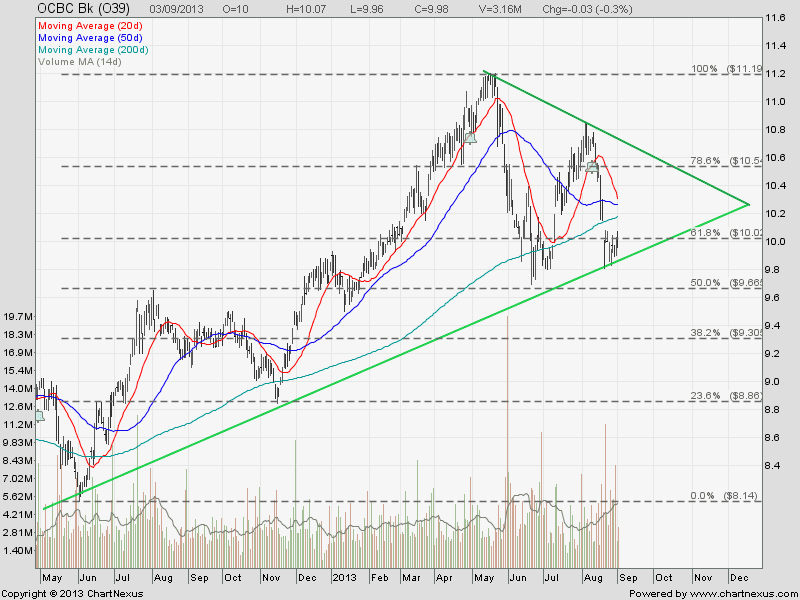

OCBC breakout from a Symmetrical Triangle and rebounded from the uptrend channel support (also the 38.2% FR level). The down trend is officially ended which this breakout. The minimum price target of this symmetrical triangle breakout is $10.50. As there are no clear significant resistance, the next immediate will base on the Fibonacci Retracement Level.

Key Statistics for OCBC

| Current P/E Ratio (ttm) |

9.5142 |

| Estimated P/E(12/2013) |

13.3935 |

| Relative P/E vs. FSSTI |

0.7293 |

| Earnings Per Share (SGD) (ttm) |

1.0910 |

|

Est. EPS (SGD) (12/2013) |

0.7750 |

| Est. PEG Ratio |

1.9319 |

| Market Cap (M SGD) |

35,617.86 |

| Shares Outstanding (M) |

3,431.39 |

| 30 Day Average Volume |

5,356,500 |

| Price/Book (mrq) |

1.5041 |

| Price/Sale (ttm) |

4.2132 |

| Dividend Indicated Gross Yield |

3.18% |

| Cash Dividend (SGD) |

0.1700 |

| Last Dividend |

04/29/2013 |

| 5 Year Dividend Growth |

3.34% |

| Next Earnings Announcement |

08/02/2013 |