REITspots: IREIT Global’s Properties (Overseas Site Visit)

On the second edition of REITspots, we travel to Barcelona, Spain to visit 2 properties belonging to IREIT Global (SGX: UD1U). This time round, gain an exclusive look inside the 2 properties, Saint Cugat Green and Parc Cugat.

Put on your walking shoes and grab your investment hat, because REITsavvy is taking you on a stroll through the exciting world of REIT properties with our brand-new series: REITspots! Whilst at one of the properties, I got to briefly talk to Charles de Molliens, Vice President Real Estate Private Equity at Tikehau Capital. Throughout this article, you’ll get to know more about the properties and IREIT Global itself.

IREIT Global

R | S | P | I

Overview

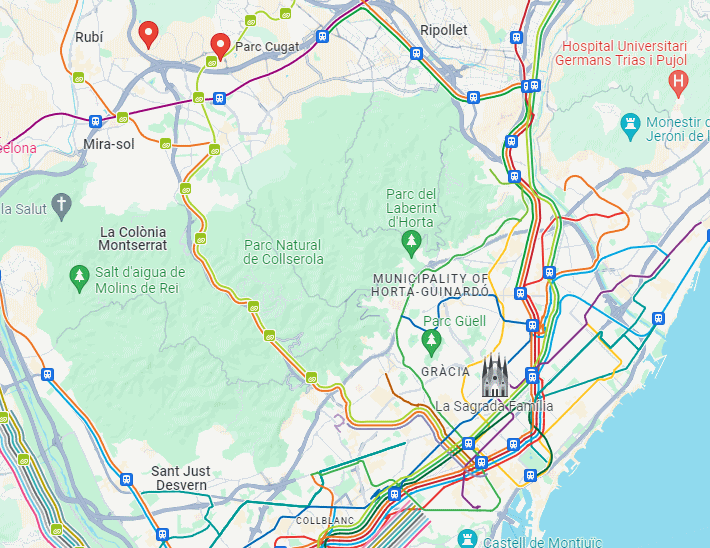

IREIT Global owns 2 properties, namely Saint Cugat Green (€44.6 mil valuation) and Parc Cugat (€27.0 mil valuation). This visit was done on a Monday afternoon, therefore there’ll be a good indication of occupancy and ‘liveliness’ of the area. The properties are about 1.5 hours from the Barcelona Airport and about a 30 min drive from the city centre.

Taking public transportation, Parc Cugat is a mere 5 mins’ walk from St Joan Station, which is also a 30 min train ride from the city centre. For Sant Cugat Green, it is a 5 mins’ bus ride (or a 30 mins’ walk) from St Joan Station.

Saint Cugat Green

“Sant Cugat Green is a modern office building in Barcelona with a 5,256 sqm data centre space and a restaurant for internal use by its tenants. The property comprises three basement levels, a ground floor and four upper floors, and 580 parking spaces (of which 30 are for motorbikes). The property has floor plates with more than 3,000 sqm situated around a central atrium and enjoys good natural light throughout the building. Sant Cugat Green is LEED Gold certified.” – IREIT Global’s website.

On first glance, this property looks very modern both from the outside and inside. I was only allowed to access the lobby area inside the gated area, as this is a mainly data centre focused building. Data centres are stricter in general due to confidentiality. You may ask, doesn’t IREIT Global specialise in Office properties?

Q: You have acquired Sant Cugat Green not too long ago. Are you looking to diversify and move towards Data Centres?

Charles: Not really. It is only because Sant Cugat Green was formerly a Data Centre operated by Deutsche Bank. After they moved out, we bought the property and have leased it to various companies such as HP. As the building was built back in 1993, we have renovated the building in 2022 and now it is currently tenanted to Oxigent Technologies. Their lease is due to end in 2034.

Parc Cugat

“Parc Cugat is a modern office building situated within a business park in the office market of Sant Cugat del Vallès (Barcelona), which offers various services such as restaurants and hotels, as well as an efficient transport connection to the city of Barcelona. The property is located just 3km from Sant Cugat Green. The building consists of 12,000 sqm of office space, an auditorium with capacity for 200 people and more than 400 parking spaces for cars and motorcycles. With a modern façade and a versatile space distribution, the property comprises four basement levels, a ground floor and four upper floors with more than 2,000 sqm. Parc Cugat is LEED Silver certified.” – IREIT Global’s website.

For Parc Cugat, I was able to gain access and tour the property in depth. This was a very insightful visit of one of IREIT Global’s properties. Enjoy the slideshow.

This property is still undergoing minor works, such as the ongoing enhancement of the common terraces. For example, new automatic water pipes are being installed, and flowers and trees have also been ordered.

Common Areas

Office Spaces

Occupancy of Parc Cugat is reported to be only 61.1%. Judging by the untenanted office spaces, it is easy to see why. However, one of these office spaces have already a Letter of Intent to be let, although it is still not confirmed.

IREIT Global’s ESG efforts

One notable observation of Parc Cugat that is clearly visible is their intent to meet ESG targets (at least for the environmental aspects). A trip to the rooftop reveals arrays of solar panels, to provide clean solar energy for the office building.

Rooftop

Bonus: IREIT’s leasing strategy

Charles: Most of IREIT’s tenants (and in Europe) have a mandatory minimum leasing period (i.e. tenants must pay a penalty is they leave early). For example, in Germany, it may be 10 years, while in Spain it can be 4-5 years.

Conclusions

This site visit to IREIT Global’s properties has been eye opening. I got to see first-hand ongoing Asset Enhancement Initiatives (AEIs) of office buildings as well as the initiatives that REITs are taking as part of their ESG Commitment. Lastly, I would like to thank Charles de Molliens, Vice President Real Estate Private Equity at Tikehau Capital for his time.

Kenny Loh is a Wealth Advisory Director and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments, Digital Assets and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also invited speaker of REITs Symposium and Invest Fair. You can join my Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement