IREIT Global: High 9.85% Distribution Yield, Good Buy?

IREIT Global Investor Non Deal Roadshow on Mar 2015

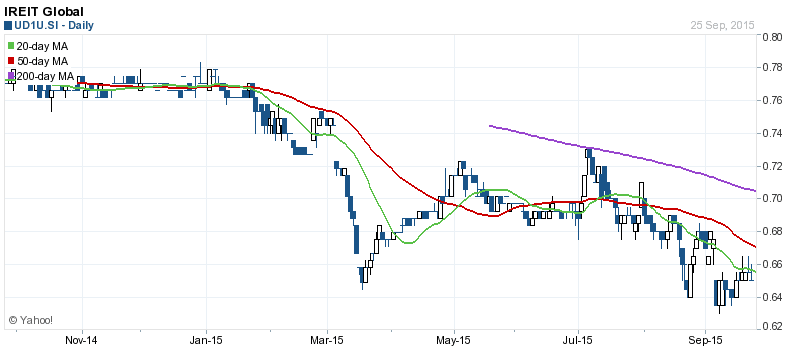

- Last Done Price = $0.65

- Market Cap = $397 M

- NAV = $0.767

- Price / NAV = 0.8474 (15% Discount)

- Price / NAV (High) = 1.19

- Price / NAV (Low) = 0.88

- Distribution Yield = 9.85%

- Gearing Ratio = 31.2%

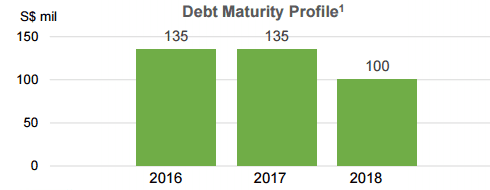

- WADM = 4 Years

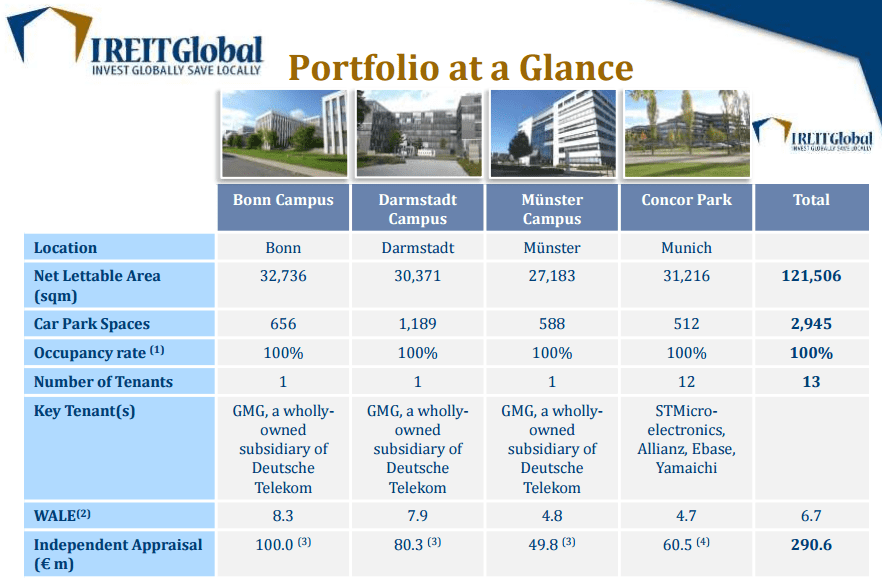

- WALE = 6.7 Years

- Occupancy Rate = 100%

See IREIT Global IPO information here.

IREIT Global Technical Analysis & Stock Chart

IREIT Global has broken the 200D SMA support and currently in on the down trend.

Germany PMI and GDP Growth looks healthy but not very strong.

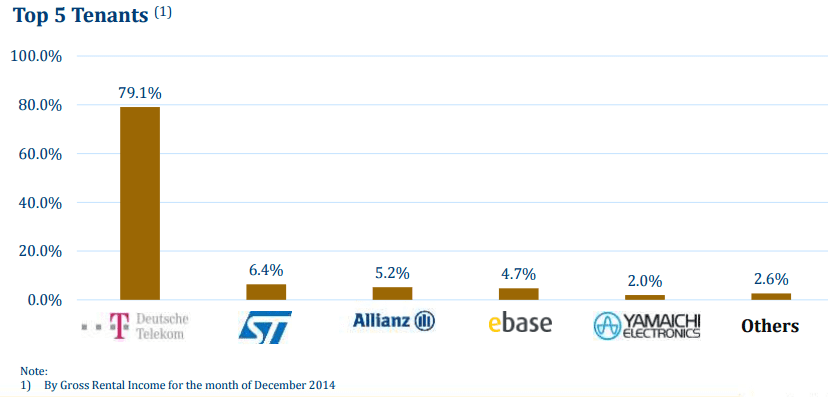

Although the 9.85% yield looks very attractive and the trust is undervalue, there are forex risk and tenant diversification risk. Do your Due Diligence before investing.

Check out Singapore REIT Course here on how to identify the risks and analyse the sustainability of Singapore REIT. https://mystocksinvesting.com/course/singapore-reits-investing/