Drag: Historically, the Singapore Dollar has shown long-term strength against the Greenback. If the USD weakens while your stocks are up, your actual returns in SGD terms will be lower.

- 2026 Outlook: Current trends suggest a more cyclical decline for the USD as global interest rates normalize. For a Singaporean investor, a 10% gain in a US stock could be wiped out if the USD drops 10% against the SGD.

Comparison Summary

| Feature | US Stock Market | Singapore Stock Market (STI) |

| Primary Goal | Capital Growth / Innovation | Dividend Income / Stability |

| Dividend Tax | 30% (for SG residents) | 0% |

| Estate Tax | 40% (above $60k USD) | 0% |

| Currency Risk | High (USD fluctuations) | None (for SG residents) |

| Top Sectors | Tech, AI, Healthcare | Banking, REITs, Industrials |

In conclusion, navigating the choice between the US and Singaporean stock markets requires a careful balance of ambition and pragmatism. While the US market offers unrivaled growth potential through its dominance in global tech and AI, it comes with a significantly more complex “tax and legal tail” for Singapore-based investors. The 30% Dividend Withholding Tax and the looming 40% US Estate Tax on assets above $60,000 are critical hurdles that can erode long-term wealth if not managed through specific structures like Ireland-domiciled ETFs.

Furthermore, investors must remain vigilant about probate complications across different jurisdictions and the constant fluctuations of the USD/SGD exchange rate, which can act as a silent drag on your total returns. Ultimately, the Singapore market remains a powerhouse for stable, tax-free dividends and local currency security, while the US serves as the essential engine for capital appreciation. A well-diversified portfolio for a Singapore resident often utilizes both—relying on the STI for a resilient income core and the US markets for high-octane growth, provided one is mindful of the regulatory and currency risks involved.

Kenny Loh is a seasoned Wealth Advisory Director with deep expertise in comprehensive investment planning and estate management. He is dedicated to helping clients strategically grow their investment capital, generate sustainable passive income for retirement, and seamlessly transition wealth to future generations. Through meticulous asset structuring, he ensures tax-efficient portfolio transfers, allowing beneficiaries to benefit from tax-free capital appreciation while optimizing long-term financial security. With a professional approach and a wealth of experience, Kenny empowers clients to preserve and enhance their legacies with confidence.

Arrange for a non-obligatory one-to-one free consultation here!

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.