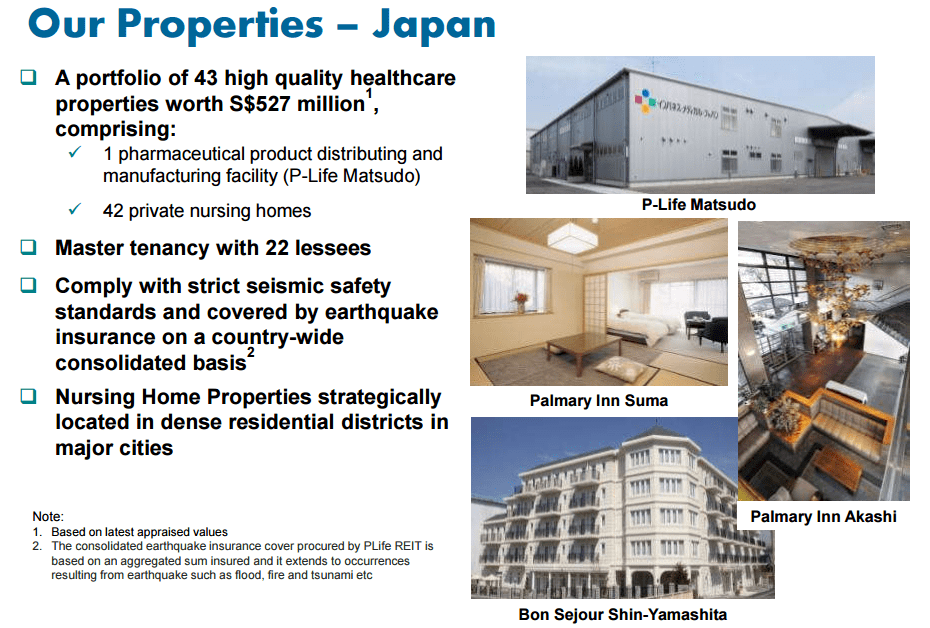

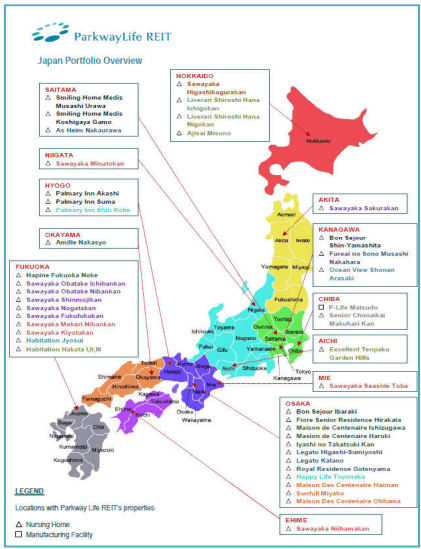

Parkway Life REIT: Good for Passive Income Investing?

Parkway Life REIT 3Q 2015 Investor Presentation on Nov 5, 2015

- Last Done Price = $2.31

- Market Cap = $1.398 B

- NAV = $1.66

- Price / NAV = 1.375 (37.5% Premium)

