Apple’s Partner ZAGG Falls But Rises Again

Guest Post: Peter Cruz

The price per share from ZAGG has fallen by 14.1% in the morning of May 3rd of this year because of an article that was published in Seeking Alpha which have claimed that figures in revenue it was reporting were not adding up to their calculations. The article implied that ZAGG was committing fraudulent activities allegedly in its finances. The article’s publishing time in high speed Internet was also suspicious to many people. This was probably an act by the author to shorten ZAGG’s stocks. It became suspicious because ZAGG was reported to have good earnings in the afternoon of that day.

ZAGG as a company is the main partner for Apple in making cases for its products. That being said, it was obvious that it is meant to walk the paths that Apple did and make healthy revenue growth for the financial quarter this year. It was supplying its main product to Apple named the invisibleSHIELD, which is a plastic cover for Apple products such as its iPad 3.

It is a very popular case choice for users and is being used by many because it effectively prevents damage to expensive Apple products like the iPads. InvisibleSHIELD covers for the iPhones and Apple’s other products are also being marketed by ZAGG.

ZAGG’s marketing strategy has been very effective as it sold products through different mediums such as Best Buy, EBAY and even Apple stores. Its aim is to continue providing high quality products in order to capture a large part of the market share within the cases industry and fervently pursues this strategy as its growth continues with the success from Apple.

This effective strategy has had their financial numbers growing from $76 million in 2010 up to $179 million in the last year. They also had a net income that nearly doubled within this same time period. For a company that started in 2005 in a backyard shed, these are remarkable figures indeed.

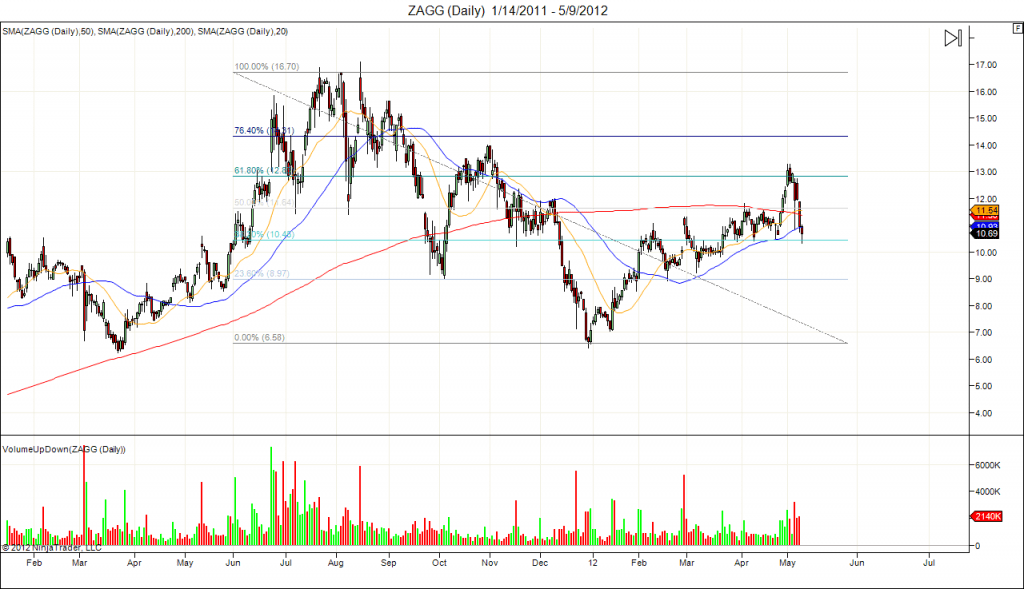

The valuation of ZAGG went low, especially in the morning of May 3rd – falling to 14.1%. Wall Street however has rated it as a solid buy, giving it a 1.0 rating which is its highest. It is likely that its revenue growth this quarter is going to soar, which will cause its share price to increase. Predictions on ZAGG stock values have been positive even for the coming months ahead.

ZAGG Incorporated (ZAGG) designs, manufactures and distributes protective coverings, audio accessories and power solutions for consumer electronic and hand-held devices under the brand names invisibleSHIELD, ZAGGaudio, and ZAGGskins. The invisibleSHIELD is designed for iPods, laptops, cell phones, digital cameras, personal digital assistants (PDAs), watch faces, global positioning (GPS) systems, gaming devices, and other items. As of December 31, 2009, ZAGG offers approximately 4,000 precision pre-cut designs with a lifetime replacement warranty through online channels, big-box retailers, electronics specialty stores, resellers, college bookstores, Mac stores, and mall kiosks. The ZAGGaudio line of electronics accessories and products was released during the year ended December 31, 2008. In June 2011, it acquired iFrogz, Inc.