Frasers Commercial Trust (FCOT) Fundamental & Technical Analysis

Frasers Commercial Trust April 2017

- Last Done Price = $1.41

- Market Cap = $1.127 B

- NAV = $1.54

- Price / NAV = 0.90 (10% Discount)

- Price / NAV (High)= 1.02

- Price / NAV (Low) = 0.6

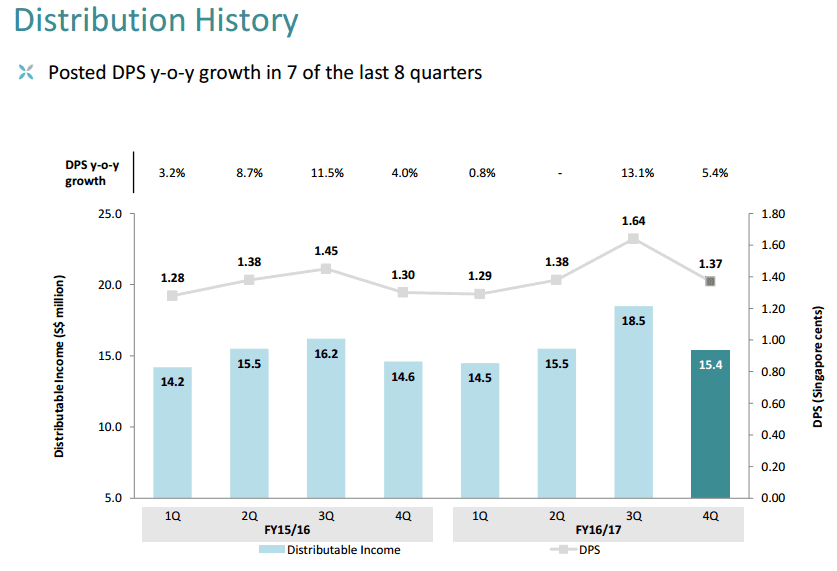

- Distribution Yield (TTM) = 7.01%

- Gearing Ratio = 35.9%

- WALE = 3.7 Years

- WADM = 2.5 Years

- Occupancy Rate = 91.8%

Other Singapore REITs Comparison Table

.

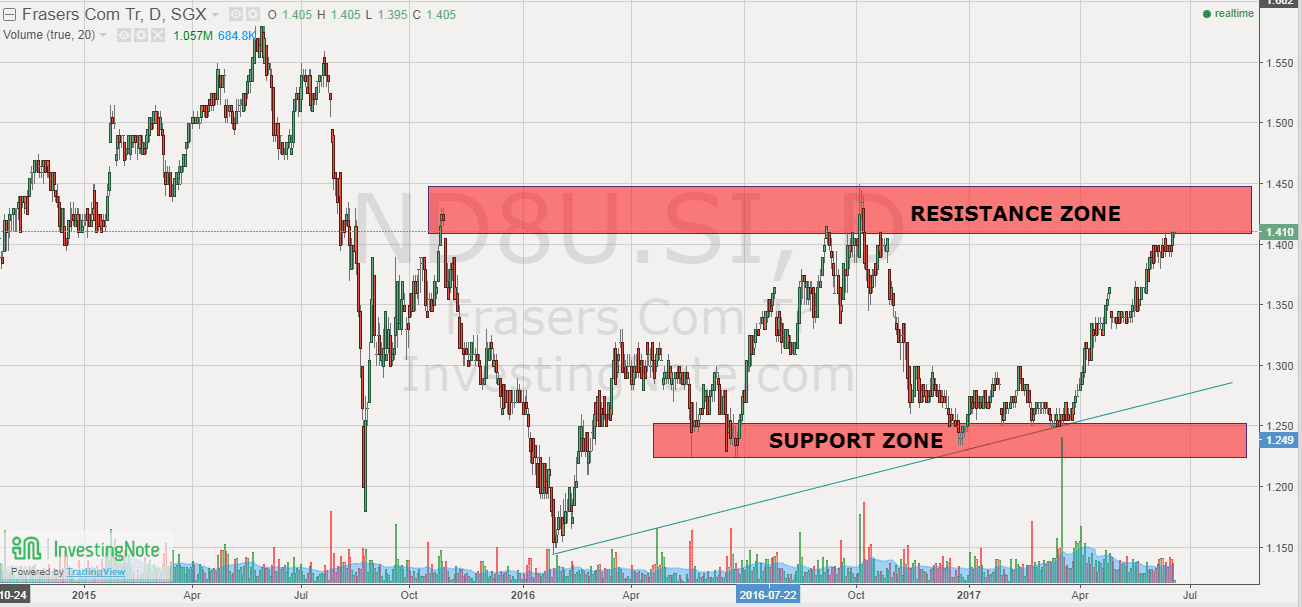

Frasers Commercial Trust Technical Analysis

Frasers Commercial Trust is currently facing the resistance zone. There is also Price Volume Divergence observed. Expect FCOT to take a pause or retrace before the next move up.

Singapore REITs Office Sector Comparison

Check out longest running Singapore REITs Hands on Course & Training here.

Click here to find out Singapore REITs Portfolio Advisory