- Price / NAV (High) = 1.77

- Price / NAV (Low) = 1.33

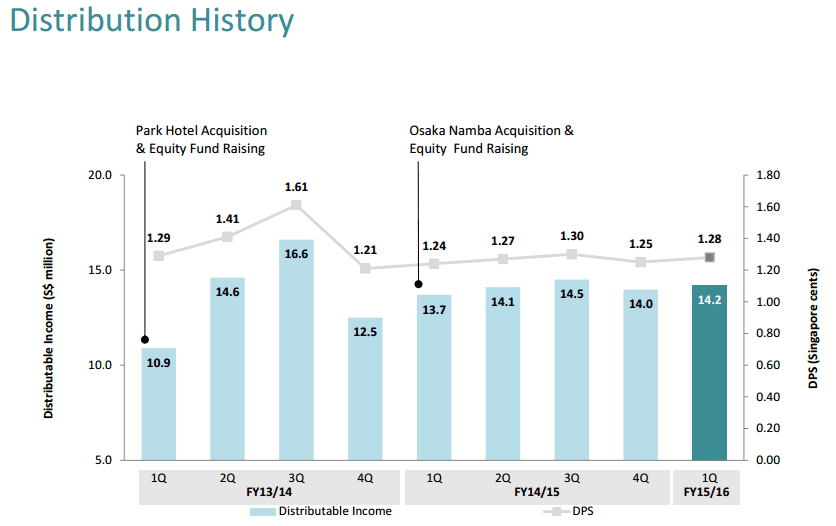

- Distribution Yield (includes Divestment Gain) = 5.818%

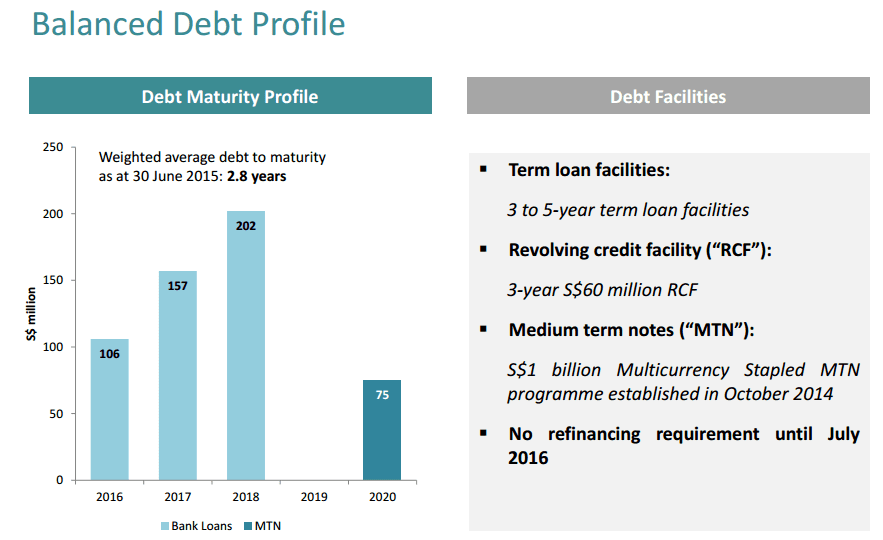

- Gearing Ratio = 35.8%

- WADM = 3.7 Years

- WALE = 9.39 Years

Singapore REITs Fundamental Analysis Comparison Table

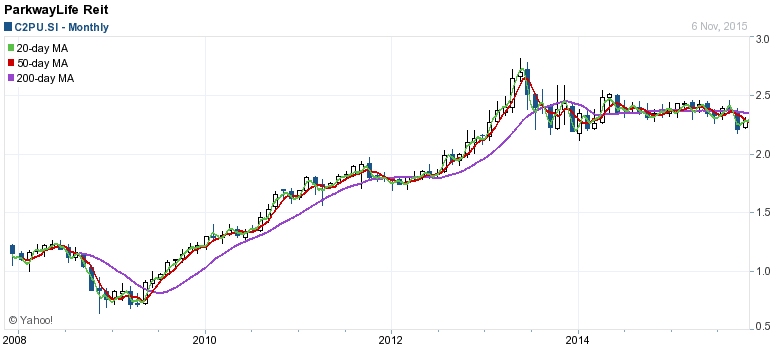

Parkway Life REIT Technical Analysis & Stock Chart

Parkway Life REIT is currently moving side way with limited upside potential base on the valuation (already 37.5% overvalue) and distribution yield below 6%. The yield is lower after fully payout of the divestment gain in next quarter.

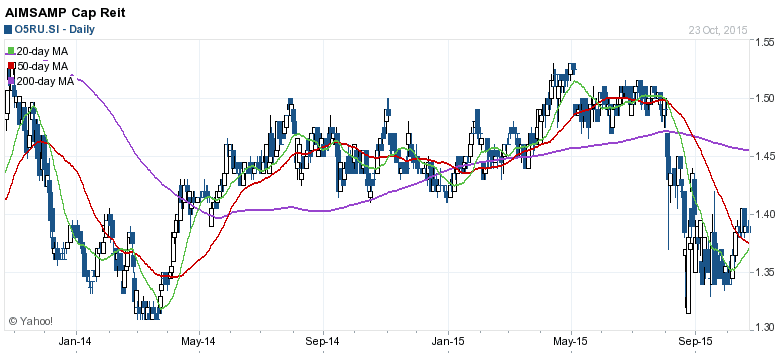

FIRST REIT is another healthcare REIT to compare with Parkway Life REIT. Do you Due Diligence to compare the Fundamental of both healthcare REIT for Passive Income Investing. Healthcare REIT is defensive in nature and should be included into retail investors’ portfolio as the distribution income is more sustainable and predictable. However, it is important to know the entry price and entry timing otherwise we will lose out our initial invested capital.

Check out Singapore REIT Course here on how analyse the fundamental and dividend sustainability of Singapore Healthcare REIT. https://mystocksinvesting.com/course/singapore-reits-investing/