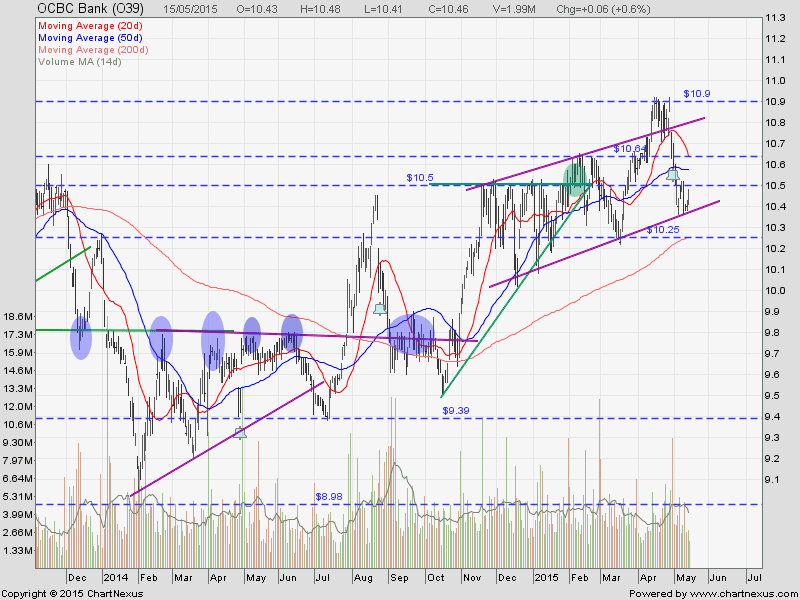

OCBC: Evening Star Reversal!

OCBC rejected at the previous resistance turned support level (purple line) with an Evening Star reversal pattern. Expect short term pull back to $10.00 long term up trend support line at about $10.00.

A good shorting opportunity for OCBC stock with high reward versus risk ratio.

Note: Earning Release on July 31, 2015.