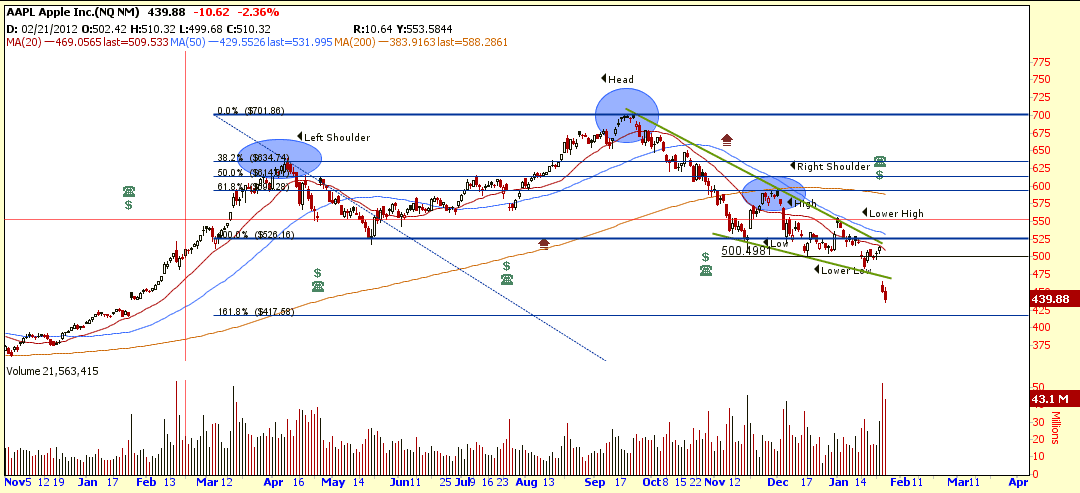

AAPL is currently forming a Falling Wedge with resistance at about $540 & support at $500. Watch closely on AAPL because breakout from current chart pattern will trigger a big move for Apple.

A few bearish signals on current AAPL chart:

- “Lower Low, Lower High” Down Trend pattern.

- AAPL is trading below 20D, 50D and 200D SMA. 20D & 50D SMA are trending down and 200D SMA looks like turning down.

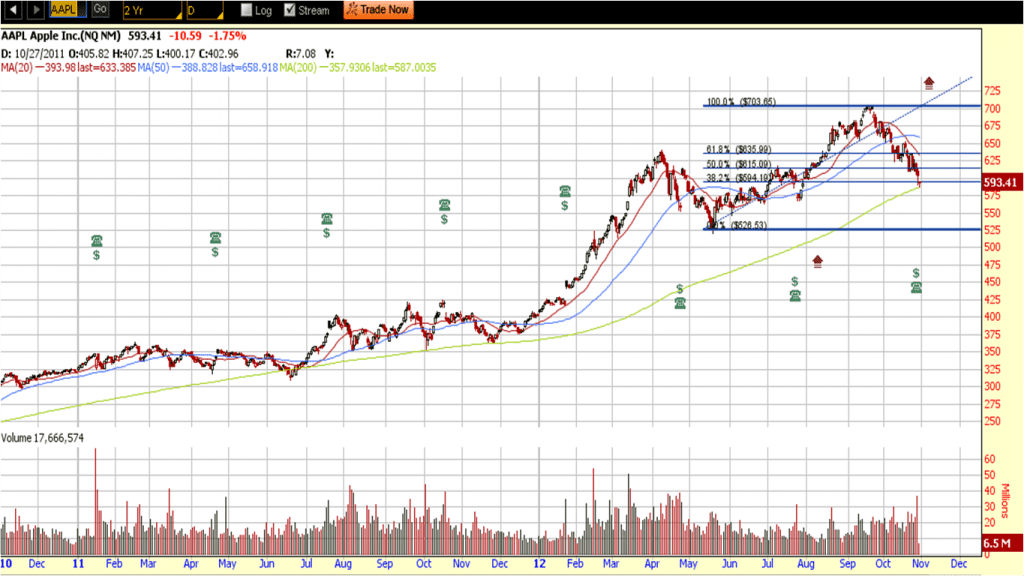

- AAPL retrace back to 61.8% Fibonacci Retracement Level and rejected. Breaking below $500 support will send AAPL to 161.8% FR target of $417.58.

Although AAPL stock price is under value now but this is still not the right time to accumulate for long term investing. However, current AAPL chart is nice to trade but need to wait for the breakout, either a bullish trade or bearish trade.

Note: Earning on Jan 23, 2013.

Last Analysis of AAPL with Intrinsic Value calculated.

VALUATION RATIOS

|

COMPANY |

INDUSTRY |

SECTOR |

| P/E Ratio (TTM) |

11.93 |

18.13 |

20.71 |

| P/E High – Last 5 Yrs. |

20.09 |

21.43 |

55.59 |

| P/E Low – Last 5 Yrs. |

14.61 |

10.70 |

11.85 |

|

| Beta |

1.10 |

1.14 |

0.92 |