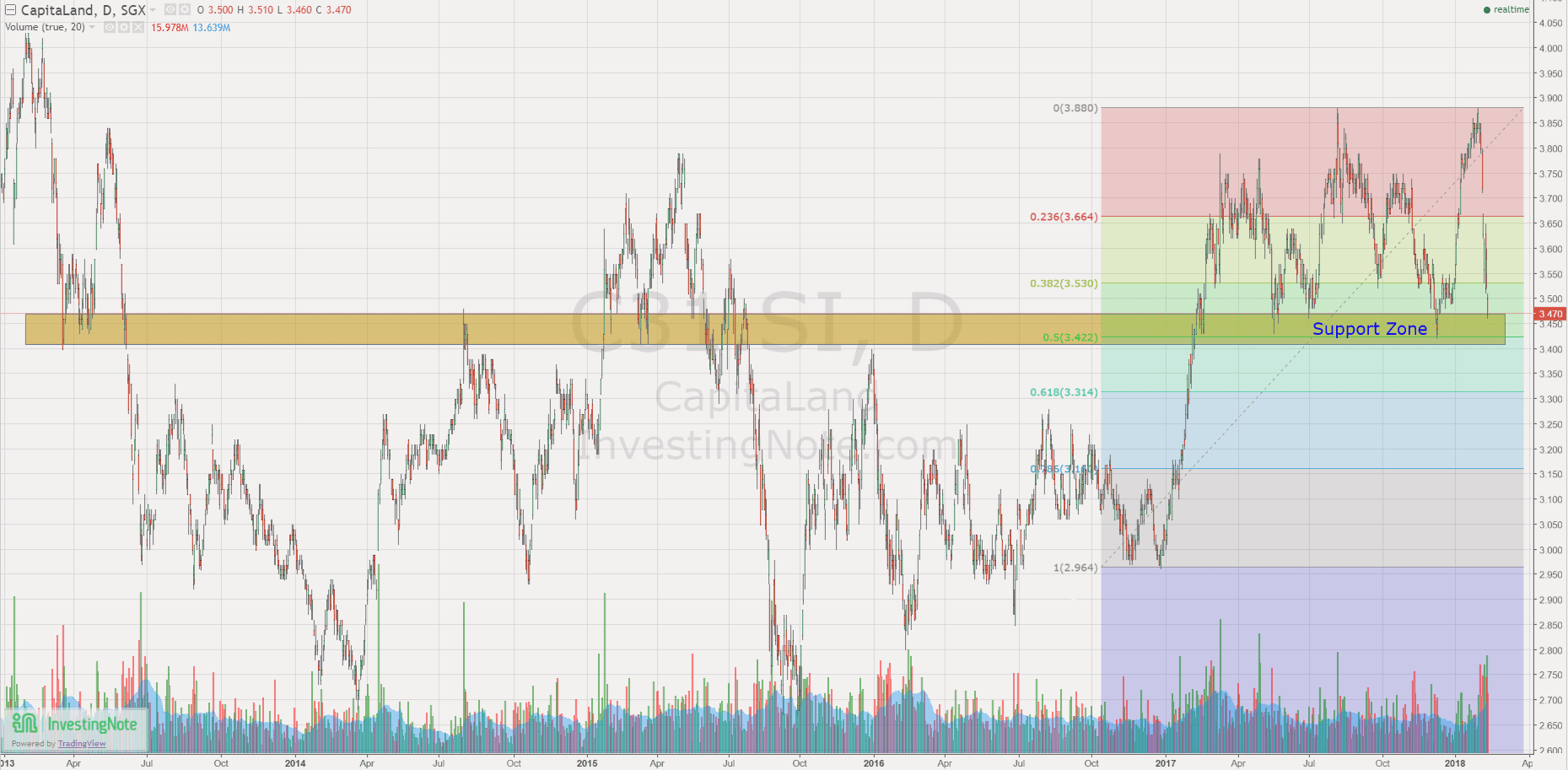

Capitaland: Fall Into Support Zone

Capitaland is getting closer to a very important Resistance Turned Support Zone. This support zone have been tested 4 times for past 1 year. Will Capitaland rebound from here? Also interesting to take note that this support zone is also within the 50% Fibonacci Retracement level.

Break or rebound? There is definitely a trading opportunity! Keep a close eye on reversal candlestick formation.