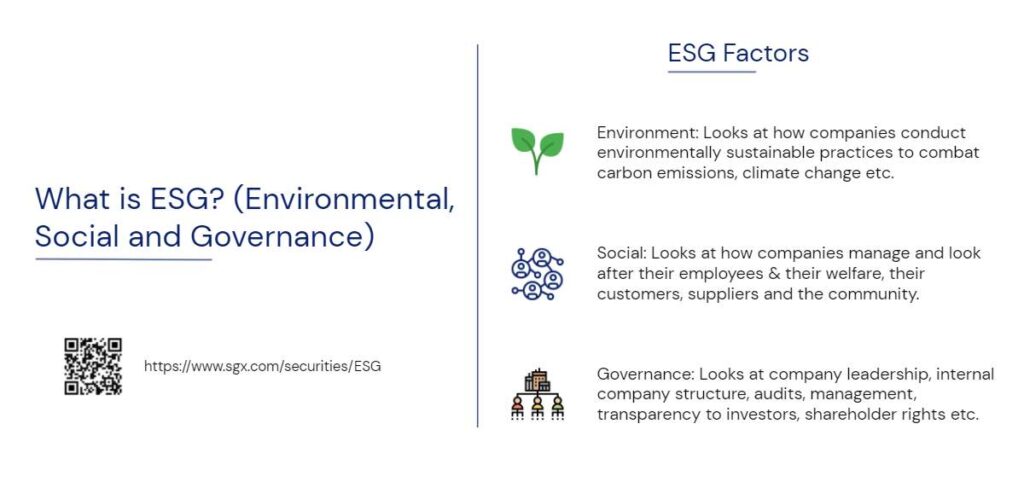

In recent years, ESG (Environmental, Social and Governance) Investing has come into the forefront. As investors become more aware of the impact business have on climate change, so will their view towards businesses with more sustainable practices.

Several Singaporean corporations have already been recognised for their sustainability efforts, including Capitaland Limited and Cromwell European REIT.

MUST Go Green 2021

Manulife US Real Estate Investment Trust (“MUST”) launched its week-long thought leadership initiative on October 5, 2021 to raise understanding of ESG and how mandatory climate-related disclosures for Singapore financial institutions and asset managers from 2022 will impact REITs and investors. The event, titled MUST Go Green 2021, a thought leadership initiative under its Green Dot Series, includes ESG conferences with industry experts, as well as one-on-one meetings with ESG investors. Both conferences today received an eager response and were well-attended by media, analysts as well as institutional and retail investors.

To learn more about ESG Investing, and how MUST is working to achieve net-zero, the recordings to both conferences are now available here: http://manulifeusreit.

With regards to the webinar, Kenny Loh, founder of MyStocksInvesting.com has asked 2 questions on behalf of investors. We thank Ms Jill Smith, CEO of Manulife US REIT for getting back to us on the following questions.

1. What is the financial impact of being green? In the short term vs in the long run? (E.g. Implementation costs vs cost savings)

- With the real estate sector contributing to about 40% of carbon emissions, green buildings need to positively impact the natural environment in their design, construction, and operations.

- When it comes to greening a building or portfolio, there is always the challenge of balancing environmental sustainability with economic viability. The bulk of ESG costs lie in the ‘E’ aspect of greening a building (e.g. improving building energy efficiency through optimising equipment and processes). On average, construction or retrofitting costs for a LEED-certified building is about 7% to 9% higher than that for a non-LEED building.

- Green buildings run more efficiently, thus lowering operating costs. For MUST, our portfolio has registered lower energy and emissions intensities in 2020 compared to the other U.S. REITs, translating to lower costs and sustainable returns. Compared to conventional non-green buildings, they usually have higher occupancies, fetch a higher rental and command a higher selling price. A recent survey by JLL also showed that the value of LEED assets (US$/psf) was 21.4% higher vs non-LEED buildings.

- Beyond financial returns, green buildings have health benefits for occupants in terms of better air quality, accessibility, etc. In 2020, MUST’s Michelson property located in Irvine, California achieved the Fitwel Building certification. Fitwel is the world’s leading certification for healthy building performance based on building features that promote occupants’ health and well-being.

- Green buildings also help us attract and retain quality and ESG like-minded tenants such as government and top-tier corporates in their sustainability journey or their race to Net Zero. In major U.S. cities, only about 14% of buildings are certified green. Since the start of the pandemic, there is an increased demand for such green buildings by tenants. Within our portfolio, we have also received requests from tenants to discuss the ESG performance of our buildings to ensure they meet with their own sustainability criteria.

- On the operation front, having ‘green’ certified buildings could also lower the REIT’s tax expenses. For instance, in New York, LEED-certified buildings are exempted from a portion of their local property taxes.

- Many U.S. states and local regulators are incentivising energy efficient buildings and penalising carbon emitters, which means that the cost of owning non-green buildings that do not meet regulatory requirements is going to increase down the road. For example, starting in 2024, New York City has mandated large building owners to drastically limit carbon emissions or pay an annual fine of US$268 per metric ton of CO2 over the limit.

- Closer to home, Singapore has also set ambitious targets under its Singapore Green Building Masterplan to green 80% of its buildings and pursue ‘best-in-class’ standards for new and existing buildings.

- As recently shared in our MUST Go Green event, net inflows into sustainable funds for 2020 has grown +109% YoY to US$347b. By 2023, 80% of investors intend to incorporate ESG into their investment strategy.

- The cost of ignoring or paying lip service to ESG is high. Not only will we miss this new wave of ESG investors, we will also end up with stranded assets that deplete property values and returns for investors, causing brand erosion.

2. Given the lack of one consistent ESG rating used across REITs, what will be the outlook and approach for Singapore?

- A recent Business Times article highlighted that issuers in Singapore grapple with trying to reconcile various ESG reporting standards as well as transparency issues within rating methodologies, among other challenges, within the resource-limited environment where they operate.

- ESG-related information that can negatively impact the financial performance of an organisation and its stakeholders are considered material and thus, should be disclosed. We think that this is precisely why the Monetary Authority of Singapore has mandated such reporting according to the Taskforce on Climate-related Financial Disclosures (TCFD) framework for all financial institutions and asset managers (including REITs) with effect from 2022.

- A common framework will allow for reliable and comparable climate-related disclosures, leading to better pricing of climate-related risks and more effective risk management and capital allocation towards financing green activities.

- A prescribed recommended framework to guide all sustainability reporting will help to streamline the current confusion about ESG ratings and rankings. This will also allow for more comparability of sustainability performance among peers.

- Come 2022, MUST will incorporate further disclosures on its climate-related strategy, targets and performance, in alignment with the TCFD framework. We will also be participating in TCFD-aligned ratings such as CDP and adopting preferred standards such as SASB (Sustainability Accounting Standards Board) which is commonly used in countries such as the U.S., Australia, Japan and South Korea.

- Good ratings on notable global sustainability benchmarks will align our sustainability performance to global best practice, and through ongoing gap analyses, we will continue to identify potential risks and opportunities in our pursuit of ESG excellence.

New REIT index: iEdge-UOB APAC Yield Focus Green REIT Index

On October 15, 2021, Singapore Exchange and UOB Asset Management launched the iEdge-UOB APAC Yield Focus Green REIT Index. Formerly known as the Global Real Estate Sustainability Benchmark (GRESB, this REIT index is weighted based on environmental performance, based on a tilting methodology. Click on the image below to view the factsheet of this new REIT Index.

Kenny Loh is a Senior Financial Advisory Manager and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments, Digital Assets and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also invited speaker of REITs Symposium and Invest Fair. You can join my Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement