SINGAPORE — In a move expected to inject new life into the sluggish initial public offering (IPO) market in Singapore, Manulife US Real Estate Investment Trust (Manulife US REIT) is seeking to raise as much as US$470 million (S$632 million) in its second attempt at a listing here, which would be the largest such deal in the Republic in nearly two years.

The company, a unit of Canadian insurer Manulife Financial Corp, plans to sell 566 million units at between 82 US cents and 83 US cents apiece, according to a draft prospectus filed with the Monetary Authority of Singapore yesterday. Of the units on offer, 169.5 million will be taken up by cornerstone investors, which include Oman Investment Fund, Fortress Capital Asset Management and certain private banking clients of DBS Bank. The balance will be offered to institutional investors and the public. Read more on Manulife US REIT IPO news

Previous post on Manulife US REIT IPO for comparison purpose

Base on Manulife US REIT IPO Prospectus (549 pages)

OVERVIEW OF MANULIFE US REIT

Manulife US REIT is a Singapore REIT established with the investment strategy principally to invest, directly or indirectly, in a portfolio of income-producing office real estate in key markets in the United States, as well as real estate-related assets.

- Type = Commercial (Office)

- Sponsor = Manulife (9.5% stake)

- Market Capitalization = US$513 Million to US$519 Million

- Total Unit = 625,540,000 (Page 52)

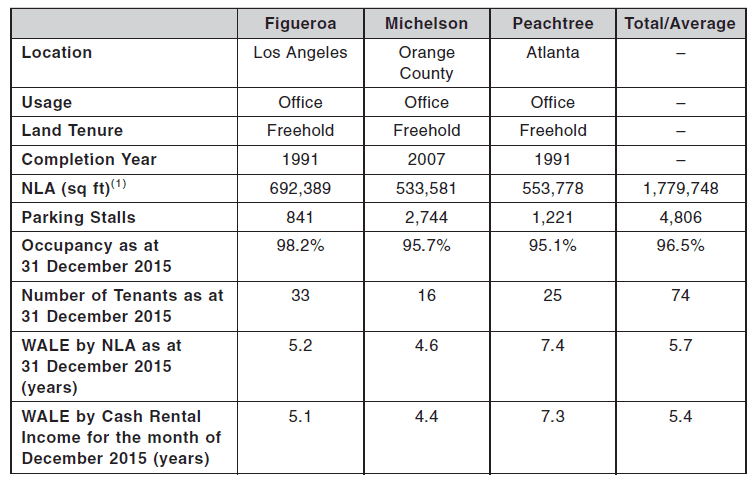

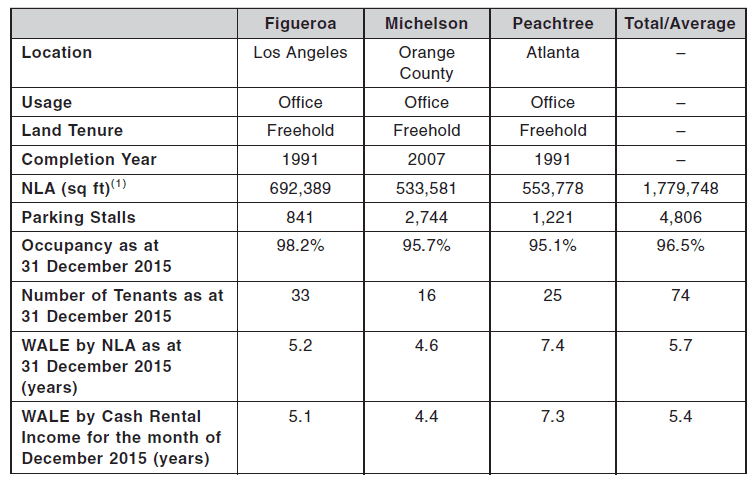

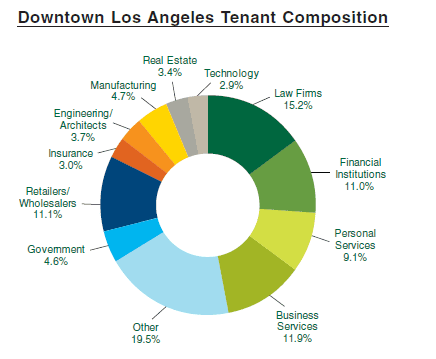

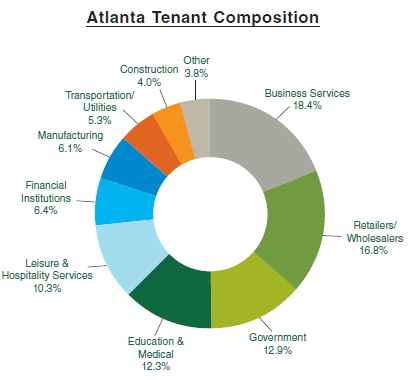

- Portfolio = 3 Grade A Commercial Property. Peachtree @ MidTown, Figueroa @ Los Angeles and Michelson @ Irvine

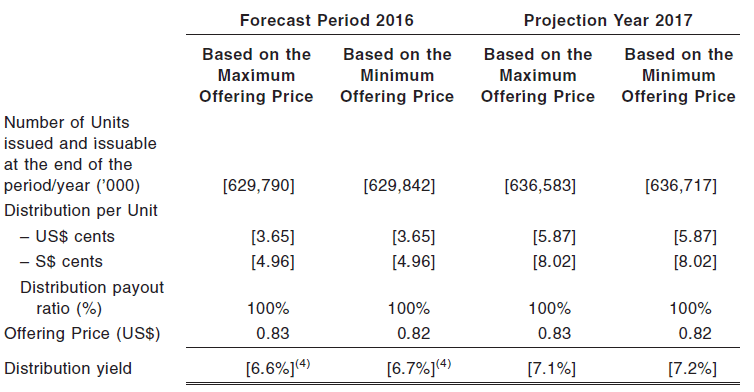

- IPO Offer Price = Between US$0.82 to US$0.83

- NAV = US$0.78 (Page 52)

- Price / NAV = between 1.051 to 1.064

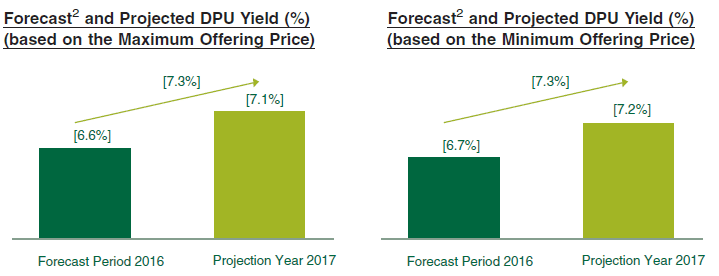

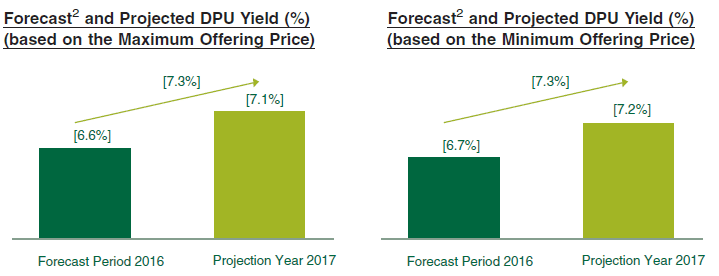

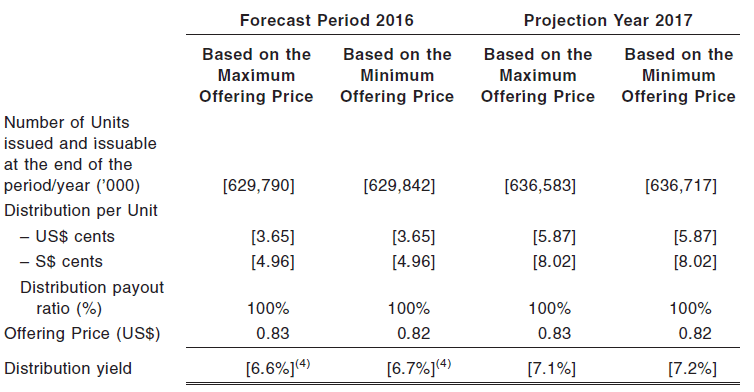

- Distribution Yield = 6.6%/6.7% (2016) 7.1%/7.2% (2017)

- WALE = 5.7 Years (Page 19)

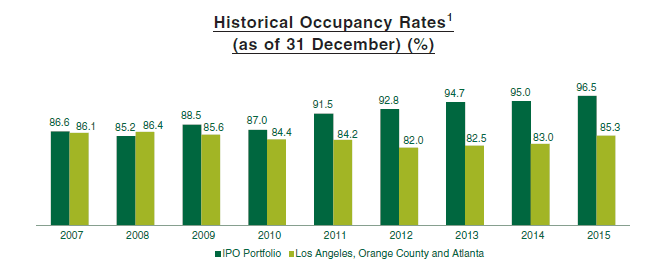

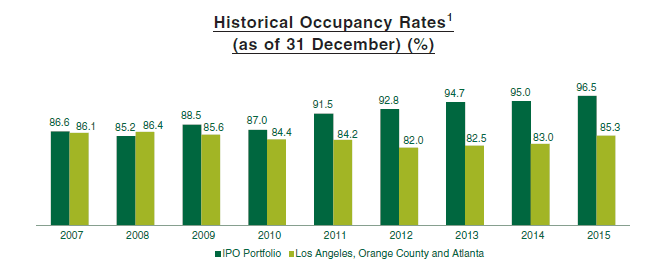

- Occupancy Rate = 96.5% (Page 20)

- Gearing Ratio = 294,000/777,450 = 37.8% (Page 52)

- Plan Listing: May 20, 2016

Compare Manulife US REIT with other Singapore REIT here.

Is it a good REIT to subscribe? Is the yield attractive with the IPO share price? How to analyse the fundamental of this Manulife US REIT to see whether it is a good long term investment? What are the risks? Check out the coming Singapore REIT Public Workshop here.