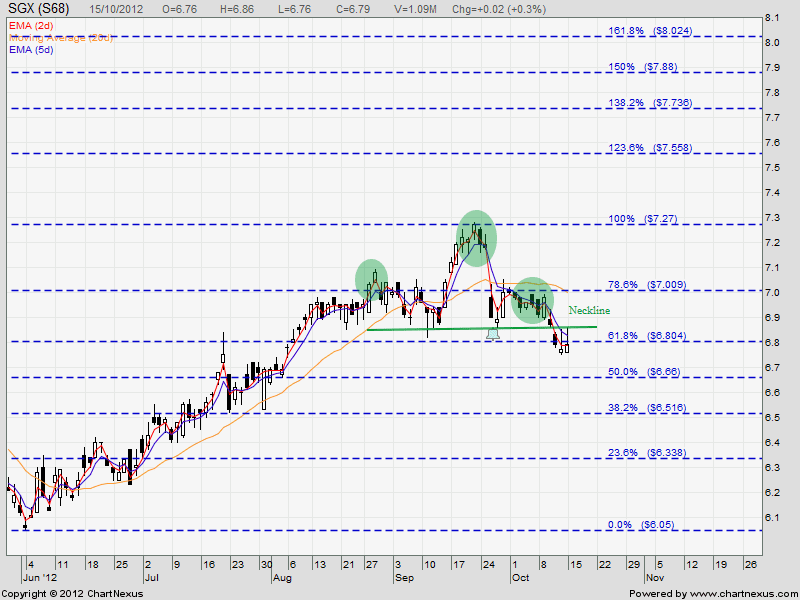

SGX: Bull or Bear?

It can go either way for SGX. Anyway, just need to wait for the release of quarterly earning result before deciding how to trade SGX.

Bullish Sign from the Chart:

- SGX rebound from 61.8% FR and looks like this support level is good from past 3 sessions.

- 2 consecutive Inverted Hammers candlesticks pattern were formed at this support level, indicate potential reversal.

- If this 61.8% Fibonacci Retracement Level is a good support, SGX has potential to reach 161.8% (about $8.00) in a few months time.

- 200D SMA support is at about $6.70 indicates limited down side risk.

- Dividend Yield of about 4% paid out quarterly should limit the selling pressure.

Bearish Signs from the Chart:

- 2/5 EMA are both bearish on daily and weekly chart.

- Head & Shoulders chart pattern are form with neckline at about $6.85. Price target for the breakout is $6.50.

- Current price is below 20D and 50D SMA.

| Current P/E Ratio (ttm) | 24.9634 |

|---|---|

| Estimated P/E (06/2013 ) | 22.9630 |

| Earnings Per Share (SGD) (ttm) | 0.2732 |

| Est. EPS (SGD) (06/2013) | 0.2970 |

| Est. PEG Ratio | 3.6449 |

| Market Cap (M SGD) | 7,286.71 |

| Shares Outstanding (M) | 1,068.43 |

| Enterprise Value (M SGD) (ttm) | 6,589.03 |

| Enterprise Value/EBITDA (ttm) | 17.87 |

| Price/Book (mrq) | 8.7442 |

| Price/Sale (ttm) | 11.2624 |

| Dividend Indicated Gross Yield | 3.96% |

| Next Earnings Announcement | 10/18/2012 |